Editorial

$500 repo fee. Sounds pretty radical, doesn’t it? Well, really, it’s not. I imagine every one of us has had a father or grandfather who tells us how candy bars used to cost a nickel and gas was a quarter a gallon. Well, they’re usually telling the truth. These changes are reactionary to operational costs of living and operations and fall under a proven thing called (dig this) inflation.

According to economist, this “inflation” is 1.6% YTD and has averaged 2.14% per year since 2000. Now, I am not an Economist, but thanks to the internet, there are inflation calculators available for you to do your own math.

I used a spread sheet and did my own math. Now, take the 2.14% and add that to a $325 repo fee from the year 2000 and you increase the fee by an average of $8.30 per year against the previous year and, by 2017, you come up with an average repo price of $466.16. That’s assuming that $325 was a decent fee in 2000, which, as I recall from the tail end of my repo company management years, was our standard fee and did not include storage, keys, delivery and of course personal property fees.

So, that gets us pretty damn close to $500. Now, consider the additional compliance requirements that have been placed on everyone and that additional $33.84 per repo applied onto 100 units and that’s an additional income of $3,384.09 by scale. Sounds awesome right?

Wrong! Do your own math on this one and tack on the price of all of the additional compliance required by lenders and technological additions that are pretty run of the mill these days, such as LPR, cell phones, network fees, dash cams or body cams. $33.84? The aforementioned expenses actually apply across all assignments, not just the repossessions. Let’s face it. No one is recovering 100% of their assignments.

That $33.84 surplus would get gobbled right up if you paid your agents a similar rate increase. If you paid an agent $75 per repo in 2000, that would come up to $107.58 per repo today. A measly $32.58 increase. Now apply that over 100 units. $3,257.52. Now you would have a whopping $126.58 left over to pay all of those other expenses I mentioned above. Whoop-ti-frickin-doo! (Yeah, I’m being facetious, if you can’t tell.)

As you can see, the root of the soon decline and demise of the professional repossession agency, is the result of an industry wide lack of desire, or dare I say more accurately, fear in doing what must be done and should have been done over a decade ago. Apply standard inflationary costs to your businesses!

The fear arises from the fear that someone else will always do it cheaper, and that is a valid fear. The only leverage you have to accomplish this, is unity across the industry! All associations must come together and demand of their members to apply price adjustments to meet economic and operational demands. This can not be optional!

Obviously, the associations all need to get on board and launch a pressure campaign against lenders and forwarders unwilling to accept these reasonable terms. This would unfortunately, require boycotts and demonstrations of the deaths, injuries and danger to public safety that untrained and uncompliant agencies and their employees have caused by deed and tactics and will continue to do so until the lenders find themselves on the cover of every website and newspaper in the country.

In an industry full of “A type” personalities and self made men and women, any reasonable person would assume this wouldn’t’ be so difficult, but alas, easier said than done. This requires leverage and unity folks, lots of it!

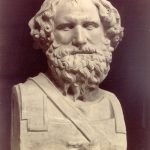

“Give me a lever and a place to stand and I will move the earth.” (paraphrase) Archimedes @ 225 BC

“Give me a lever and a place to stand and I will move the earth.” (paraphrase) Archimedes @ 225 BC

Kevin Armstrong

Editor, CUCollector.com