EDITORIAL

If you didn’t think the big Lenders thought very highly of the men and women and the industry that recovers their delinquent auto loans before, their latest actions show their clear disdain and dismissiveness. It has just recently been reported that numerous repossession agencies have recently had their access to company credit cards and bank accounts closed by Bank of America, Citibank and Chase.

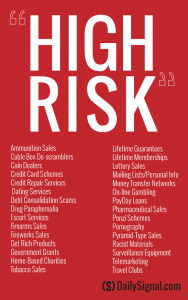

Despite a change in presidential administrations, a Department of Justice program named “Operation Choke Point”, leftover from the Obama administration, appears to be rearing its tyrannical malfeasance against the repossession industry. It appears that the  aforementioned banks, at least, are labeling the repossession industry as a “high risk” industry and a source of reputational risk. This puts the repossession industry under the same category as gun manufacturers, the porn industry and drug paraphernalia shops.

aforementioned banks, at least, are labeling the repossession industry as a “high risk” industry and a source of reputational risk. This puts the repossession industry under the same category as gun manufacturers, the porn industry and drug paraphernalia shops.

While answers as clear as I’ve spelled out above are not as clear from Bank of America and the others, the agencies affected are being told that their “line of work” is the reasoning for these cancellations.

This labeling, of an industry which they also hypocritically use with frequency, has recently been the source of numerous repossession companies having their bank accounts and credit card accounts frozen without notice.

Since 2011, regulators have increased scrutiny on banks’ customers. The Federal Deposit Insurance Corp. in 2011 urged banks to better manage the risks of their merchant customers who employ payment processors, such as PayPal, for credit card transactions.

In 2013, the Justice Department has launched Operation Choke Point, a credit card fraud probe focusing on banks and payment processors. The threat of enforcement has prompted some banks to cut ties with online gun retailers, even if those companies have valid licenses and good credit histories.

Under President Barack Obama, the department said the effort was intended to root out fraud by banks and payment processors and to cut off the banking system from wrongdoing by merchants.

In August 2017, it was reported that the DOJ had committed to lifting this overly punitive operation as it was hurting legitimate businesses and causing undue damage.

In a letter to House Judiciary Chairman Bob Goodlatte (R-Va.), Assistant Attorney General Stephen Boyd referred to the program as “a misguided initiative.”

“We share your view that law abiding businesses should not be targeted simply for operating in an industry that a particular administration might disfavor.”

might disfavor.”

Karl Frisch, executive director of Allied Progress, blasted the letter as “a massive giveaway to predatory payday lenders and other shady financial scam-artists.

“Operation Choke Point has been incredibly effective at cracking down on the flow of money to fraudulent merchants that violate the law and target vulnerable consumers,” Frisch said in a statement.

But Republicans in Congress have argued that the program hindered banks from serving legitimate businesses and tried to get officials to back off by using legislation and investigative powers.

Perhaps we missed the memo from the DOJ adding the repossession industry as “High Risk?” Perhaps there has been other auditory guidance issued by the FDIC or others? Regardless, the thought process seems to be rather disjointed that they would refuse to do business with the very people who they hire (mostly through Forwarders) to do their dirty work. That said, are they looking at Forwarders the same way? I would think not.

Perhaps we missed the memo from the DOJ adding the repossession industry as “High Risk?” Perhaps there has been other auditory guidance issued by the FDIC or others? Regardless, the thought process seems to be rather disjointed that they would refuse to do business with the very people who they hire (mostly through Forwarders) to do their dirty work. That said, are they looking at Forwarders the same way? I would think not.

This hypocrisy illustrates the disconnect between overzealous compliance efforts and a simple knowledge of their own larger picture processes utilizing legal and compliant businesses that to implement their own processes. There is no logic in this.

Consider this. If a business feels your business is not worthy of doing business with, why would you do their dirty work? Perhaps it’s time the industry “took a knee” on repossessing their vehicles?

It has been suggested that unless a lifting of this mislabeling is made, a full industry boycott should be advocated by the repossession industry, thus affecting the recovery rates of these lenders. Boycott or not, perhaps the repossession industry should turn its backs on these same lenders for their personal accounts as well as recovering their delinquent collateral.

[poll id=”163″]

Kevin Armstrong

Editor

CUCollector.com

Facebook Comments