Guest Editorial

Guest Editorial

As another fiscal year for my company is coming to an end, it is time to start planning for the next one and as I do every year I get to dive into last year’s budget to begin the process of building a new one. This gives me clear insight as to what we were able to accomplish and what we believe we will accomplish next. It also allows me the advantage to see if my predictions we correct, were there trends that I didn’t anticipate, and so on. I firmly believe that this is the single greatest tool a business owner or manager can have to run their company.

This particular year my curiosity got the best of me and in addition to looking at the previous year I decided to go back even farther.

Some background for you before I go on. I came to purchase my company June of 2010 after being the senior executive for two years, and in hindsight I think we can all agree it was the most difficult time this industry has seen in decades. That was the first year right after the boom where everyone with a tow truck thought they could get into the business and before the CFPB was the new sheriff in town. One of the advantages of purchasing an existing company is that you instantly have historical information, an identity and a way of doing business that would take a startup many years to create. My particular company’s identity dated back to 1997 which allowed me almost 15 years of data to dive into.

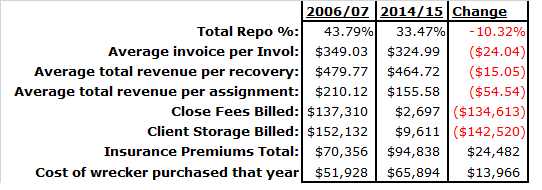

For this particular exercise I went back to the 2006-2007 fiscal year, this was the first full year with the current accounting software and allowed for easy year to year comparison. After only five minutes reviewing the data, a range of thoughts and emotions hit me like a ton of bricks. It was truly eye opening to see in less than 10 years how much my company changed not only in how we do business but what we were being paid for our services. I would be lying if I said I wasn’t concerned, not just for my company but for the industry as a whole. Allow me to share my company’s exact numbers from both 2006-2007 and 2014-2015 so you can see what I am talking about. The numbers are true and exact, there is no rounding up or attempt to conceal information for any reason.

Let’s do a side by side comparison.

So what does all this mean? How can the numbers change so much in less than a 10 year span? I will be the first to admit that some of this change is possible simply by the change of ownership and new management style. As much as I would like to say I’m a great business owner, I will admit that I am not Warren Buffet. I am young, human and made mistakes along the way. However with that said I am very well versed in my numbers and what it costs to run this business, and what I see here scares the hell out of me. This is a trend that is breaking this industry and taking it from a one of service to a commodity that is traded on a whim and the clients out there that do value the “service” are a small minority.

Obviously, I only have the numbers that my company produces to identify trends in our market. What the above numbers suggest is that in the very near future we will reach critical mass, where the basement of fees has been reached and the only way to go is up. If my company is anything like other companies across the country (which I fully believe we are) the same awakening is happening. We cannot continue to endure the cost increase of insurance, compliance, employee training and so on with fees continuing to decline. There is a breaking point and I think we are at ours.

I offered my companies numbers in an effort to spawn thought and conversation amongst my peers. I know there will be some that will be critical and some that may not trust the information, but my overall hope is that at the minimum it leads to more of my peers joining in the conversation, share their information, and build a community of truly informed business owners.

I want to encourage everyone to run the same experiment, if you can, and see what your numbers say. You may be as surprised as me.

Jeremy Cross

President, International Recovery Systems.

As a result of our RepoRoute platform being in the final stages of development and beta testing, I’ve met with some of the largest lenders in the US in the past few months to specifically discuss the (lack of) quality in regard to the assignment process, i.e. the assigning of so many bad addresses as well as the rotating of accounts to so many vendors without any guidelines or consequences regarding address qualification being done and the need for everyone’s technology to be connected to help everyone better understand issues like this. That’s the root of the problem, along with the reduction in non repo fees, as Jeremy also points out. The first step is to get everyone talking about this to our clients, good job Jeremy!

They clearly know its a problem, they want to improve, but seem to be lacking the resources to improve in many cases, as they’re all getting hammered by compliance requirements and that’s tying up the resources. I think if we all do what Jeremy has done and if the industry keeps presenting this consistent message, the lenders will actually cooperate. I’m also challenging and measuring our masterQueue lender users who are assigning accounts to be more efficient, own internal