–

Current Used Vehicle Market Conditions

Welcome to the inaugural edition of Kibler’s Korner! At Location Services, we strive to offer industry-leading services in the automotive Repossession, Recovery, and Remarketing markets. In addition, due to our depth of experience in these industries, we seek to offer economic insights for those areas where we operate. More specifically, as evidenced by this publication, we are hoping to share perspectives for the automotive industry as well as the broader economy. Our hope is that this recurring publication will add a deeper understanding of the current state of the industry and economy, while also leveraging those perspectives to gain foresight into where we might be headed in the future.

For those of us operating in the various segments of the automotive industry, it is clear that we are navigating through unprecedented volatility. Our industry can be highly sensitive to macroeconomic shifts. Whether you are a new or used car dealer, a financing organization, an OEM, a fleet management company, or a wholesaler, we are all feeling the implications of rapid changes in the industry.

Let’s dive-in to some of the key indicators…

–

Macroeconomic views

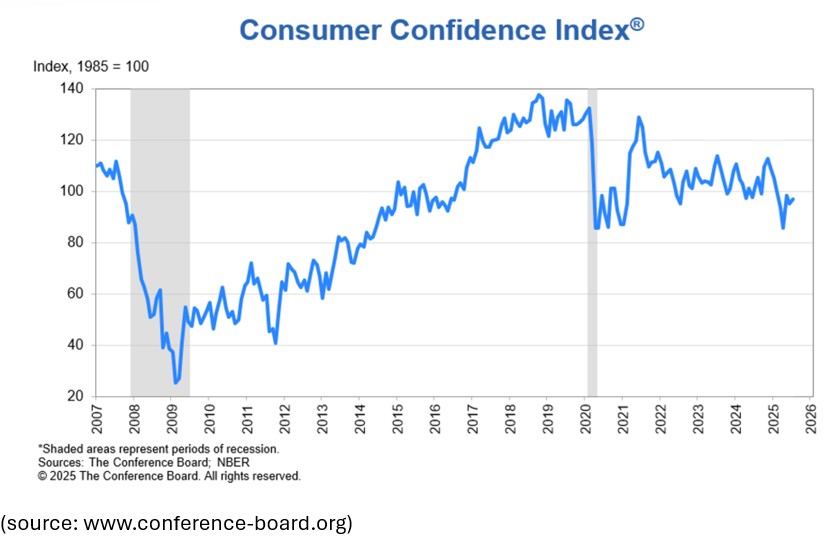

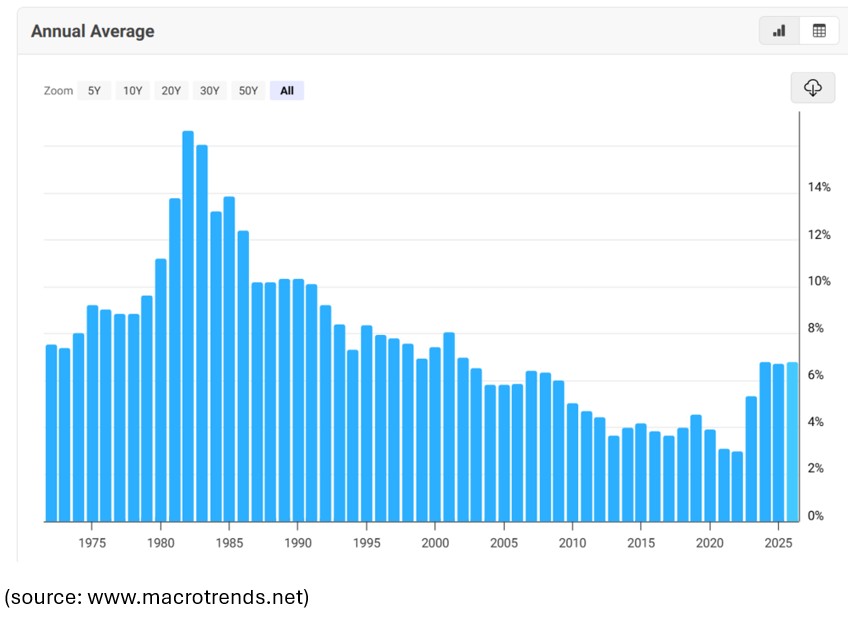

As we exited the COVID-19 pandemic, inflationary pressures began to have an impact on every sector of the economy. Monitory policies, as part of the pandemic, as well the more recent US Tariff policies, have created upward pressure on the prices which consumers pay every day. The Consumer Price Index (CPI) is a reference point to view our inflationary impacts. As shown below, the CPI numbers have declined from a high in 2018, however have shown some mild variability over the prior 3 years. The July numbers came in at +2.7% (yoy), which was slightly below expectations of +2.8%.

