EDITORIAL

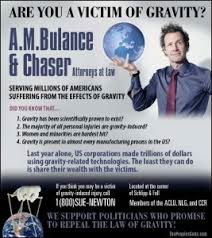

Having come from a lending and collections background, I am intimately familiar with the scourge of legal action emanating from the never ending line of consumer advocacy attorneys stemming from alleged and frivolous claims of FDCPA and repossession law violations. What is new, is the size and volume of these cookie cutter strategized legal actions designed to exploit a flawed legal system and even worse, lazy insurance practices that feed into this “puppy mill” championed by ambulance chasing attorneys.

If you drive down the highways in Minnesota, Wisconsin or many other states, you will see billboards advertising the services of consumer advocacy attorneys pandering to consumers who have been the “victim” of a repossession or collections activity. It’s really no different than their advertising for personal injury representation but its damage is exponentially more damaging to the repossession industry, which already struggles with low fees, high insurance and never ending increases to operational expenses.

What is occurring, for those of you lucky enough not to have already been targeted by these actions is, a borrower reaches out to the attorneys and explains what occurred and the attorney digs into the minutia of legal actions that he can make claim to. Breach of peace, FDCPA violations, TCPA violations, right to cure violations or even notice of intent violations. I know, you’re wondering how a repossession company could be dragged into the fight over a right to cure or notice of intent to sell issue?

Here’s the deal, it doesn’t matter if any of that was your responsibility.  The attorneys throw every possible allegation they can against every person and entity they can and make the defendants fight their way out of it. Unfortunately, policies and procedures for most lenders are pretty cut and dry. Settle and move on. This sometimes leaves the repossession agency dangling as the lenders are not seeking additional dismissal of claims against the other entities (repossession companies) as a part of the settlement.

The attorneys throw every possible allegation they can against every person and entity they can and make the defendants fight their way out of it. Unfortunately, policies and procedures for most lenders are pretty cut and dry. Settle and move on. This sometimes leaves the repossession agency dangling as the lenders are not seeking additional dismissal of claims against the other entities (repossession companies) as a part of the settlement.

I am not an attorney and am not offering legal advice so much as practical advice. Check your “Hold Harmless Agreements“ with all of your clients and vendors to make sure that under these terms they agree to remedy all settles and claims against you for issues arising during the course and scope of your work that are otherwise not within the scope of your assignments. Namely, notice to cure letters, notice of intent to dispose of a motor vehicle and notices of deficiency balance. I currently know of one agency who was left out to dry by A very large national lender on a lawsuit over a right to cure letter, which was sent by that lender and is not the agency responsibility under normal circumstances. That lender settled for themselves alone and now the agency is still being pressured by the court to settle on a case that the attorney is seeking $30,000 from them on!

We all know what happens if you file a claim on your insurance for that size, it could very well get your insurance cancelled or have the expenses go up so high it is unsustainable. Worse, in a low fee world where most agencies are living hand to mouth and literally financing their association dues, the option of paying out of pocket is the same as closing their doors.

The legal system that allows these frivolous lawsuits to flourish is driven by a lax and overly consumer friendly legal system which believes that the lenders all have deep enough pockets to pay out on every claim and they get the joy of playing “Robin Hood” for the downtrodden masses. This attitude and practice is obviously flawed and has unintended consequences that drive up the costs of insurance for everyone, which in turn, drive up the costs of services and goods in many ways and in many businesses.

Once upon a time, it was enough that you simply left the scene of a repossession once the borrower came out and objected. The new criteria seems to be far looser in that, even if they allow you to take it, if they later feel in any way that their peace of mind or “Zen” has been disturbed by your action, either in their presence or not, their peace has been breached and is thus a cause for action in the minds of the attorneys seeking their payday.

As ludicrous as this may sound, many courts are upholding this definition. Of course, this varies from venue to venue, but when it comes to legal action, from a practical standpoint, and I am not an attorney, I suggest that you know your venue and always prepare for the worst.

