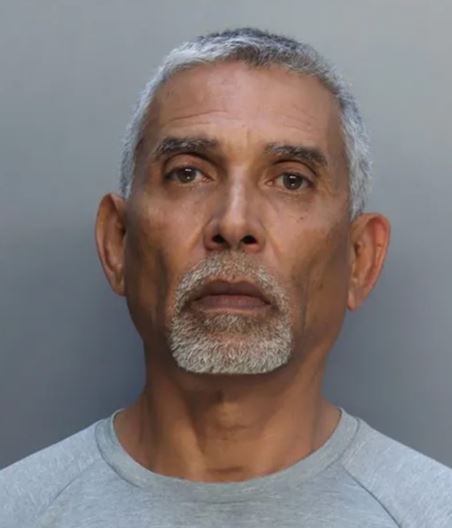

Miami-Dade Barber Linked to South Beach Bust Out Syndicate in $750,000 Auto Fraud Scheme

-Another Man Busted in South Beach Syndicate Auto Fraud Scheme

In a dramatic crackdown on organized auto loan fraud, another Miami-Dade man, Pavel Gomez-Deben, 53, have been arrested in connection with a sophisticated “credit bust out” scheme. He is potentially tied to the notorious South Beach Bust Out Syndicate who has allegedly defrauded car dealerships and financial institutions of over $750,000 by fraudulently acquiring high-value vehicles. Authorities suspect their actions are part of a larger $24 million fraud enterprise targeting South Florida’s auto finance industry.

Pavel Gomez-Deben’s High-End Vehicle Scam

On May 17, 2025, Pavel Gomez-Deben was arrested at Lorenzo Buick GMC in Miami Gardens, charged with seven counts, including organized fraud of $50,000 or more, first-degree grand theft exceeding $100,000, second-degree grand theft, and obtaining vehicles and credit by false statements.

Gomez-Deben allegedly attempted to purchase a 2021 Mercedes-Benz AMG G63 worth over $175,000 and had recently acquired a 2025 GMC Yukon XL for nearly $97,000, totaling over $270,000 in fraudulent transactions.

The scheme unraveled when the general manager of Mercedes-Benz of Miami flagged Gomez-Deben’s credit application, noting 16 credit inquiries in less than 48 hours. Investigators found that Gomez-Deben falsely claimed to earn $247,000 annually as president of P&G Truck Lines, a company inactive since 2021 but reinstated in February 2025.

In reality, Gomez-Deben worked as a barber. He used nearly identical falsified applications at both Mercedes-Benz and Lorenzo Buick GMC, securing financing through Santander Bank for the Yukon. The Yukon’s OnStar tracking system was disabled, and technicians confirmed tampering, suggesting an intent to obscure the vehicle’s location.

Gomez-Deben was lured back to Lorenzo Buick GMC under the pretense of a service issue, where deputies detained him. He initially denied applying for credit at Mercedes-Benz, claiming identity theft, but dealership records confirmed his involvement via his personal phone number.

After requesting an attorney, his interview was halted. Gomez-Deben faces multiple charges. After he was booked into jail, Gomez-Deben appeared before a judge who granted him a bond.

Omar Guardia’s Alleged $500,000 Fraud

Omar Guardia was arrested on May 7, 2025, facing charges including organized fraud of $50,000 or more, grand theft of a vehicle, unlawful vehicle subleasing, and obtaining property by false statement. According to an arrest report, Guardia executed a “systematic organized scheme” by purchasing 10 vehicles in March alone, amassing nearly 20 vehicles under his name, including an Acura, two BMWs, a Honda, two Mercedes, five Toyotas, a Kia, a Ram truck, a motorcycle, and two Yamaha vessels. The estimated losses from his scheme exceed $500,000.

The fraud came to light when Bomnin Chevrolet reported suspicious activity after Guardia applied for credit to purchase a 2025 Chevrolet Silverado, later reported stolen. Due to a spike in fraud, the dealership contacted authorities, who discovered Guardia’s extensive vehicle acquisitions.

Investigators noted that Guardia misled dealers by failing to disclose his vehicle stockpiling, a hallmark of credit bust out fraud. During questioning, Guardia provided inconsistent statements and claimed ignorance about the Silverado’s whereabouts.

A prosecutor revealed Guardia’s prior federal conviction for marijuana trafficking during his bond hearing, where his bond was set at $111,000 with orders to avoid dealerships.

Connection to the South Beach Bust Out Syndicate

Both Guardia and Gomez-Deben’s schemes align with the tactics of the South Beach Bust Out Syndicate, a Miami-based fraud ring linked to $24 million in fraudulent auto loan applications.

According to Point Predictive’s 2025 Auto Lending Fraud Trends Report, the syndicate recruits individuals with good credit as straw borrowers, targets high-value vehicles ($65,000-$100,000), and falsifies incomes (averaging $284,000) using suspicious LLCs, often tied to trucking companies. The syndicate monetizes vehicles through overseas exports, VIN alterations, illegal subleasing, fraudulent lien releases, and mechanics liens.

Guardia’s rapid acquisition of 10 vehicles in a month and Gomez-Deben’s use of a dormant trucking company and inflated income mirror these patterns. Authorities suspect both men may be straw borrowers or operatives within the syndicate, which has contributed to a $9.2 billion fraud loss exposure for auto lenders nationwide, a 16.5% increase from 2023. South Florida, particularly Miami, ranks as the nation’s fraud epicenter, with its proximity to shipping ports and history of financial crime fueling such schemes.

A Growing Threat in South Florida

The arrests of Guardia and Gomez-Deben highlight the escalating challenge of organized auto fraud in Miami-Dade, where sophisticated rings exploit the auto finance industry. As investigations continue, authorities are working to determine the full extent of the men’s involvement with the South Beach Bust Out Syndicate and whether additional arrests will follow. With Florida leading the nation in fraud complaints, these cases underscore the urgent need for enhanced vigilance among dealerships and lenders.

If either of these men ever make it to the first court appearance, it would be a surprise. If either of them end up in the morgue would not be a surprise.

Related Articles:

Miami Man Busted in $500,000 Auto Fraud Scheme Tied to South Beach Syndicate

Straw Purchase Bust Out Fraud – Miami’s Multi-Million Dollar Auto Fraud

Another Man Busted in South Beach Syndicate Auto Fraud Scheme – Another Man Busted in South Beach Syndicate Auto Fraud Scheme –

Another Man Busted in South Beach Syndicate Auto Fraud Scheme Another Man Busted in South Beach Syndicate Auto Fraud Scheme – Police – Police – Arrest – Arrest – Credit Union Collections – Credit Union Collectors – Lending – Fraud

More Stories

NC Man Charged with ID Theft and Auto Loan Fraud

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions