GUEST EDITORIAL

Charge off. The end of the line for loans. On the collections floor, it usually means the loan moves from the active loan queue and off into the afterthoughts of the previous month as new queues fill and the requisite short memory of the collections staff moves off to new challenges.

In the accounting department, the reserve for these impaired loans has long since been felt in the profit sheets and it moves from the active loan ledger and into the purgatory of the loan afterlife.

Unless your credit unon or bank has it’s own internal charge off collections department, these loan losses tend to be disregarded as uncollectible due to the perceived improbability of recovery due to their prior history and the time necessary to pursue these recoveries.

This perception is shortsighted and wrong!

Assignment

Every credit union or bank, does or should, have a good recovery strategy. This strategy starts with post charge off assignments to a third-party collection agency. Simply throwing the accounts out there and hoping for the best isn’t enough though.

Every good collection agency worth it’s weight, should be providing you monthly recovery reports that provide important portfolio data that includes a waterfall analysis of the balances of your assigned loans by month and the totals recovered from those assigned pools, month by month by both dollars collected and the aggregate balances collected as a ratio of the assigned pool.

From these ratios, somewhat predictable trends of recovery can be seen. Trends that can be used in budgeting and forecasting future recoveries. Traditionally, these recoveries, depending upon average loan balances and other loan factors, peak between 3-6 months and digress beyond that.

This is not the end of the line.

Bad Debt Sales

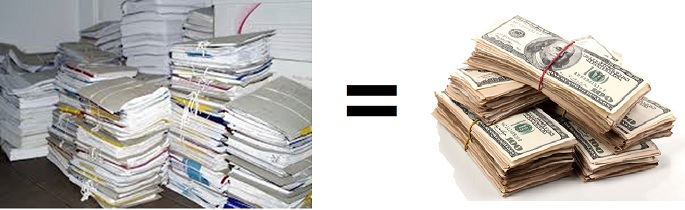

Prior to the 2008 housing meltdown that led to the “Great Recession”, it was standard practice amongst large banks and some other larger lenders, to sell their uncollectible loans to third party buyers. Depending on the age, balance sizes and other loan characteristics, these loans could sell from anywhere as much as 2-6 cents on the dollar.

That does not sound like a lot on the surface, but based on the aforementioned sales amount, a sold portfolio of $2M has a value of $40K-$120K to the seller. Not a bad return on non-performing loans and definitely a positive bump to your charge off recovery numbers.

Also note that it is imperative that your outsourcing partner understands that they are effectively an extension of your brand and MUST act accordingly at all times. Comprehensively vet your prospective partner to ensure that their Operational methodology aligns with your operational code of standards.

*** Article written by Industry Executive Roy Nickerson

*** Article written by Industry Executive Roy Nickerson

Roy Nickerson is the Executive Vice President, Business Development for Recovery Remedies Corporation, an Irving, TX based Accounts Receivable Management company. Recovery Remedies was formed by executives in the lending space to provide an “ultra-compliant” recovery platform that still delivers robust liquidation ratio’s and cash results. Please feel free to reach out to Roy for questions or consultation on Recovery Strategies. 833-273-6339 or 214-605-3111 Roy.nickerson@recoveryremedies.com … Recoveryremedies.com