I know, you’re wondering how the hell a repossession company could be named as a co-defendant could be named in an issue of a notice to cure letter, notice of intent to dispose of a motor vehicle or notice of deficiency balance?

It doesn’t matter. If the attorney wants, he could name the President of the United States himself. The legal system requires all defendants to fight their way out of a civil claim and makes no self-determination of common sense.

I once had a borrower sue me that later received a hearing for a lawsuit against the world for being mean to him. Yeah, they heard it. Yes they dismissed it, but regardless, it made it into the legal calendar and wasted someone’s time and taxpayer money. That’s just how the legal system works. Tort reform and re-compensation for defenses against frivolous legal suits, like exist in more legally civil parts of the world, are desperately needed, but neither side of the aisle wants to take any serious action on it and the attorney lobbies have huge war chests to fight change.

Lawyers are the easiest professionals out there to disparage and make fun of and for obvious reasons. You love to have a good one in your corner, but damn if you ever want to need them. The consumer advocacy attorneys are a different breed than most in that, like personal injury attorneys, they exploit systems and insurance company policies and procedures to assure their victory. They even keep records of expected paid claim amounts by claim type by defendant types.

I could get into their ethics and professionalism in great detail with some very specific anecdotes of some of their histories of being sanctioned, suspended and even disbarred for their actions in their careers, but hell, I don’t want to get sued either. First amendment or not, that doesn’t make me immune to legal action.

In short, expect no mercy and don’t underestimate their sway in more consumer friendly venues. These people, and I use that term loosely, are business killers. Unfortunately, state bar associations and the courts themselves tend to be reticent and ambivalent to their actions and they have flourished in this high oxygen content environment over the past eight years with little opposition mounted. Don’t expect Washington or your state capital to be of much help, they’re attorneys too.

This new breed of ambulance chaser is prone to work contingent. Too funny right?!? As if that wasn’t bad enough, there is a company that finances lawsuits. Yup, that’s right. They can get a loan to finance a frivolous lawsuit. Legislation is pending in Missouri to cap the interest rates, but no one is batting an eye at this at any level of the legal spectrum.

Perhaps if the insurance companies would actually start fighting instead of rolling over and coughing up ridiculous checks so easy, this might end. One of the big problems we all know about contingency is that if you don’t recover on the account quickly, you tend to lose focus on it or just quit running it altogether. Perhaps that’s a legal strategy that might help. Countersuing for stress or the “fear” they placed on your agent and how that affected his recovery numbers that made him less profitable.

Yeah, that’s a frivolous claim. And you’ll probably lose, but so are theirs! Fight fire with fire if necessary. It may make them not want to come back when you double their workload.

There has been a long and growing segment of Americans unwilling to accept responsibility for their own actions or failures. This is no surprise in our “victim culture” where everyone is supposed to be the victim of someone else. And in their eyes, no one is more to blame than the “deep pockets” of the lenders, insurance companies and, from their perspective, repossession companies.

The lure of easy money is a very attractive thing to the “victim culture” and when they see billboards and other advertisements telling them that they can make easy money from the “deep pockets”, they are easily pulled in. In reality, it has become easy money. It shouldn’t be, but it has become that way.

Fortunately for the borrowers involved in these frivolous suits, they very, very rarely step into a deposition or courtroom before the insurance companies start making settlement offers. They just don’t want to fight out of principal. They only fight to win cases.

The average American has never been sued. Even for those of us who have and know the game, it is stressful. Just imagine how they would feel if the repossessor or agency filed a lawsuit against them? They might not be so excited about that frivolous lawsuit. I don’t imagine the contingent attorney would like to see his workload doubled for the “easy money”

The attitude of this segment of our population is evidence of an appalling lack of character. Don’t get me wrong. There are legitimate issues out there, but right now, I’m ranting about the frivolous ones.

As I was taught young that “we teach people how to treat us.” While there is a cost of doing business, there is also a value to fighting the good fight, which seems to be a practice long lost by the insurance carriers who, more often than not, just throw money to these attorneys rather than showing the attorneys that they will make them work for their money.

