GUEST EDITORIAL

Kevin,

We very much appreciate your recent editorial about Repo Agency Insurance – Are you Really Covered? While it mentions one particular division of an insurance company in referencing Progressive Paloverde, the issues mentioned in your editorial of grossly underreporting the estimated or actual numbers of repossessions or the location of the agencies trucks being run out of satellite offices and not the reported home office – are extremely common practices by many unethical insurance agencies and brokerages in their efforts to write repossession agency exposures.

Those issues are not limited to Progressive Paloverde; carriers like Liberty Insurance, Falls River, AmSouth / AmTrust, Hiscox, Wesco, National Indemnity, National Fire, and others all have been subject to receiving the same misleading insurance application submissions throughout their years of dabbling in the repossession insurance market. In fact, at the carrier level they don’t even know about it until they audit your records (which generally are done by 3rd parties) or they see claims unrelated to the traditional lines of business they write.

The problem is however that the insurance agent and/or broker know what they have submitted – and often times the insured (the repossession agency owner) themselves is very much aware of it as well; but does nothing to correct the situation. They rely on justifications like:

“My insurance agent knows what I do”,

“My insurance agent filled out the application”, or

“I just need to save money (or even just get insurance), I don’t care how the insurance agent does it.”

We have (yes, we’ll use the word) preached for years that unethical insurance agents will do anything to get a repossessors business and that almighty commission; and many times does do anything to find a market willing to write the coverage because it is a risky, hard to place, harder to maintain market. But that is why the industry keeps seeing insurance options come and go; and also why when you find a properly priced policy it is so much more expensive than what the repossession agent had previously or was expecting.

The goal of most businesses is to make money; insurance companies are not any different. So while you say and most believe that insurance carriers are always looking for a reason to decline a claim; that is not completely accurate. Insurance companies do want to make money and when losses are controlled, premiums are priced properly and investment income is good; well, insurance companies can.

However, when losses are high, premiums are low and when investment markets are underperforming, carriers don’t make money and they look at areas where they are losing money. Those areas are going to be where losses are high and premiums are low… and there goes the insurance market, time to bail out; or here comes skyrocketing insurance premiums to try to make up for the losses. And with that comes….creative insurance application submissions which include deliberate misinformation, short cuts, inaccurate loss histories, the list can go on and on. We are familiar with an agent who still writes repossessors today, who once told a repossession agency owner in search of insurance in the Atlanta metro area 15 years ago to open a mail drop box in South Carolina which had more favorable rates than the Atlanta area and then they could wait 6 months into the policy to tell the carrier they moved to Atlanta.. This same agent and others also still writing today are knowingly submitting falsified applications for their customers who have locations in a major metropolitan area and in more rural areas with the majority of their vehicles shown in the rural area and show only 1 truck or 1 spotter vehicle in the higher priced metro area

But when the repossession agent signs that application, the one they are attesting to as true and accurate information with the state required disclosures about fraud and knowingly submitting false or misleading information, they too are complicit in this deception and are just as guilty as the insurance agent that may have put the insurance submission together in the first place. The repossessor is also the one who has the possibility of having the claim denied and having to pay out of pocket for the loss and could face fraud charges. The insurance agent will just plead that he took the information given him by the repossessor and that he (the insurance agent) gave him the application to review and sign as being truthful. Not sure about you but if I had an insurance agent pulling these shenanigans I would take a hard look at who I am trusting my business to.

One other caveat on your editorial, you do mention that you’re not speaking of the cleverly marketed national carrier “Progressive”, but “Progressive Paloverde”, all of your readers should be aware they are one in the same.

