Repossessing Motor Vehicles – What to Know and Do Before You Pick Up Collateral...

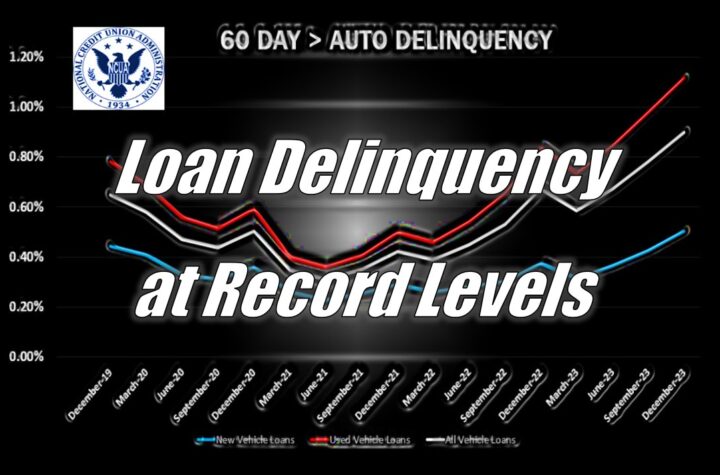

States With the Highest and Fastest Rising Auto Loan Delinquency It’s no surprise that...

The Keys to Effective Bankruptcy and Repossession Strategies As consumers struggle to make payments,...

Wholesale Auction Values Booming Following a year of plummeting wholesale auction values, Black Book...

Banks, Credit Unions, and Repossession COLLECTION GURUS! You know your business better than anyone....

BlytzPay and PassTime Partner to Revolutionize Buy Here Pay Here Sector with Innovative Payment...

Leading with Empathy and Empowerment: 🎧 Season 2, EP10 Episode #10 – Leading with...

TriVerity Collection Academy | October 1 – 2 | Bloomington, MN Make sure you don’t...

4th Quarter 24’ Credit Union Auto Loan Delinquency at Record Levels Last year I...

How Credit Unions Can Optimize Their Indirect Auto Lending Collection Strategy Credit unions currently...

CUCP Nashville Speaker Line Up Nailed Down The Credit Union Collections Professionals (CUCP) fifth...

Dive into Delinquen-Seas at the 2024 North West Credit Union Collectors Association Conference! NWCUCA...

Conquering Collection Challenges Five Common Obstacles and Strategies for Success Credit card debt continues...

RISK ALERT: Wrongful Repossession Claims Summary Wrongful vehicle repossession can take many forms. The...

BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim A Live NorthLegal...

CCUCC 2024 Collections and Lending Conference – Registration is Now Open! October 24-26th Renaissance...