In our two prior CUCollector Surveys, LPR was one of only several topics we covered, but as the result of some discussion coupled with demand, we felt that we were well overdue in approaching this topic in a more focused manner and drilling down on it a little deeper than in years past. The accompanying data is inclusive of previous years and while disparities in poll volume vary from the years, the percentages are the best methodology for illustrating the data results.

In our two prior CUCollector Surveys, LPR was one of only several topics we covered, but as the result of some discussion coupled with demand, we felt that we were well overdue in approaching this topic in a more focused manner and drilling down on it a little deeper than in years past. The accompanying data is inclusive of previous years and while disparities in poll volume vary from the years, the percentages are the best methodology for illustrating the data results.

While responses to polls tend to lean toward the negativity you would expect in a “Yelp” review, I would like to think that this years responses are perhaps more fairly balanced despite some clear underlying pessimism within.

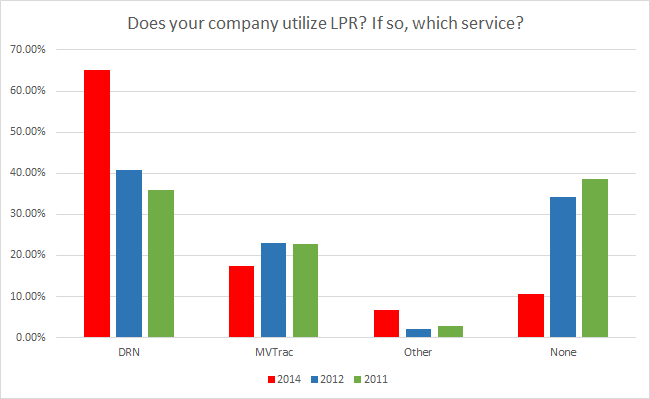

Does your company utilize LPR? If so, which service?

Right out of the gates we found that DRN users led the pack in their responses. While this was not intended, it was expected since there do appear to be very strong feelings both for and against this provider.

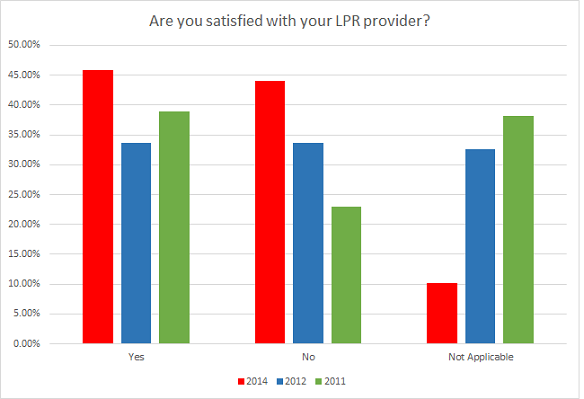

Are you satisfied with your LPR provider?

A pretty straight forward question, with really mixed results and not bifurcated by vendor. There is clearly some improvement in user satisfaction from previous years as illustrated below. While I am sure most would like to see this split between the vendors, for the sake of some level of objectivity, I kept these consolidated.

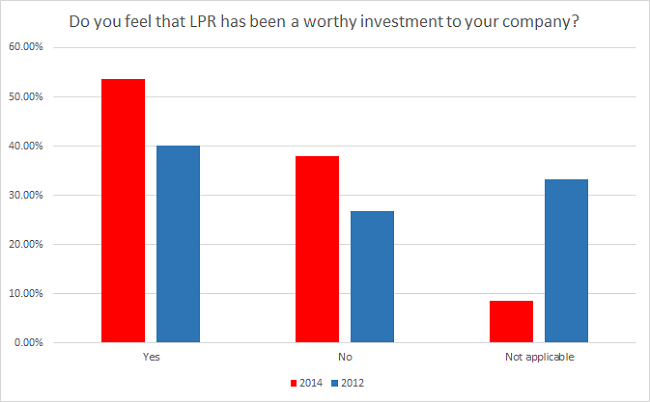

Do you feel that LPR has been a worthy investment to your company?

Once again, these results show an improved perception from the end users, at least as far as the respondents answers show.

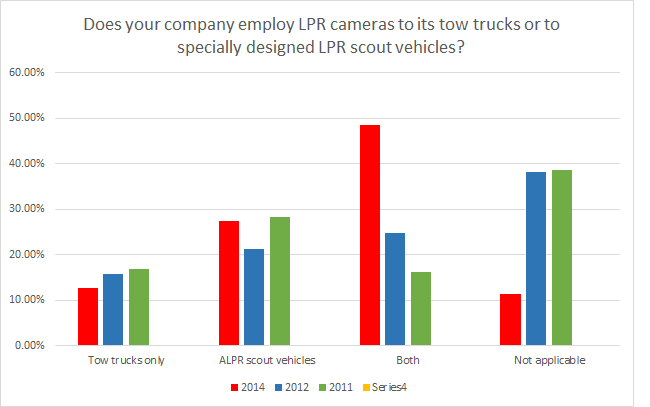

Does your company employ LPR cameras to its tow trucks or to specially designed LPR scout vehicles?

