“The Largest Not-For-Profit National Trade Association Of Repossession Specialists Since 1936”

“The Largest Not-For-Profit National Trade Association Of Repossession Specialists Since 1936”

FOR IMMEDIATE RELEASE

November 16, 2016 – Recovery/Repossession businesses across the country recently received a letter from MBSi Corp.—telling these small business owners that they are REQUIRED to purchase and download MBSi’s newest evolution software and operating system, Recovery Connect. Failing to do this, the letter said, would discontinue the ability of the repossession company to do business with Santander Consumer USA, Inc. and Chrysler Capital. No, MBSi didn’t try to sell the use of Recovery Connect system… they DEMANDED that the system be purchased and used.

There are several reasons that blindly following the “required” instructions should be avoided:

There are several reasons that blindly following the “required” instructions should be avoided:

The first, and most obvious, concern is the cost to the end-user of the Recovery Connect System. Thirty dollars per month, plus $5 per user per month, may not seem like a lot of money to the people creating and adopting these changes with every “new innovation”; however, the profit margin for the small businesses who actually do the work in the recovery industry has already been squeezed down to a miniscule amount—if a profit even exists! Adding more expense for the “privilege” of working an account from any lender, or through any forwarder, is not an option if many of these small businesses are going to stay in business! In almost any other small business relationship, when the company in need of a service prefers the company providing the service to use a specific platform for the service, the company in need of the service requests that the service be provided on that platform at the expense of the company wanting the platform used.

No less important when working within a small profit margin, is that the use of the Recovery Connect platform will increase minutes and data for which the recovery company pays each month with their phone carrier. It is not the recovery businesses’ expense to bear! This could be deadly to the bottom-line of repossessors—especially if this type of demand grows or is adopted by more clients.

Secondly, even if the platform were free for use by those in the field actually doing the work of recovering collateral on defaulted loans, the use of this platform will require a third party’s software to be downloaded onto repossession company computers, and onto company or personal cell phones. Here are a few of the reasons that is unacceptable to the heart of the repossession industry:

According to the Recovery Connect FAQ’s produced by MBSi Corp., one of the “perks” of the Vendor Comply, complaint-management portion of the Recovery Connect platform is the ability for the lender to schedule follow-ups and tasks for the repossession company to do in connection with any lodged complaint. According to the IRS and CFPB, if a lender is scheduling contacts and directing tasks for our offices to do, we are employees and no longer independent contractors—regardless of what our contracts say! Does this mean these lenders want to provide us with employee benefits and overtime pay? We don’t think so.

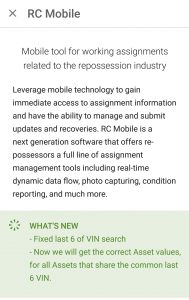

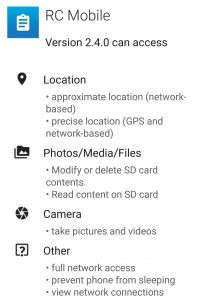

Downloading the RC Mobile application onto a cell phone carried by our employees in the field gives MBSi the ability to track the location of repossession field agents using passive GPS location data. Yes, we understand that this “service” can be turned off when the app is not in use, but who decides the settings on employees’ personal cell phone? Not the employer… and not the app generator… except that the default setting is to track field agents. And what are the implications to the lender if the location services are turned off? Also, by installing an application and accepting the required permissions the developer is granted permission to add additional capabilities, and possibly further access, through updates.

Downloading the RC Mobile application onto a cell phone carried by our employees in the field gives MBSi the ability to track the location of repossession field agents using passive GPS location data. Yes, we understand that this “service” can be turned off when the app is not in use, but who decides the settings on employees’ personal cell phone? Not the employer… and not the app generator… except that the default setting is to track field agents. And what are the implications to the lender if the location services are turned off? Also, by installing an application and accepting the required permissions the developer is granted permission to add additional capabilities, and possibly further access, through updates.

If each field agent has “their own Recovery Connect account” that can be accessed on any device, as set out in the MBSi Corp. Recovery Connect FAQs, how can the employer insure that confidential information is kept confidential? It can’t. Portable communication devices were declared vulnerable to the improper use of non-public personal information included in repossession accounts before the CFPB even existed. Cell phones are used for screen shots millions of times each day! Our field agents are trained to understand that this nppi is confidential and must be kept safe; however, there are no guarantees that someone other than the authorized user will not pick up a phone or tablet and see the information as interesting—saving it for sharing or use at another time. When the information is taken outside of the secure environment of a desktop or laptop operating system, the risk increases exponentially. Isn’t there a potential infraction against rules set by the GLB, FDCPA or UDAAP?

Some of the terminology included in the platform makes the industry vulnerable to outside forces. For example, if an account is labeled as “Pending Recovery” AFTER the collateral is “on-hook”, just because a condition report has not yet been completed, the label implies that recovery has not yet occurred. The ramifications in litigation are huge when an issue turns on whether a repossession is complete prior to some other event occurring.

Since this platform allows the field agent to receive “information from the lender in real time”, the possibility for the small business repossession company to lose control of its employees in the field is an unacceptable risk. Lender employees who monitor defaulted accounts may, or may not, be trained in the laws and regulations applicable to a repossession in the field, in a given location. Repossessors often receive instructions from their client’s representatives that are unacceptable in a certain state or locality. Recovery company owners work long and hard to stay updated on the laws covering their operations, and to make sure their employees operate within those parameters. But if some other authority figure on a given account is advising the employee to do “the wrong thing”, and the employer is not in the loop to advise about the local regulations, the employee could easily act in accordance with Client instructions rather than in accordance with the law applicable to the recovery. It is the recovery company owner who then becomes responsible for the illegal activity. That owner should not be asked to give control of field agents and their work product to the lender, just to make communication happen in real time. Synchronized communication is not better if it results in a wrongful repossession.

And since the Recovery Connect platform requires access to the files on the devices to which it is downloaded, what is the assurance to the small business that the information from unrelated files will be secure? Is this too a GLB, FDCPA or UDAAP issue?

Allied Finance Adjusters’ Members, and other small business owners in the repossession industry need, and deserve, answers to these concerns before they are “forced” into a purchase of Recovery Connect. MBSi, if you have something to sell, please sell it to us by convincing the industry that its use is legal, it will work for repossession companies, and its use will result in a larger profit margin rather than a smaller one!

Allied Finance Adjusters Executive Committee

Allied Finance Adjusters Conference (800) 843-1232 Fax (888) 949-8520 www.alliedfinanceadjusters.com

Facebook Comments