January Auto Delinquency Even Worse than December per Cox Automotive By tradition, December auto...

Experian

S&P/Experian Consumer Credit Default Indices Show Higher Composite Rate For December 2022 – Auto...

NY Fed’s Q3 Data shows an economy under strain Record high inflation and fuel...

Equifax, Experian and TransUnion to begin changing how medical debt collections are reported Credit...

Equifax, Experian, and TransUnion routinely failed to fully respond to consumers with errors WASHINGTON,...

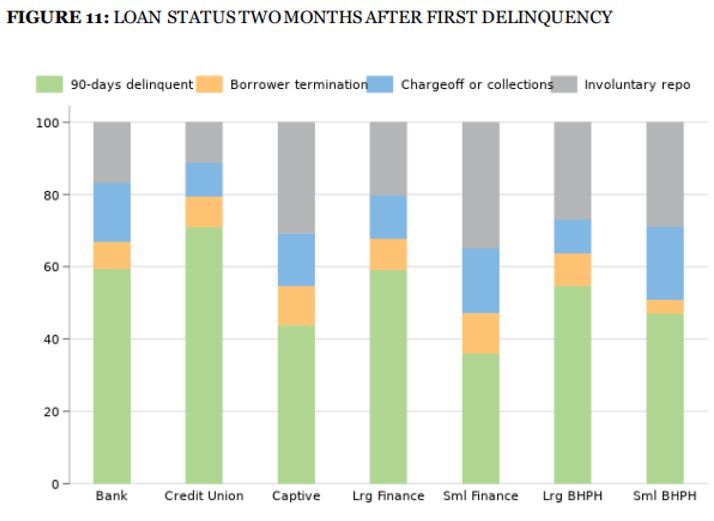

Almost unnoticed last month, the Consumer Financial Protection Bureau released a Data Point report...

