New York, NY – 21 November 2017 – The growth in household debt can be attributed, at least in part, to the growth in auto loan balances, which have increased for 26 consecutive quarters as a result of new loan originations. In the aggregate, there are apprx. $435 billion worth of auto loans outstanding that were made to consumers with a credit score below 660.

Another area for concern, according to the New York Fed, is rising auto loan delinquencies to “sub-prime” borrowers – primarily those with lower credit scores. The New York Fed estimated that 23 million consumers hold subprime auto loans, which are based on a credit score below 620.

Apprx. 20% of new car loan originations are made to sub-prime borrowers. These loans were not made by traditional banks or credit unions, but by auto finance companies such as car dealers and related lenders.

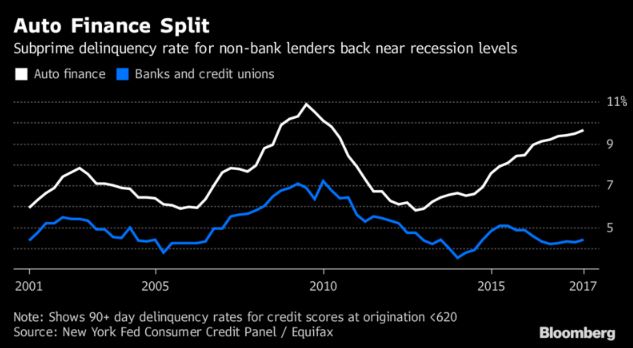

As you might expect, there is a divergence in the delinquency rate for auto loans between bank and credit union lenders compared with non-bank lenders. Auto loans from traditional bank lenders had a 4.4% delinquency rate (90 days or longer), which has been improving since the financial crisis. However, delinquencies on auto loans from non-bank lenders have been more than double those of traditional bank lenders – at 9.7% over the year ended September.

Given its current relative size as a consumer loan segment, the NY Fed says delinquent sub-prime auto loans from auto finance companies do not, on an absolute basis, meaningfully impact the overall economy – assuming it does not continue to worsen. Given that caveat, the subprime auto loan market is important to monitor, at least in the near-term as one economic barometer.

In summary, Americans faced with lackluster income growth continue to finance more of their spending with debt. The largest gains came in student loans, auto debt and credit cards. The question is, how long can this trend continue?

There are early signs that loan burdens are growing unsustainably large for borrowers with lower incomes. That will only worsen as the Fed raises interest rates most likely in December, with additional increases likely next year.

Source: Valuewalk

Facebook Comments