“of all loans, 1.84% were severely delinquent, which was an increase from 1.74% in...

Subprime

“For almost 4 out of 10 loans, Credit Acceptance predicted that it would not...

With Christmas behind us reality is about to kick in to the millions of...

Loan delinquency and plummeting wholesale values clobbering subprime bond market (Bloomberg) — Subprime auto...

Smell Fire? Subprime auto loan delinquency climbs to highest rate since April 2020 Now...

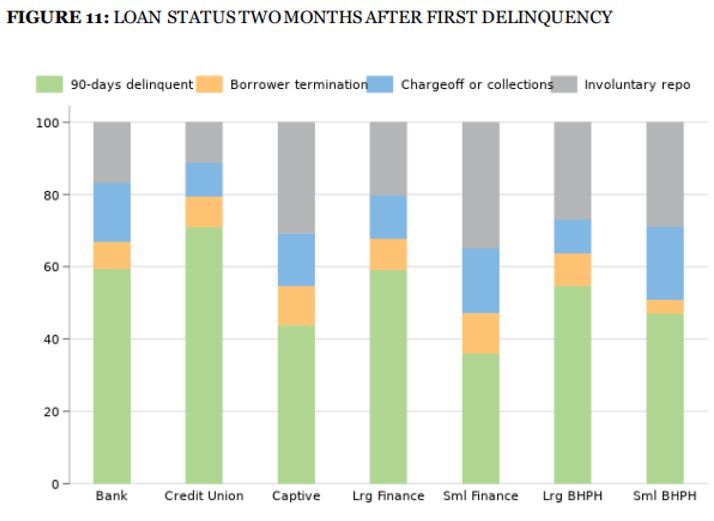

Almost unnoticed last month, the Consumer Financial Protection Bureau released a Data Point report...

Washington, D.C.- September 23, 2021 – The Securities and Exchange Commission (SEC) announced fraud...

Denver, CO – 10 September, 2021 – Colorado Attorney General Phil Weiser announced Friday...

Santander, has settled with 34 states to the amount of $550 million and will...

Auto Lender to Provide More Than $700,000 in Debt Relief and Refunds to Consumers...

Steady increases in U.S. auto debt over the past seven years have raised concerns...

The assistance of a city police officer in the repossession of a car downtown...

Cruising Google for stories, as I frequently do, I stumbled across this interesting article...

New York, NY – 6 April 2018 – Growing numbers of small subprime auto...

Auto lenders can now view real-time analytics for key indicators used to monitor the...

Subprime auto lending has faced intense regulatory scrutiny over the past year, and one...