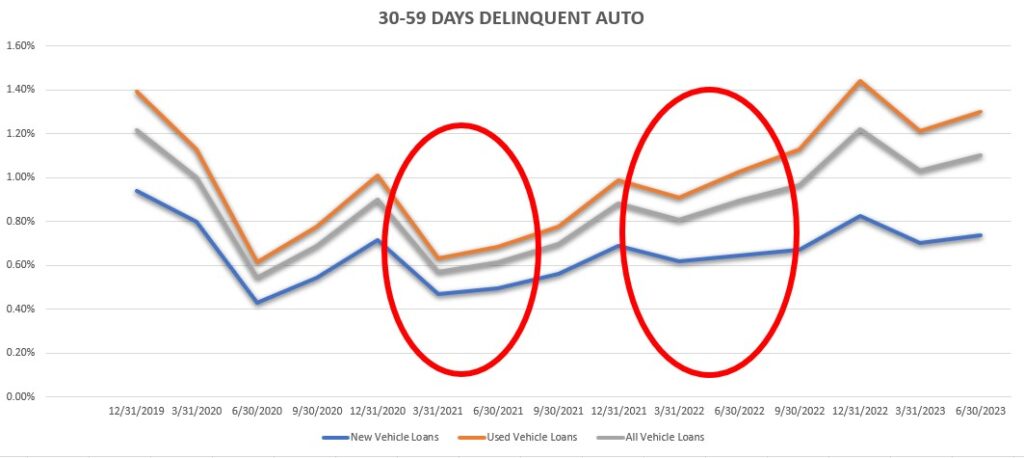

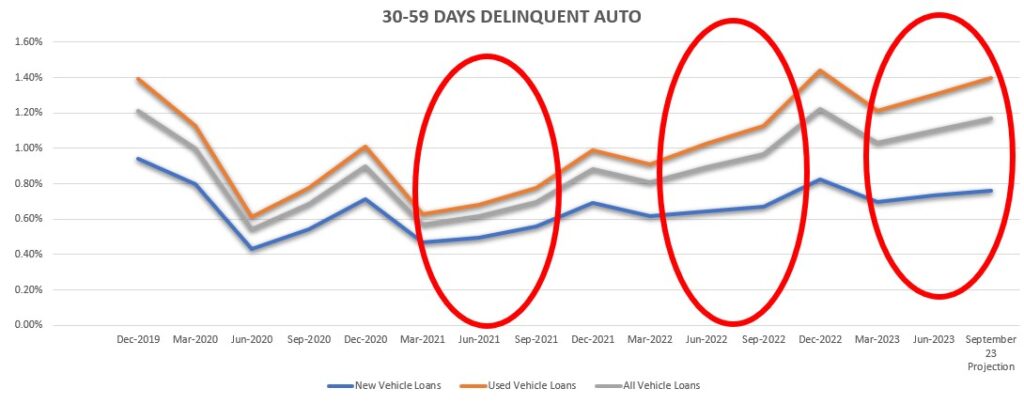

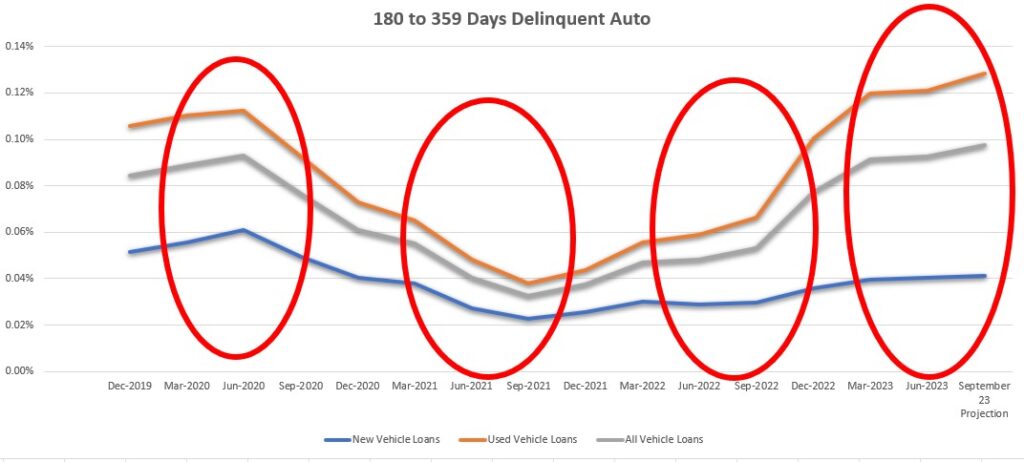

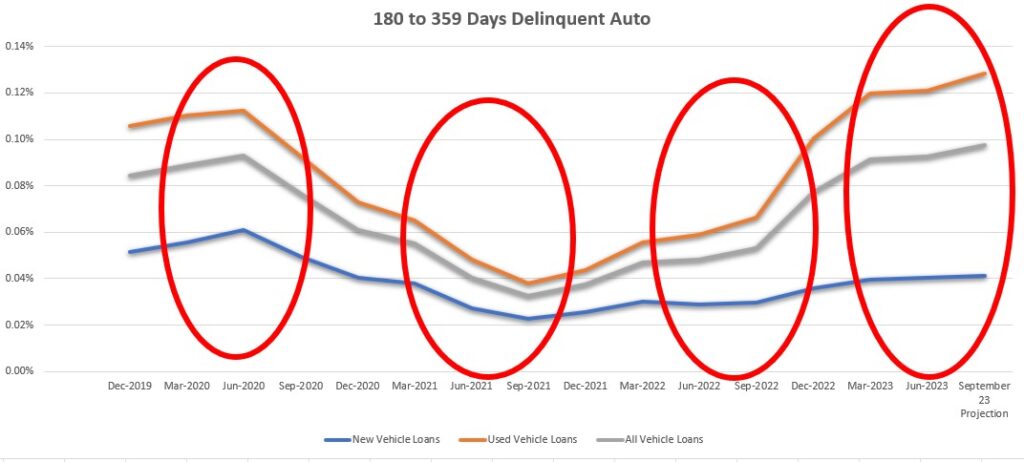

In my publishing of the 1st quarter 2023 NCUA Financial Performance Review aggregate auto delinquency results, I reported that the seasonal credit union auto loan delinquency pattern had returned to normal. I also predicted increases in delinquency to correspond with this return to normalcy. Well, my actual projections that I tied to this were wrong. They came in higher.

On September 9th, the National Credit Union Administration (NCUA) finally released their quarterly combined credit union 5300 FPR financials for the second quarter of 2023. For auto loan delinquency, whose seasonality was interrupted by the pandemic, the second quarter has demonstrated that it is back and that paves the way for even more extreme rises in the future.

Download the Data Here!

The old saying goes that data lags behind reality. Nowhere is that truer than with the NCUA’s combined credit union reporting data which doesn’t get released until late in the next quarter. With delinquency ratios for this quarter exceeding the pre-pandemic period, the spikes normally seen during the summer are doubtlessly underway.

30 Day Delinquencies

As far as my projections go, this was the one bright spot in the data. I had predicted the 30-day delinquencies in auto loans would rise to almost $5.7B. As it turns out, they only rose from Q1’s $5.1B to $5.5B. From a ratio standpoint, this is still relatively low and finished at 1.10%, a 0.07% increase over three months. As usual, new cars are performing at a much more moderate level than are used across all tranches of delinquency.

Regardless of my projection model error, I’m sticking with it and predict that the quarter we’re currently in rises to $6B. Aside from Q4, Q3 tends to be the second highest delinquency season of the year. That’s not to say that it couldn’t get worse than usual.

