Leading with Empathy and Empowerment: 🎧 Season 2, EP10 Episode #10 – Leading with...

Collections

TriVerity Collection Academy | October 1 – 2 | Bloomington, MN Make sure you don’t...

How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy Credit unions currently...

CUCP Nashville Speaker Line Up Nailed Down The Credit Union Collections Professionals (CUCP) fifth...

Conquering Collection Challenges Five Common Obstacles and Strategies for Success Credit card debt continues...

CCUCC 2024 Collections and Lending Conference – Registration is Now Open! October 24-26th Renaissance...

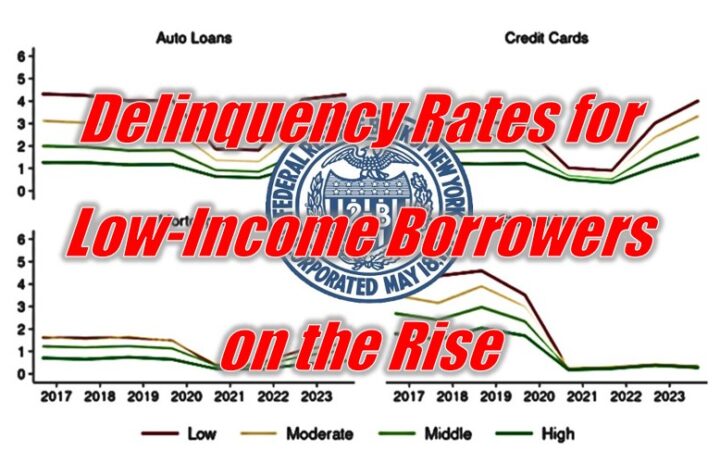

Brace for the Impact of Rising Auto Loan Delinquencies, Repossessions, and Bankruptcies Delinquency rates...

Lexop – 2024 Trends & Predictions for Credit Union Collections Episode #08 – 2024...

From $269M to $724M – Charge Off More than Doubled in 2023 If you...

New York Fed Report Finds Early Delinquency Rates Rose for Low-Income Borrowers “We see...

Lexop and Allied Solutions Announce Strategic Partnership! Empowering Credit Union Collections: Lexop and Allied...

SEPTEMBER 10 – 12, 2024 Gaylord Texan Resort & Convention Center Save the date...

Chapter 7 Bankruptcy Filings Increase 17 Percent in 2023 Chapter 13 bankruptcy filings rose...

The Fifth Annual CUCP Summit May 15th – 17th, 2024, Loews Vanderbilt Hotel, Nashville,...

Our training courses are designed to strengthen your collection staff by increasing their knowledge...

MALVERN, PA – AKUVO, a technology organization specializing in collections and credit risk, has...