but Seasonal Trends are Beginning to Realign

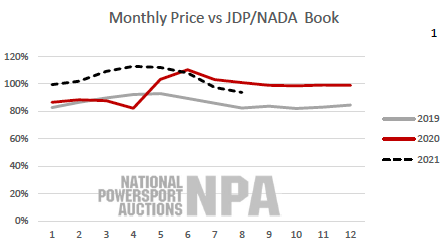

Traditionally powersports pricing follows a consistent seasonal trend. Prices build from January to April, reaching their peak in May and then softening as summer transitions to fall, with the lowest points in October and November before they build again at the start of the new year. 2020 and the first half of 2021 were complete outliers, however.

The pandemic put the powersport industry on hold for several months in 2020, leaving everyone with questions about what the future would hold. Luckily, the industry not only bounced back quickly but saw massive growth as people and their families switched their priorities to outdoor activities. With this shift in habits and the continued flow of money into the economy, giving consumers more discretionary funds, we’ve seen a surge in demand in all powersport and recreation categories.

This, coupled with the production halts early in the pandemic, which OEMs have struggled to catch up on, has left dealers with a limited supply of new products, ultimately driving them to source pre-owned inventory through the auction.

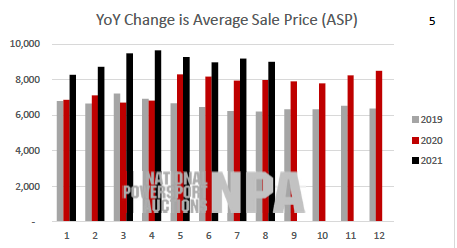

Overall, pricing in 2021 has continued to be much stronger than in 2019 and 2020. Average Sale Price (ASP) through the auction lanes YTD in 2021 is up 16% vs 2020 and 28% vs 2019. While we are starting to see a slowdown in conversion (overall sell-through rate) and a dip in price-to-book performance, this indicates typical seasonal pricing trends.

ASPs remain well above average, evident in Price vs MSRP performance, despite average MSRP rising in both 2020 and 202. The biggest change has come in book values. In over a decade, JDP/NADA had the most significant increase in month‐over‐month book values (+12% from JUN to JUL of 2021). Two key factors drive the adjustment; steeply rising used acquisition costs and the necessity to align these rising used vehicle values with lender financing amounts and rates.

As long as new inventory levels remain low, dealers will continue to turn to the auction to source used vehicles, keeping ASPs abnormally high. Lenders continue to see strong portfolio performance but also see a normalization in payment, collections and default trends heading into fall.

For more information on how National Powersport Auctions (NPA) services can efficiently and consistently deliver maximum returns on your powersport or recreation inventory, please contact Business Development Manager Colleen Baldwin at cbaldwin@npauctions.com or 858.204.0459.

With over three decades of transactional data, NPA also offers extensive data reporting on the powersport market to help drive your decisions. Customized packages are available based on your business needs. For information on NPA Data Services, contact VP of Business Development Tony Altieri at taltieri@npauctions.com or 858.395.1836.

###

About National Powersport Auctions:

Established in 1990, National Powersport Auctions (NPA) is the world’s leading provider of powersport vehicle remarketing services. NPA’s nationwide footprint serves the industry’s largest financial institutions, manufacturers, and dealers through a multitude of live and online selling platforms. NPA also offers comprehensive data services, including the NPA Value Guide™, the industry’s most accurate wholesale valuation tool. NPA has company-owned and staffed facilities in California, Colorado, Florida, Georgia, Ohio, Oregon, Pennsylvania, and Texas. NPA is a wholly owned subsidiary of Copart, Inc (Nasdaq: CPRT). For more information about NPA, visit: www.npauctions.com