BlytzPay and PassTime Partner to Revolutionize Buy Here Pay Here Sector with Innovative Payment...

Auto Loan Delinquency

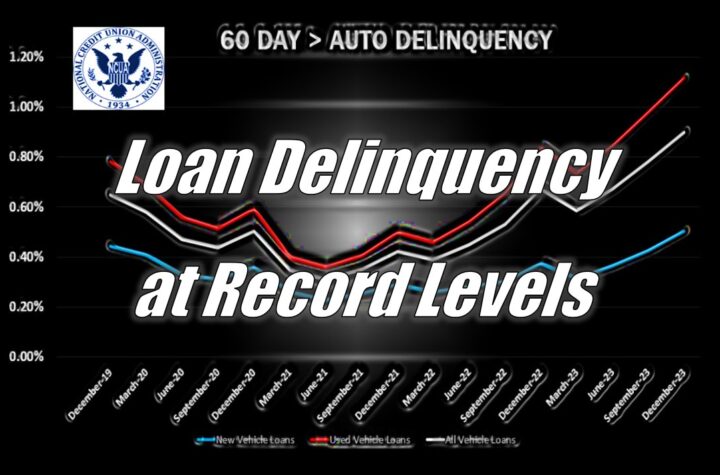

4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels Last year I...

How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy Credit unions currently...

Join Us! At Bellagio Las Vegas April 2 – 4, 2024 Delinquency is on...

Brace for the Impact of Rising Auto Loan Delinquencies, Repossessions, and Bankruptcies Delinquency rates...

From $269M to $724M – Charge Off More than Doubled in 2023 If you...

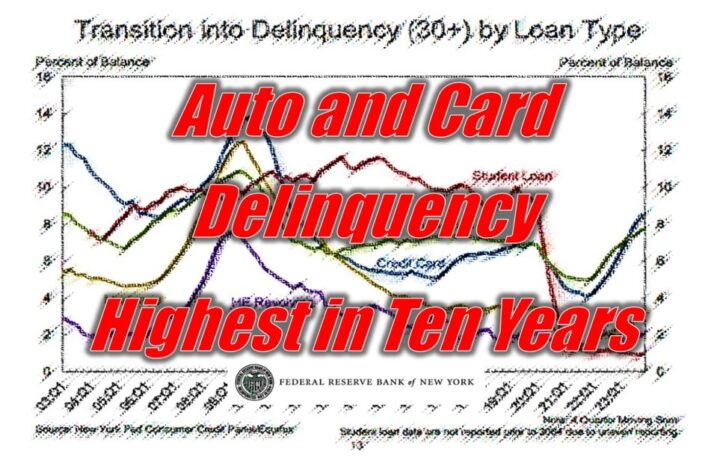

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,”...

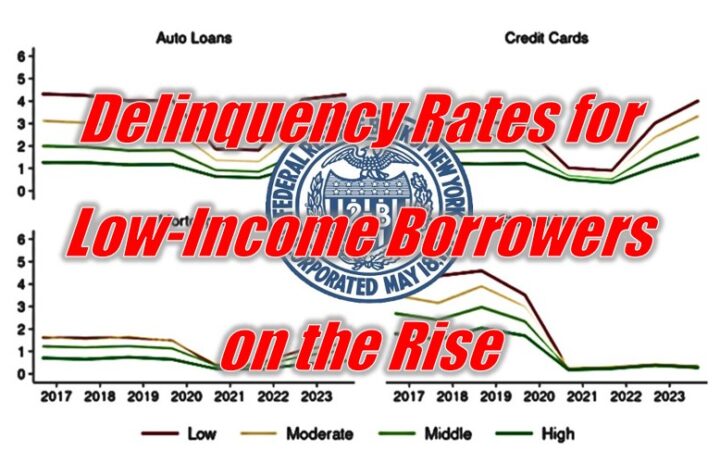

New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers “We see...

After the 1st quarter of the year’s NCUA’s combined credit union 5300 FPR financials,...

Delinquency transition rates increase for most debt types PRESS RELEASE New York, NY –...

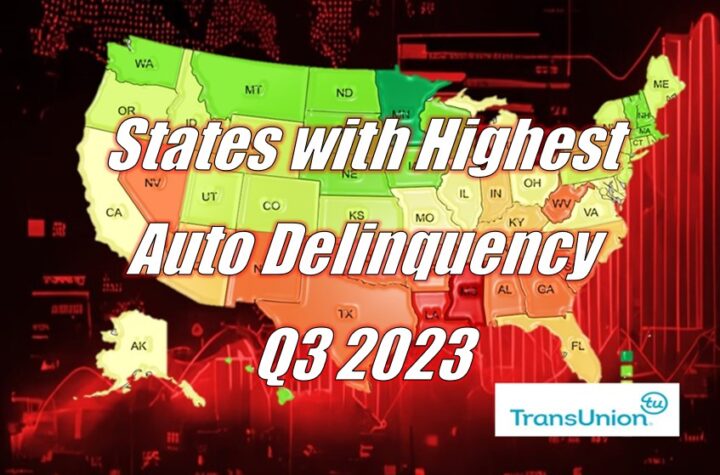

States with Highest Auto Loan Delinquency in Q3 2023 Earlier this month, TransUnion, one...

In my publishing of the 1st quarter 2023 NCUA Financial Performance Review aggregate auto...

ffThe Gen Y – The Ticking Debt Timebomb Earlier this month, the Federal reserve...

In a July 24th tweet on X (fka; Twitter) from Ridgefield, Connecticut base unaffiliated,...

As Auto Loan-to-Value Ratios Rise and Used Vehicle Values Fall, More Consumers Find Themselves...

Before the Covid-19 pandemic struck, collections were top of mind at most financial institutions,...