This practice, which I’ve always referred to as “feeding stray cats”, which I hope everyone knows assures their constant return for more food, is partially to blame in that the “stray cats” aka; consumer advocacy attorneys, know the eventual outcome of their claims with near certainty. Remove that certainty and they will pause or quit returning.

More meaningful, would be legal change to allow for cross complaints and penalties for re-compensation of legal fees associated with the defense of frivolous lawsuits. Alas, I am dreaming out loud again. So long as attorneys run the government, profit from the laws that they write and run amok as they are allowed, we will all suffer for their profit.

If your lender or forwarder would leave you hanging out to dry while buying their way out of one of these claims, you really need to question their value or at very least raise their rates! If you compensated in rates for this legal exposure, your fees would probably need to be near $1,000 per repo to make up for your annual losses in one of these litigious areas.

Forwarding Companies

Now, I may be wrong, but I haven’t heard of any forwarding companies getting dragged into the fray of these lawsuits. In the banking world, lawsuits are like an STD. Lots of people get them, but no one wants to talk about them. Is it possible that these lawyers are unfamiliar with this process and their existence? I imagine if they did know, they would salivate at the prospect of another pocket to steal from.

From the consumer point of view, I am sure there are plenty of people who’ve laughed their heads off collecting on these frivolous suits. But there is nothing free in this world and consequences for every action.

As the insurance claims keep paying out, the insurance premiums rise. As the insurance premiums rise, so does the agencies cost of operations. At $300-$325 per repo, it’s just a matter of time until agencies in these litigious areas (Wisconsin, Minnesota and California) just shut their doors.

In a flat fee environment created by forwarding and low paying direct lenders, it’s not like they can charge what the expense would be to make up for it. If they could, and keep in mind the necessity this environment would create for paying the increased insurance premiums as well as capitalizing for out of pocket settlements for claims not covered under their insurance like Breach of peace and FDCPA violations stemming from letter and notification lawsuit claims, a repossession would cost up to $1,500 on the agency end alone. Drag the forwarders into this and it would rise to $3,000.

I know those fees sound laughable and would likely be the cause for additional lawsuits from allegations of consumer gouging by these very same attorneys. But the alternative is bleak.

If no one could afford to maintain a repossession company in these areas, lending would suffer directly. No repossession companies means no repossessions outside of those acquired through legal judgement. These would cost in the area of $2,000 to $5,000 per instance and clog up the court schedules causing slower recovery periods and higher lender losses.

Higher lender losses would contribute to higher interest rates to the consumer.

While the practice of “red lining” (a form of illegal discrimination in which a bank provides unequal access to credit, or unequal terms of credit on a prohibited basis based on the location of the applicant’s residence.) or not doing business in specific areas is illegal by the Equal Credit Opportunity Act (ECOA) or Reg. B. While this was designed to stop abuses in lending in predominantly minority neighborhoods, it would very easily translate well into other frivolous lawsuits to the lenders.

This would also prohibit lenders from charging higher interest rates in these areas meaning that lenders would have to raise interest rates across the respective states and regions to make up for these losses. These higher rates would have a chilling effect on auto sales which would trickle up to the manufacturers and the entire auto industry and eventually cost jobs.

across the respective states and regions to make up for these losses. These higher rates would have a chilling effect on auto sales which would trickle up to the manufacturers and the entire auto industry and eventually cost jobs.

Funny how that all fits in together, isn’t it. I’ve been saying for years that the entire auto industry is an ecosystem in itself. Take one part down and the whole thing collapses. As much as the nation’s economy is tied to the auto industry, the courts, the attorneys and least of all the consumers, fail to see the ramifications of these actions and how they can affect the nation’s financial well being and especially small business owners.

“Penny wise, pound foolish” so the old saying goes. Even if their motives were pure, at the end of the day, there would be a tightening of credit and a rise in rates which would affect the lower income consumers most.

”But what the hell, it’s easy money for them, right?

Kevin Armstrong

Editor

Facebook Comments