FINANCE EDUCATIONAL CONFERENCE LAS VEGAS | AUGUST 4TH – 6TH, 2025 You’re Running Out...

Bank Collections

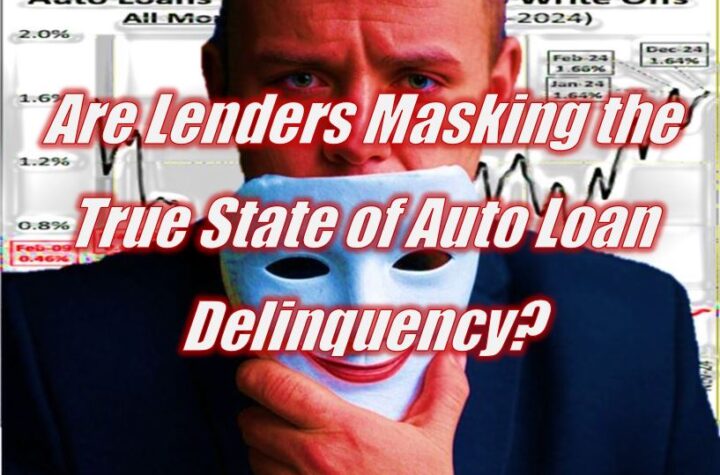

– A new analysis shows that delinquent car payments are increasing across the U.S.,...

– AKUVO, a leading technology organization specializing in collections and credit risk management, announced...

– Meet the Minds Shaping the Future of Collections – Join us in Minnesota,...

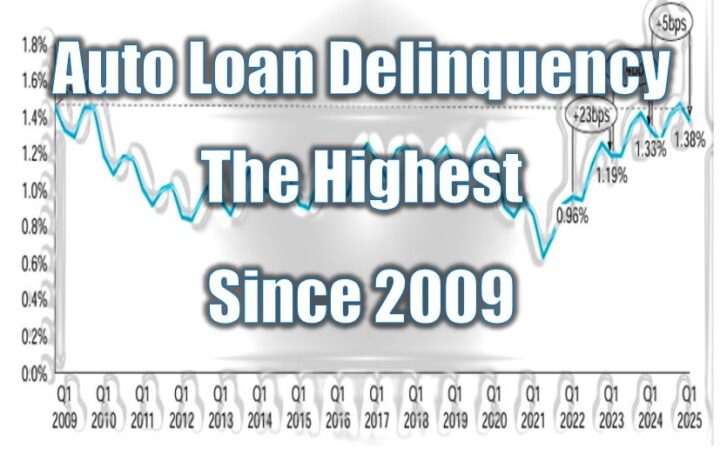

The 60+ DPD delinquency rate increased by 5 basis points YoY in Q1 2025...

Allegedly defrauded car dealers and financial institutions of over $500,000 _ Miami, FL –...

Strengthen Your Team’s Growth TriVerity Collection Academy | Bloomington, MN | September 22-24 Empower...

Reducing Risk in Recovering active, discharged, or dismissed vehicles Repossessing a vehicle from a...

LITTLETON, Colorado—March 25, 2025—PassTime®, a leading provider of asset tracking solutions announced today that...

It almost sounds like the story in a Coen brothers’ film. A four-time World...

“… we’ve been moving back the timing of repossession.” In a high-stakes game of...

On February 1st, CFPB Director Rohit Chopra was fired by the Trump administration. Taking...

Household Debt Rose Modestly; Delinquency Rates Remain Elevated Press Release New York, NY –...

Whenever you have a REPO, get it listed or list it yourself with Carsker...

Automotive lending enablement provider to increase loan conversion and paystub fraud prevention via new...

“Examiners found that servicers engaged in unfair acts or practices when they erroneously repossessed...