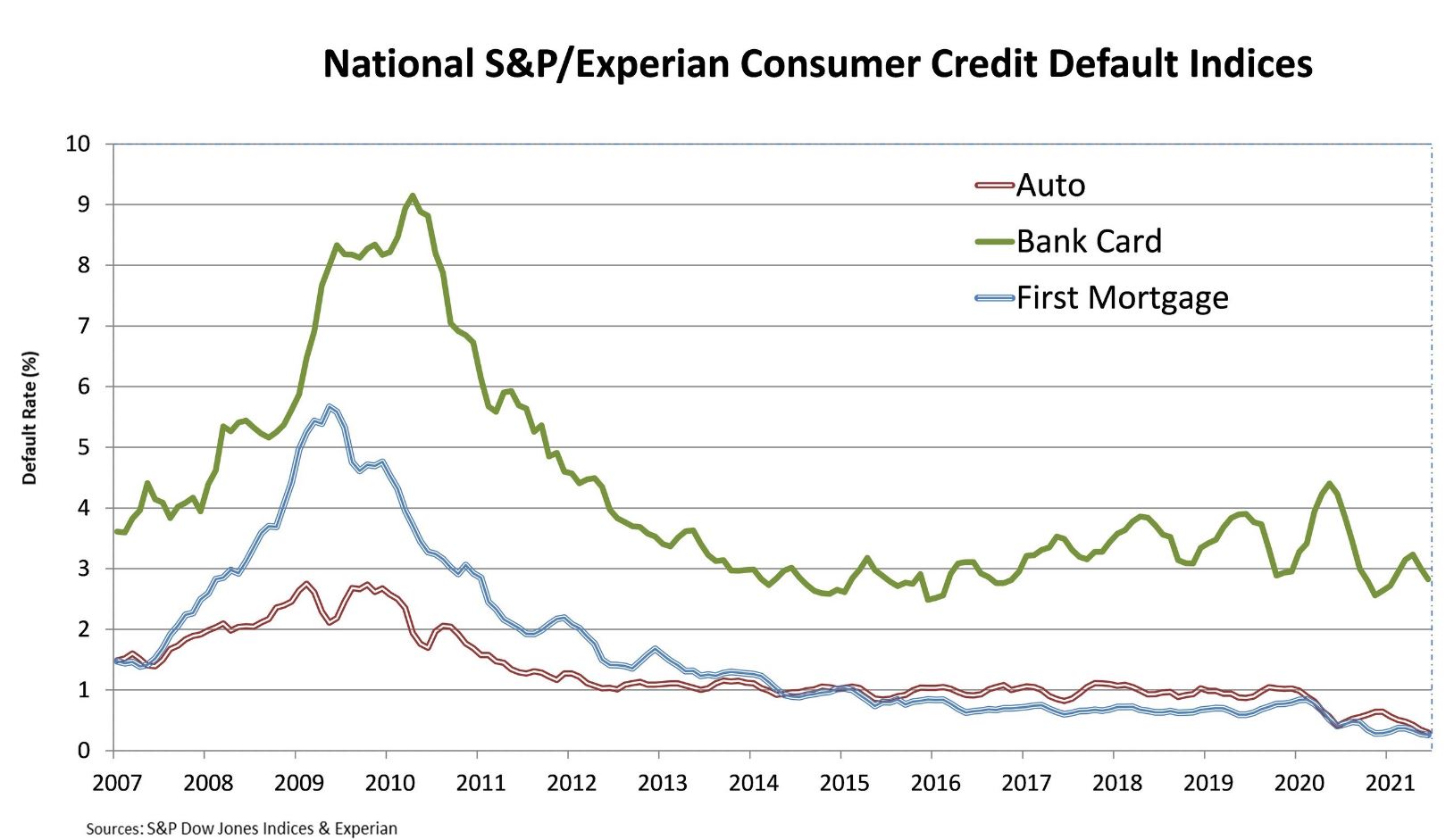

Bank Card and Composite Rate at Lowest Levels Since 2004 NEW YORK, SEPTEMBER 21,...

All Loan Types Show Lower Default Rates On July 20, Experian and S&P Dow...

Hearing focuses on legislation and reforms to consumer protections by credit bureaus. ACA International...

