So, the loan underwriters stipulated for proof of income, proof of residency and even called the employer and references. So, how did these fraud loans slip through your otherwise stringent underwriting guidelines? They got “took” by pros, that’s how.

Since the proliferation of GPS, License Plate Recognition technology and state of the art security on most newer vehicles, auto thefts are actually down. But this has not deterred the auto thieves of this world who have in recent years migrated to loan fraud in order to acquire these otherwise difficult to steal vehicles.

Straw Buyers

One of the most difficult of all time fraud methods to detect from the underwriting standpoint, has always been the “Straw Buyer” purchase. This fraud is traditionally perpetrated by luring the “Straw Buyer”, a borrower who, either through bribe or deception, applies for and signs the loan documents for a vehicle that they never intended to purchase.

Typically, the Straw Buyer is deceived by the Grifter, usually a “Confidence Man“, who gains their trust in believing that the loan will be transferred or paid off quickly and the buyer will suffer no consequences from the transaction.

Fake Paystubs

One of the biggest hurdles for the Grifter committing a Straw Buyer purchases is usually proving adequate income to overcome debt to income (DTI) or payment to income (PTI) underwriting guidelines. Unfortunately, since the advent of the internet and so many document altering programs, creating a paystub is fairly easy. It takes a trained eye to spot inconsistencies in tax rates and year to date (YTD) totals.

income (DTI) or payment to income (PTI) underwriting guidelines. Unfortunately, since the advent of the internet and so many document altering programs, creating a paystub is fairly easy. It takes a trained eye to spot inconsistencies in tax rates and year to date (YTD) totals.

This is where PayStubCreator.net comes in.

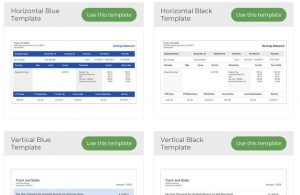

Pay Stub Creator has numerous paystub styles and can create a custom pay stub with the correct tax calculations and have them delivered online within a couple of hours for a mere $7.50 per pay stub.

Bundled Fake Employment Companies

While many fraudsters resort to manually photoshopping paystubs to overcome the proof of income stipulation, new services to facilitate their fraud have emerged.

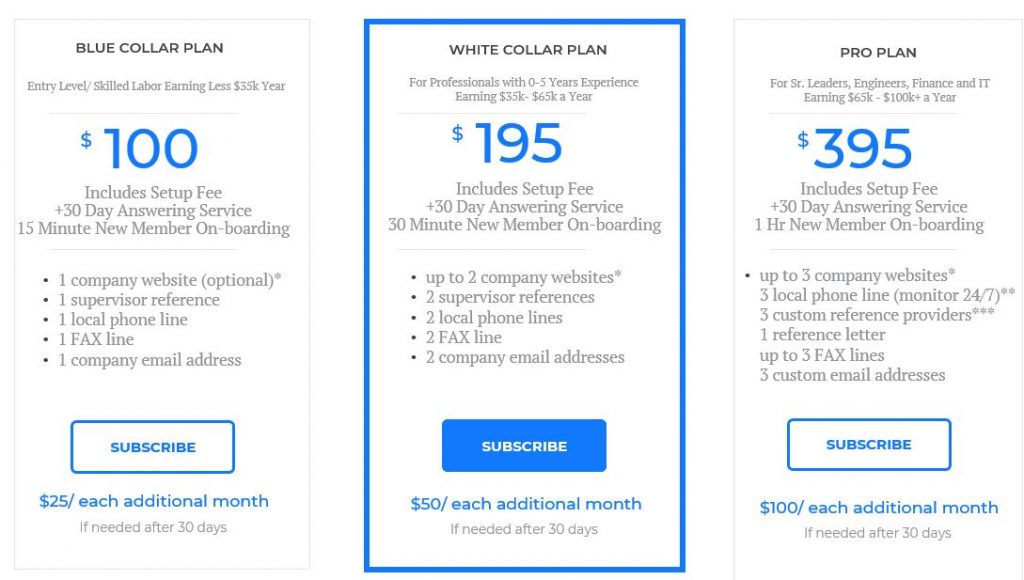

Careerexcuse.com, of Columbus, OH is a company who claims to be in the service of helping prospective employees overcome issues of good references, gaps in employment or lack of experience. To aid their prospective customers, they can create a five page company website and email addresses of a fictitious company, answer calls from a local area provided phone number in the companies name with customized scripts and even help beef up a resume to appear more appealing to employer application tracking systems (ATS.)

These programs are offered for as little as $100 with a “Pro Plan” at $395.

For enough money, Career Excuse can basically turn the hiring or loan stipulation process into an alternate reality game, with prospective employers or lenders as the “Marks.”

Boldly enough, Career Excuse founder William Schmidt, boasts in an interview at Motherboard;

“It all depends on how much they want to invest in making this company look real,”

“A lot of companies will use outsourced HR departments,” said Schmidt, who describes himself as, effectively, the HR manager for about 200 nonexistent companies. “They’ll use the work number for employment verification. I am basically creating one of those.”

Unfortunately, Careerexcuse.com is not the only player in the employment deception market. Two others include Paladin Deception Services of Minnesota and fakeyourjob.com.

Paladin Deception, unlike Career excuse.com, relies solely on the telephone and a very skilled ex-private investigator, Tim Green’s communications expertise to aid persons looking for work.

An important thing to remember here, is that none of these companies are accused of or are suspect, to the best of my knowledge in the assistance of perpetrating any form of loan fraud. The state that they are merely providing a service to help people get their employment lives back together, and they are proud of it.

Regardless, it doesn’t take much imagination to see how these services can be manipulated to perpetrate a wide variety of fraud.

The Aftermath

Let’s suppose one of these fraud loans makes it down the road. The car ends up with the “Confidence Man” and before the first payment is even due, it’s being parted out in some seedy chop shop or loaded onto a shipping container headed overseas.

It is the unfortunate “Straw Buyer” who end up holding the ball. From the first collection letter to the process server sent by the lender in their efforts to recover the debt, the “Straw Buyer” usually ends up all alone after the “Confidence Man’s” burner cell phone is used up. The lender gets burned and the Grifters move on to the next victim. Frequently, several vehicles are purchased over a day or two and the problems are exponentially exasperated in scale and aggregate losses over numerous lenders.

It is the unfortunate “Straw Buyer” who end up holding the ball. From the first collection letter to the process server sent by the lender in their efforts to recover the debt, the “Straw Buyer” usually ends up all alone after the “Confidence Man’s” burner cell phone is used up. The lender gets burned and the Grifters move on to the next victim. Frequently, several vehicles are purchased over a day or two and the problems are exponentially exasperated in scale and aggregate losses over numerous lenders.

I have seen this scam evolve through the years and as long as there is a “Mark”, there will be a Grifter to take advantage of them. In this era of instant gratification requirements and instant decisions, catching fraud at this level of complexity can be arduous and leave the investigator feeling frustrated and reliving “Ground Hog Day” over and over again as these cases pile up.

Technology can be our friend, it can also be our worst nightmare as lenders, collectors, skip tracers and repossessor.