With the release of these numbers, all eyes continue to be on the Federal Reserve and if they’ll reduce the benchmark interest rate. In the July meeting, the Fed voted to keep rates unchanged for the fifth consecutive month, reflecting concerns over elevated inflation and economic uncertainty. Should the Fed reduce rates at its September meeting, it could fuel greater activity in areas such as home loans and automotive financing. Most economists and financial experts are indicating there is a +90% chance the Fed will reduce interest rates at their September meeting.

A key factor in the overall health of the economy continues to be the state of the labor market in the U.S. The U.S. labor market is currently experiencing a mix of trends and conditions. Job growth remains steady, with employers hiring over 5 million workers each month and unemployment remains steady around 4%. However, in July, the economy added a lower-than-expected 73,000 jobs nationwide and we also observed a two-month net job loss of 258,000. Despite this, wage growth and hours worked have both ticked up, indicating a positive note for the labor market. (source: usbls.gov) As shown below, mortgage interest rates have trended higher beginning in 2022. While the rates are lower from a historical perspective, they still remain higher when comparing to recent years. A downward trend in these rates would undoubtedly drive new and existing home sales, which could also spark growth in the automotive industry.

These key economic metrics are only a few of the many available, however, they appear to indicate that the overall economy remains steady and the U.S. consumer continues to demonstrate their resiliency in the face of volatility. The impacts of the U.S. Tariff policies remain an open question, however, thus far their effect on overall inflation has been more muted than some have predicted.

–

Automotive market trends…

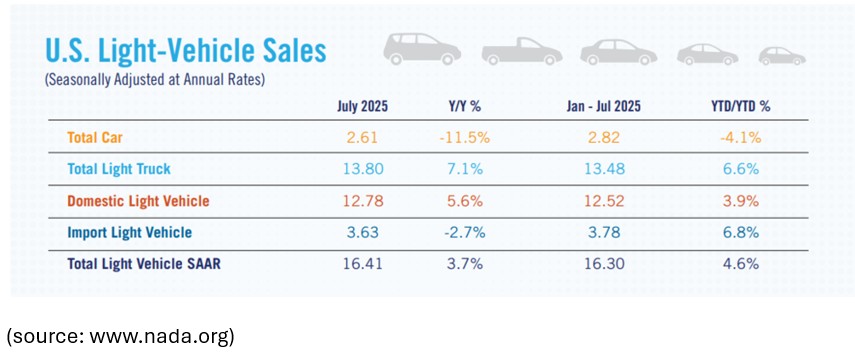

Overall in the automotive industry, we have observed the pace of new and used vehicle sales trending upward moderately. Retail used vehicle sales increased 1.7% in July compared to June and up 2% year over year. In addition, access to credit has loosened while auto loan performance was mixed in July. The Seasonally Adjusted Annual Rate (SAAR) is an industry metric that is generally considered a barometer for the overall health of the automotive industry. In July, the SAAR totaled 16.3 million units, up 7.1% from June and an increase of 3.7% year over year. This metric is useful in judging not only the health of the auto industry but also the pipeline for used vehicles. Approximately 50% of all new cars sales have an associated trade-in, which adds to the available used car inventory. This suggests that, barring a significant market disruption, the constraint on used vehicle inventory may be loosening in the months ahead.

