Insurance coverage requirements vary significantly from one creditor to the next. Although the insurance...

Repo Insurance

Guest Editorial June 10, 2019 – There are few actions that a lender takes...

EDITORIAL While everyone who is spinning their wheels for $300 a repo contingent for...

GUEST EDITORIAL Kevin, We very much appreciate your recent editorial about Repo Agency Insurance...

EDITORIAL With the never ending increases costs of repossession agency insurance, a solution rising...

Read the following article taken this week from, The Washington Post, and imagine if...

GUEST EDITORIAL Like a double edged sword, social media can be a great way...

North American Repossessors Summit adds two-hour open forum limited to business owners to NARS...

FOR IMMEDIATE RELEASE In our continued commitment to our members and the repossession industry,...

GUEST EDITORIAL Most of us remember the repo boom in 2008-2010 when the housing...

EDITORIAL As the repossession industry continues to experience downward price pressure and continuous unreasonable...

2017 Education Training and Trade Event for Repossession & Finance Industry Professionals hosted by...

Attention Financial Institutions and Recovery Agencies Owners Allied Finance Adjusters has secured individual $1,000,000...

Seems these days there is a day or a month in honor or recognition...

“The Largest Not-For-Profit National Trade Association Of Repossession Specialists Since 1936” Allied Finance Adjusters...

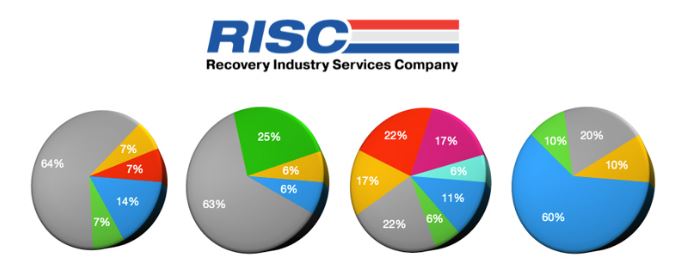

Press Release RSIG requires members and most national client contracts require repossessors to have...