More so than in prior polls, the employment of camera cars in conjunction with the mounting of LPR cameras to tow trucks seems to be gaining favor for the obvious reasons of improved fuel efficiency as well as increased capacity in data capturing while keeping the trucks employed on the actual recoveries.

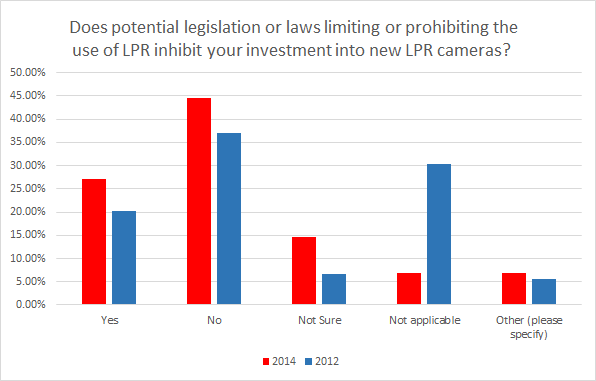

Does potential legislation or laws limiting or prohibiting the use of LPR inhibit your investment into new LPR cameras?

Over the past couple of years, legislation has come and gone attempting to eradicate the use of LPR by both the repossession industry as well as law enforcement, but to little avail. Regardless, such politically charged legal saber rattling could discourage some from investing in LPR technology and when compared to 2012, it does appear to be a source of some discouragement but clearly not too much.

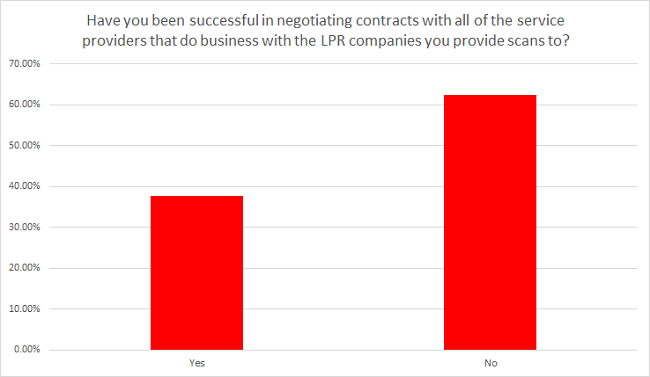

Have you been successful in negotiating contracts with all of the service providers that do business with the LPR companies you provide scans to?

Whenever I send out these polls, I like to ask a few agency owners, association leaders and service providers for any questions they would like to see. This is one. While I for one, am usually reluctant to deviate from any standardized contract, I as well can be a bit of a hypocrite in that I always request contract revisions from vendors I prepare to do business with. There is a benefit in this practice, but this clearly seems to be less wiggle room in this than many would like.

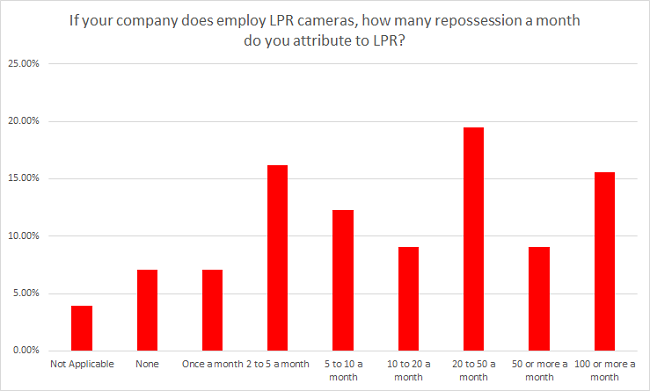

If your company does employ LPR cameras, how many repossession a month do you attribute to LPR?

I regret not branching this poll out to demonstrate some variance in production between large repossession agencies and smaller one. Hell, the argument could be even better made that population density would be even more relevant. Regardless, the poll results on this question are fairly mixed.

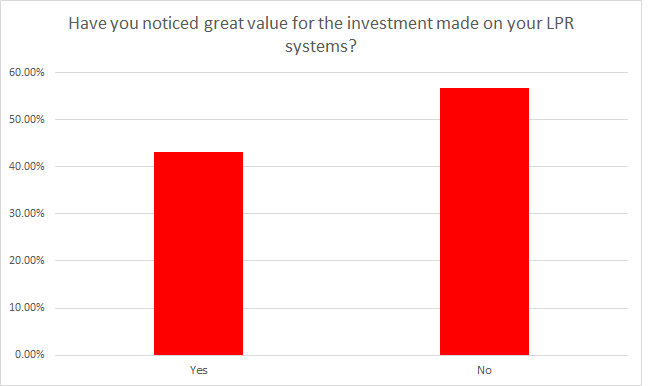

Have you noticed great value for the investment made on your LPR systems?

