From $269M to $724M – Charge Off More than Doubled in 2023 If you...

Auto Delinquency

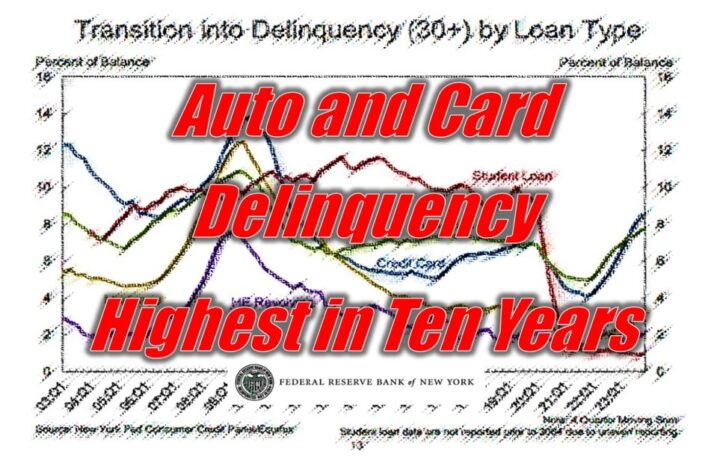

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,”...

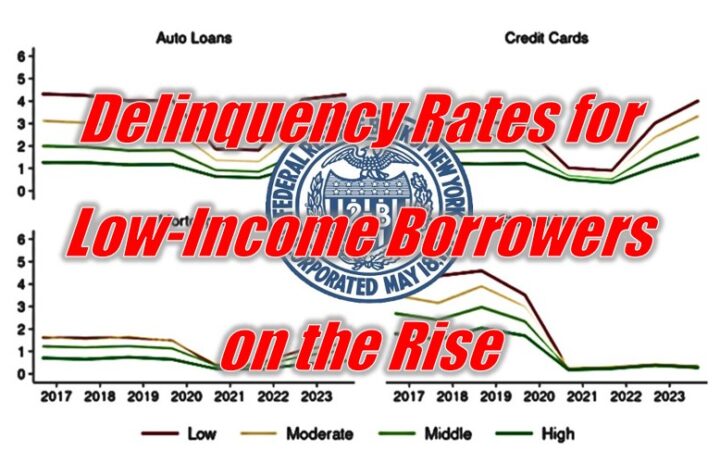

New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers “We see...

Inflation is clearly taking its toll on the American consumer. Groceries, rent, credit card...

January Auto Delinquency Even Worse than December per Cox Automotive By tradition, December auto...

“of all loans, 1.84% were severely delinquent, which was an increase from 1.74% in...

“Potentially, the biggest financial crisis ever” – Elon Musk Skyrocketing interest rates coupled with...

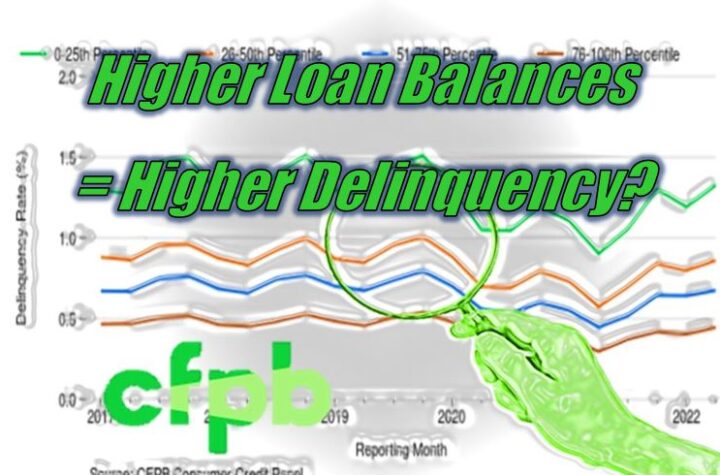

“loans originated in 2021 and 2022 are starting to show higher delinquency rates relative...

On October 19th, Ally Financial held its third quarter 2022 earnings conference call for...

Auto Loan Delinquencies on the Rise, But Consumers Continue to Place Great Value on...