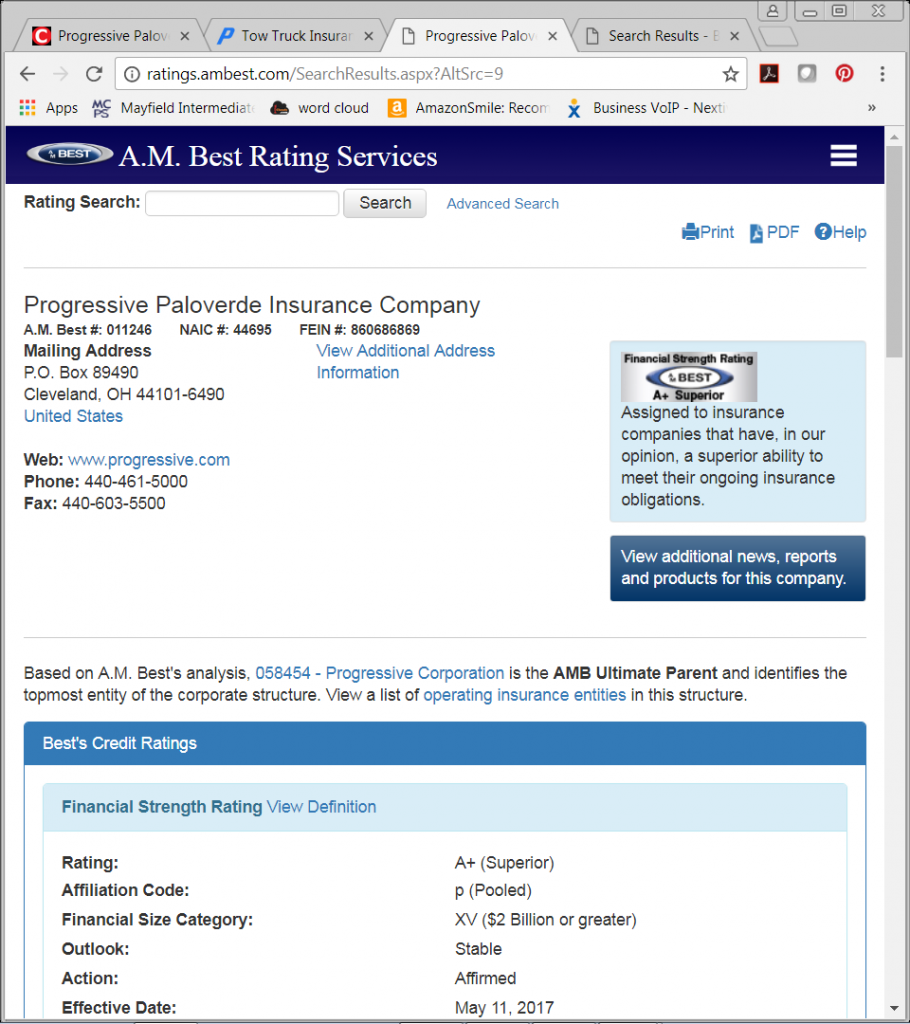

Carriers have different companies under one corporate umbrella that write in different states or regions, often due to filing or tax reasons, but a quick check of AMBest shows www.progressive.com as the company website, which goes to that carrier we all know from their TV commercials. This is taken directly from Progressive’s Commercial Insurance site:

Towing insurance: tow trucks used for repossession

Progressive does not currently offer insurance for commercial tow truck businesses that earn more than 24 percent of their revenue from repossession work.

Since repossessors don’t want to trust or believe us when we tell them, your readers can verify it for themselves here: https://www.progressivecommercial.com/commercial-auto-insurance/tow-truck-insurance/

RSIG is always told we are too expensive, but instead it should be understood that we are properly priced. Another other factor to keep in mind, while repossessors search for the cheapest policy available, they are putting themselves in a position where their losses look even worse by taking the lowest cost option. When you pay fewer dollars in and the carrier pays significant dollars out, your higher loss ratio has a very negative impact on how you look to a new carrier. We admit at times we may cost more than other providers, but when you add up everything else we provide and take into account our longevity and stability in the market place, the adage is true, you get what you pay for.

Ed Marcum

Recovery Specialist Insurance Group