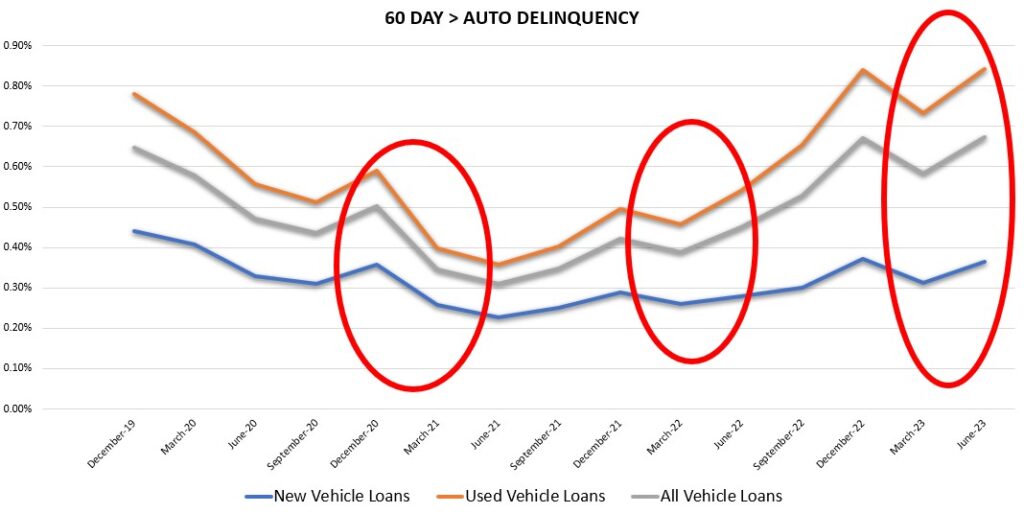

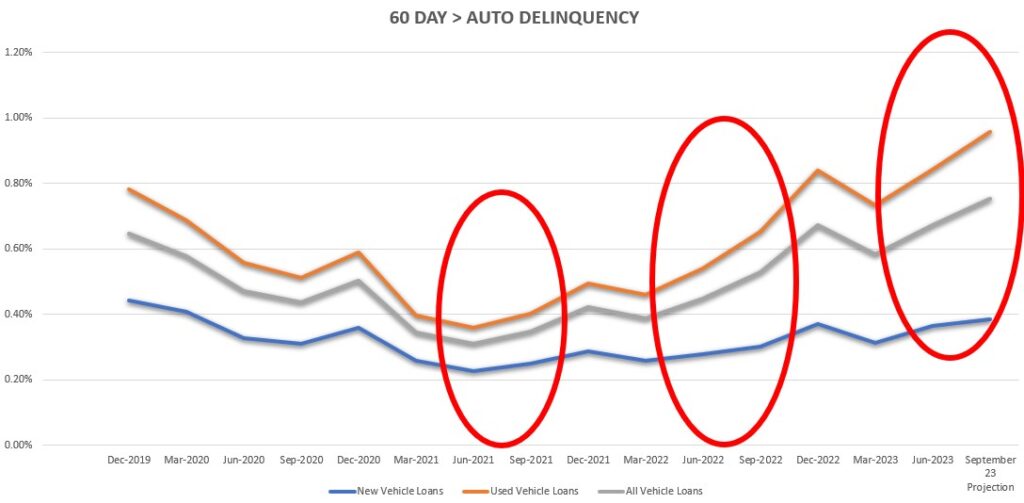

60 Day Delinquencies

This delinquency tranche is where the repossession are born. Second quarter delinquency here finished at $1.5B and a rate of 0.67%. An increase of $353M or 0.09%.

These results were pretty close to my projections of $1.46B or 0.64%. I believe that we will see this quarter end at about $3.8B or 0.75%, which is a pretty substantial increase and the highest since the NCUA began aggregating this data in early 2020.

180+ Days Delinquent

This is the boneyard of delinquency and charge off is usually a mere formality as the financial impact to a loan for a lender at this point has already been taken in reserves. Q1 showed a minor increase in this category from Q$ 22’ at 0.08% up to 0.09% was already the highest in the NCUA’s short window of records. Q2 held steady at 0.09%, which was spot on with my projection as a ratio and only off by -$10M in loan balances of a final $460M.

I project that we will get that $10M back and some at the end of Q3 and finish at $495M and a ratio of 0.10%.

Summary

Interest rates are at record highs. Inflation didn’t go away despite attempts to paint a rosier picture of it than exists. High gas prices are again rearing their ugly heads and of course we have the student loan payments about to resume. We’re sitting on a perfect storm for auto loan delinquency.

Wholesale values continue to drop at a rate of about 1% a week. This impacts LTV’s and puts many borrowers underwater making trade-ins out of the realm of possibility without huge downpayments.

It was just a year ago that we watched auto loan prices explode. Keep in mind that the majority of auto loans that go bad do so in their first 18 months and it’s easy to see that this is going to create some huge loan deficiencies on those same loans.

Bankruptcies continue to climb. While they haven’t reached pre-pandemic levels, that $1T in credit card balances carried by the American public suggests that there is a lot more borrowing out of necessity than for luxury.

Repossession volume is definitely up. You know the repossession industry is busy when an agency owner is complaining that he doesn’t have any room left on his lot for new repossessions.

I just don’t see any light at the end of this tunnel. I suspect that we’re in for a very long, dark ride. But hey, isn’t that what collectors get paid the big bucks for? Right?

Time will tell. Good Luck!

Kevin Armstrong

Publisher

Credit Union Auto Loan Delinquency Surges – Credit Union Auto Loan Delinquency Surges – Credit Union Auto Loan Delinquency Surges – Credit Union Auto Loan Delinquency Surges

Credit Union Auto Loan Delinquency Surges – Credit Union Collections – Delinquency – NCUA – Repossession – Wholesale

More Stories

Husband and Wife Face Racketeering Charges in Luxury Vehicle Title Fraud

Fraud is Top-of-Mind for Nearly Nine-in-Ten Auto Dealers

🎯 Meet Your 2026 Summit Keynote Speaker: Jovan Glasglow