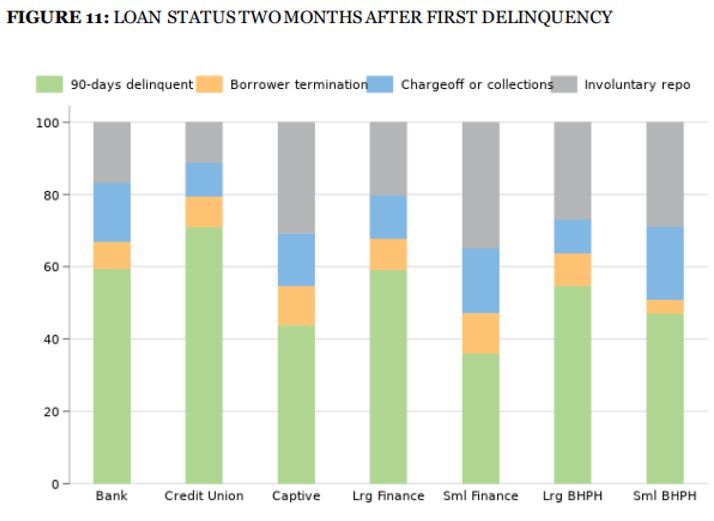

Smell Fire? Subprime auto loan delinquency climbs to highest rate since April 2020 Now...

Almost unnoticed last month, the Consumer Financial Protection Bureau released a Data Point report...

Bachman named Vice President, Operational Strategy FOR IMMEDIATE RELEASE October 4, 2021 – MALVERN,...