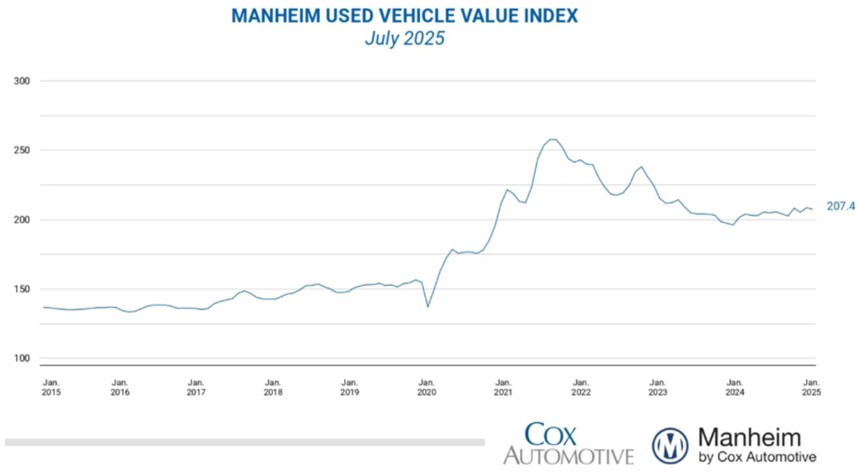

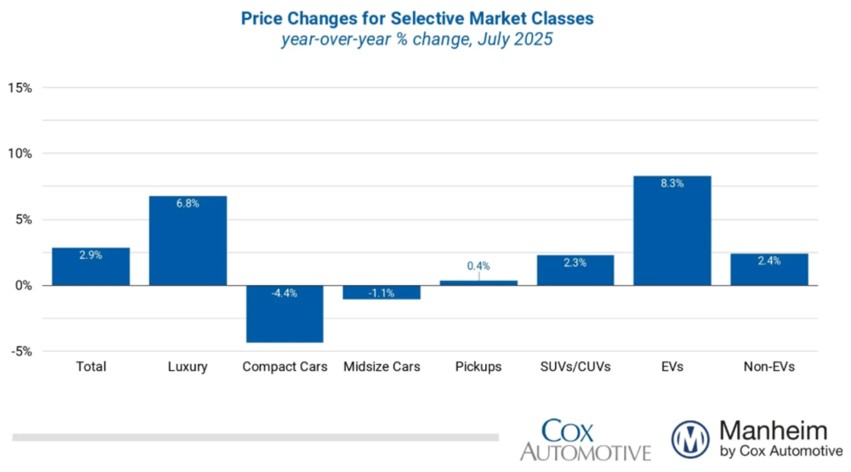

According to the Manheim Used Vehicle Value Index (shown below), seasonally adjusted used-vehicle prices were slightly lower in July compared to June (207.4), however still an increase yoy of 2.9%. While July was moderately lower, the overall trend for the prior 5 months has moved upward. Suggesting demand for used vehicles remains robust and available inventory continues to be tighter.

It is noteworthy in this graphic that Compact cars have trended lower year over year. This vehicle class has proven to be very sensitive to the price of fuel and those prices have moved lower in 2025 vs. 2024. Conversely, luxury vehicles and trucks tend to experience upward price movement when fuel prices are lower.

Auto loan performance was mixed in July with delinquencies increasing, while defaults declined. Most notable for many of our clients, 60+ day delinquencies increased 3.8% and were up .6% year-over-year. 1.95% of auto loans were severely delinquent, which is an increase from 1.87% in June and 1.90% one year ago. However, defaults decreased 2.2% in total and were down 1.9% year over year (source: Equifax).

–

In Summary

July was a strong month overall for the vehicle market with particular strength in the new and used retail sales. Vehicle prices (retail and wholesale) have trended upward moderately and we expect that to continue in the coming months. Fed interest rate decisions and available vehicle inventories could be a factor in the coming months. The impact of U.S. Tariffs continues to be an open question, however the immediate impacts appear to be muted. This remains a developing story in our marketplace.

Our primary goal is to empower and strengthen your business through our tailored industry insights and innovative solutions. We value your partnership and look forward to supporting your success every step of the way. If you’d like to learn more or have any feedback on Kibler’s Korner, please reach out to our VP of Marketing and Strategic Initiatives, Erik Kibler.

Erik Kibler

Vice President, Marketing and Strategic Initiatives

erik.kibler@locationservices.com

–

September 2025 Kibler’s Korner – September 2025 Kibler’s Korner – September 2025 Kibler’s Korner

September 2025 Kibler’s Korner – Credit Union Collections – Credit Union Collectors – Lending – Location Services LLC, Location Services – Remarketing – Delinquency

Facebook Comments