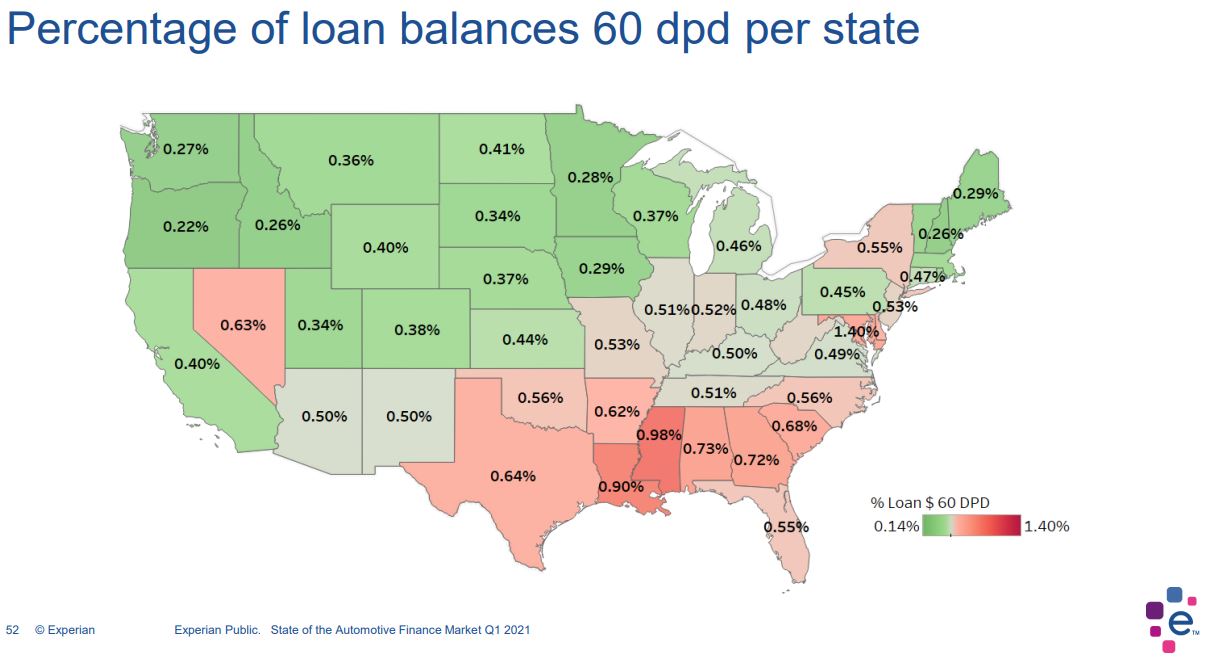

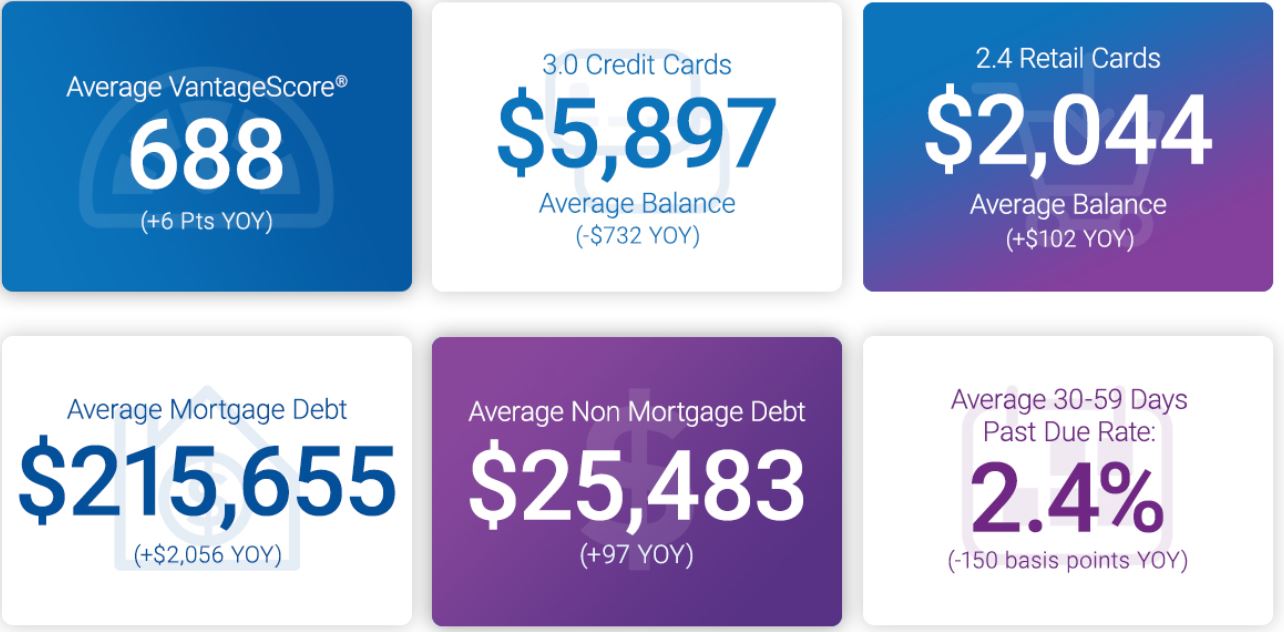

Experian, the world largest credit reporting bureau, released it’s Q1 2021 State of the...

GUEST EDITORIAL There’s a new game in town for synthetic fraudsters and unscrupulous credit...

“Biden will create a new public credit reporting and scoring division within the Consumer...

DRN’s Virtual Showcase in October 2020 brought together leaders from across the vehicle financing industry to...

In what has been an unprecedented year, marked by a global pandemic and a...

Today, Experian and Oliver Wyman launched the Ascend Portfolio Loss ForecasterTM, a solution built to...

To provide consumers with clear-cut protections against disturbance by debt collectors, the Consumer Financial...