‘If anyone tries to block or delay the CFPB payday rules, it’s time to fight back hard,’ says Senator Elizabeth Warren

Newly proposed rules aimed at reining in predatory payday lending are “a good first step,” economic justice groups said on Thursday, but “worrisome loopholes” must be closed in order to fully protect low-income Americans from financial devastation wrought by the high-interest, low-dollar loans.

The U.S. Consumer Financial Protection Bureau (CFPB) unveiled the new rules on Thursday, at a hearing in Kansas City, Missouri—a state, Politico notes, “where storefront lenders outnumber McDonald’s and Starbucks franchises.”

Under the proposal, lenders of payday, auto-title, and other high-interest loans will be required in many cases to verify their customers’ income and to confirm that they can afford to repay the money they borrow—plus fees and interest.

“It’s time for our Representatives in Congress to speak up and let us know where they stand. Do they support the CFPB’s proposed rule, or not? Will they champion the needs of their constituents and those caught in the payday lending debt trap or that of the predatory lenders who fill many of their campaign bank accounts?” —Karl Frisch, Allied Progress

In addition, the long-awaited rules would also curtail the number of times that people could roll over their loans into newer and pricier ones—thus getting stuck in a “debt trap”—and prohibit lenders from making more than two unsuccessful attempts to debit money directly from borrowers’ bank accounts.

But while there was wide agreement that the proposal would reshape the loan landscape, some said the proposal didn’t go far enough. Nick Bourke, who directs the Pew Charitable Trust’s Small Dollar Loans division, wrote on Thursday:

As proposed, the CFPB’s approach would lead to major changes in the market for payday and similar loans, notably by accelerating the general shift toward installment loans that consumers pay off over a period of months instead of weeks. However, the prospect of harmful loans would persist because the proposed rule would leave lenders free to charge any rate and set almost any term as long as they make a “reasonable determination” that the borrower can repay the loan. Under this vague directive, payday lenders are in the driver’s seat, because the rule would allow them direct access to borrowers’ checking accounts or, in the case of auto title lenders, grant them the power to repossess vehicles.

Lauren Saunders, associate director of the National Consumer Law Center in Washington, D.C., also pointed to “worrisome loopholes” including the fact that lenders could make up to three back-to-back payday loans and could start the sequence again after only 31 days.

The crackdown is likely to deepen the rift between Sen. Elizabeth Warren (D-Mass.), who created the CFPB, and Rep. Debbie Wasserman Schultz (D-Fla.), who backs a bill that would delay the CFPB regulations for two years while states put in place measures like Florida’s—under which payday loan stores have flourished.

Earlier this week, the group Allied Progress released a 30-second TV ad calling on Wasserman Schultz to drop her support for the industry and lambasting her for “refusing to put her constituents and millions of vulnerable Americans ahead of an industry that has given her more than $68,000 in campaign cash.”

On Thursday, Allied Progress executive director Karl Frisch declared: “It’s time for our Representatives in Congress to speak up and let us know where they stand. Do they support the CFPB’s proposed rule, or not? Will they champion the needs of their constituents and those caught in the payday lending debt trap or that of the predatory lenders who fill many of their campaign bank accounts?”

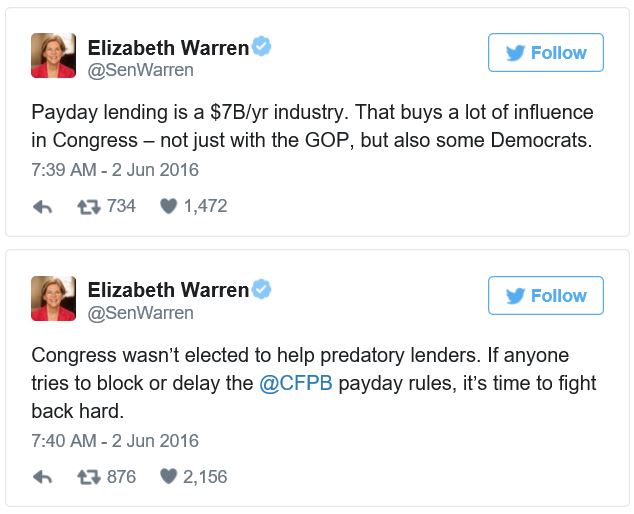

Warren tweeted to the same effect:

The CFPB will accept comments on the proposed rule until September 14, 2016. Those comments will then be examined and considered before the final rule is released.

To that end, National People’s Action and its partners across the country plan to generate tens of thousands of comments from borrowers, faith and community leaders, and grassroots activists calling on the CFPB to ensure the final rule contains three “commonsense” safeguards:

- The rule should require income and expense underwriting practices on all loans to ensure American consumers can affordably pay back the loan.

- The rule should put a stop to the constant loan rollovers and refinances that are rife in the industry and are hallmarks of the debt trap.

- The rule should prevent lenders from taking money directly from a borrower’s bank account or holding unlimited title to their car.

“Payday lenders thrive on lies and deception,” said Cherie Mortice, a community leader from Des Moines, Iowa and a member of National People’s Action affiliate Citizens for Community Improvement. “They’ve spent thousands of dollars trying to win over elected officials and deceive customers about this commonsense new rule from the CFPB. We want to make sure the industry doesn’t interfere with the public comment period, when our communities are supposed to get their say.”

Meanwhile, others continue to push to create a postal banking system as a legitimate alternative to predatory lending.

As Maine’s Portland Press Herald noted in an editorial just last weekend, post offices served as banks until the 1960s, at which point “bankers argued it was no longer necessary since deposits in their institutions were insured by the federal government.”

However, the editorial continued, “No one anticipated the banks’ abandonment of poor neighborhoods, and the rise of payday lenders.”

“The post office could fill that niche much more equitably,” the Press Herald argued. “It already has the infrastructure and the manpower. It doesn’t need to make profit on the transactions so it can keep its fees low.

“It’s time to drive out the predatory lenders and make reasonable financial services available everywhere. It’s time to bring back postal banking.”

Source: Common Dreams