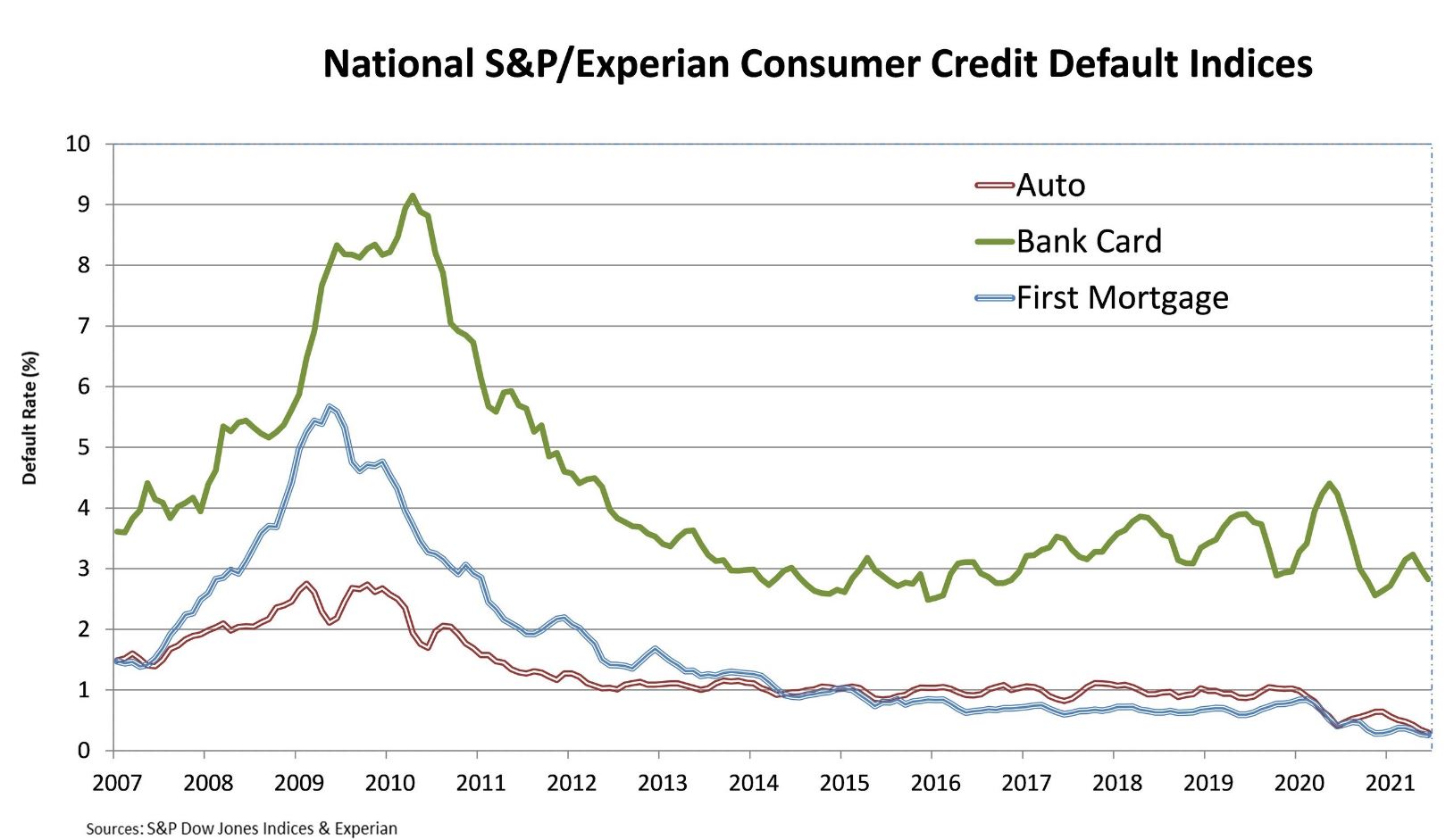

Bank Card and Composite Rate at Lowest Levels Since 2004 NEW YORK, SEPTEMBER 21,...

All Loan Types Show Lower Default Rates On July 20, Experian and S&P Dow...

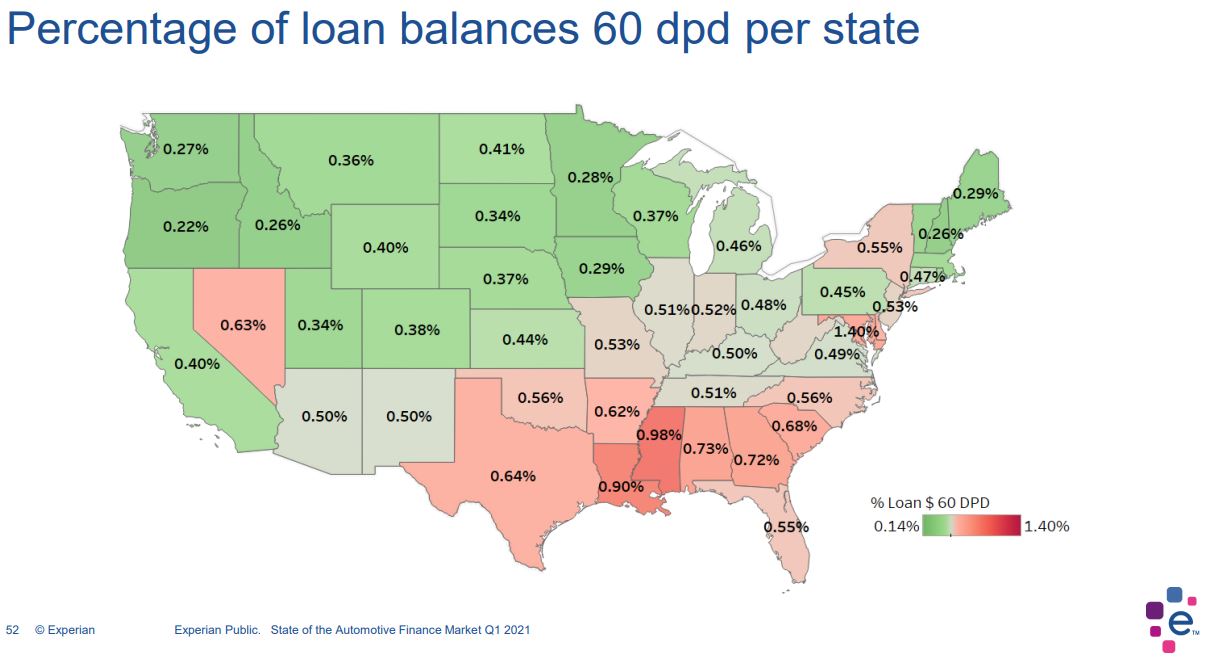

Experian, the world largest credit reporting bureau, released it’s Q1 2021 State of the...