The responses to this question are almost split. This is fairly consistent with question number two but the difference lies in the value issue and not with the service provider themselves. I had hoped that this would create some focus more on the product than the service provider.

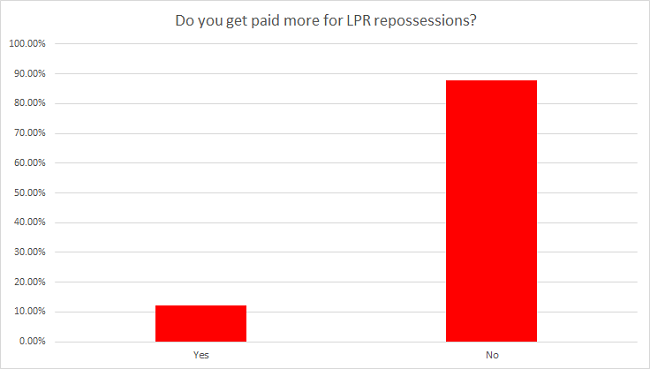

Do you get paid more for LPR repossessions?

This is a new question and frankly, I’m a little surprised that as many as 12% of the respondents claim to be getting paid more for LPR repossessions. That is pretty contradictory to what I’ve been hearing for years, but then again, who knows what those respondents are charging for a standard repossession?

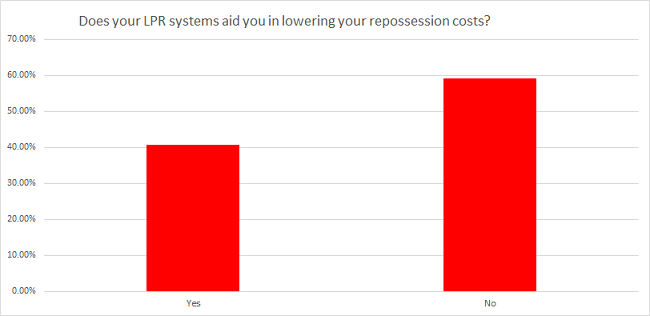

Does your LPR systems aid you in lowering your repossession costs?

Interesting results. This is a question that deserved some drilling down on to find out why some, as high as 41%, would believe that after adding in all of the costs of this service and equipment, the volume of repossessions would suffice to somehow reduce the cost of a repossession when in another question, they claim to be making less or the same for LPR repossessions.

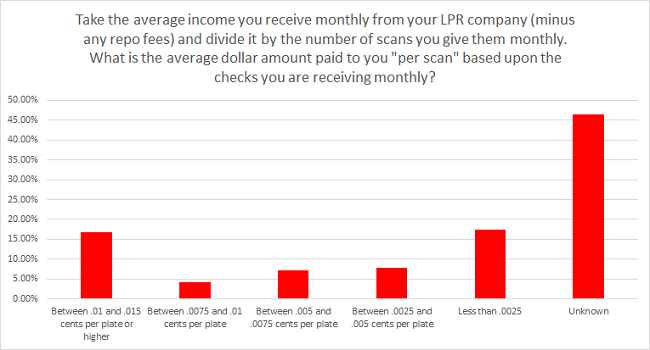

Take the average income you receive monthly from your LPR Company (minus any repo fees) and divide it by the number of scans you give them monthly. What is the average dollar amount paid to you “per scan” based upon the checks you are receiving monthly?

OK, two trains leave New York going down separate tracks. One is going to Atlanta at 75 mph… Yeah, this questions is kind of wordy and requires some math and clearly with 46% of the respondents either refraining from making the effort or outright not knowing, we ended up with seriously mixed results from both extremes of the value proposition.

No poll is perfect and I by no means claim to have any professional background in poll taking nor is this in any ways a scientific study. This is merely a poll generated to check the pulse of the repossession industry in it’s adoption of, use of and satisfaction of LPR. In my humble opinion, this technology has the potential to dramatically change the industry to everyone’s favor, from the lender, who reduces losses and increases recoveries, to the consumer, who is afforded record low interest rates as the result of these lower loss rates to both the LPR companies and repossession agencies whose relationships should be one of mutual benefit.

Unfortunately, bad blood still does exist and there is much room for improvement in developing trust and respect for each other between the LPR companies and repossession agencies. At the root of this lies prices. The same issue everyone has with the forwarders. It is an unfortunate side effect of a free market economy that forwarders and LPR providers must compete against each other at the unit price level and as such, pass it down to the repossession agencies, who can either take it or leave it. The expectation of increased repossession volume to offset the costs of subscription and hardware does not firmly seem to be the case and as such, despite improvements from years past, some discourse still exists within the industry.

Kevin Armstrong

Editor, CUCollector

Facebook Comments