“… we’ve been moving back the timing of repossession.”

In a high-stakes game of financial brinkmanship, lenders have been accused of “extending and pretending,” delaying repossessions in a desperate bid to hold off the avalanche of charge-off losses on auto loans. Over the past year, this strategy may have been the unspoken lifeline for the auto finance sector, according to a leading expert in Commercial and Consumer Auto Finance. Are we witnessing a temporary calm before the beaver damn bursts?

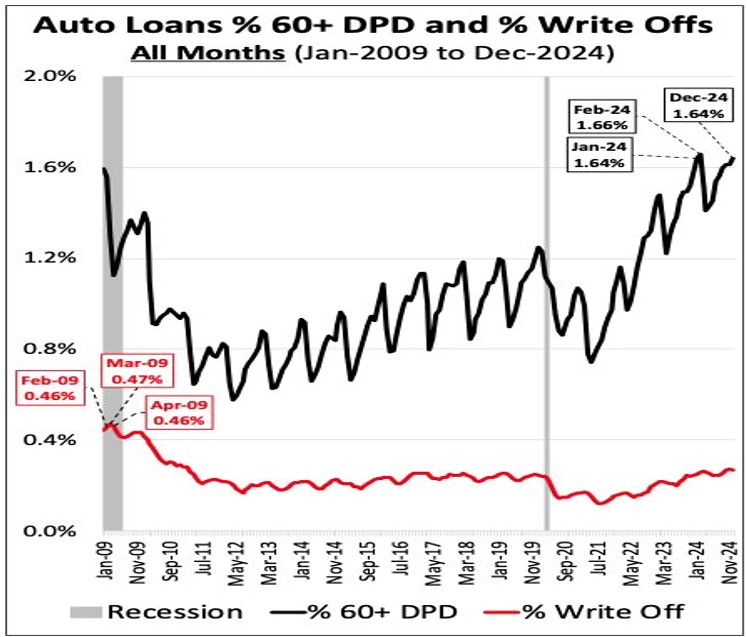

Delinquencies on auto loans have soared to unprecedented levels in 2024, with data revealing that this year has set new records for 60+ day delinquency rates, according to recent analyses from Equifax and the Federal Reserve Bank of St. Louis.

However, the pace at which these loans are being written off has not escalated as dramatically, suggesting a strategic delay in repossessions and an increase in loan modifications by lenders according to WCP Consulting Owner Bill Ploog in the following post.

Another set of data points … story is the same … auto loan delinquencies have reached historic highs while write offs are climbing at a slower pace.

Three highest of 192 months shown in image are labeled. 2024 set records for bellwether 60+ delinquency rates (black trend line); however, three-month rolling write off rates have not exploded (red trend line). Dec-2024 write off rate was 28th highest month since Jan-2009. Note: Data reflects all credit score buckets.

As stated in previous posts / articles, it appears write offs are being tamped down by actions such as lenders using modifications / extensions and delaying repossession.

Two recent examples from earnings call transcripts of some of the largest auto lenders:

- Russ Hutchinson (CFO Ally) “… we’ve been moving back the timing of repossession.” And, “…extensions, increasing the availability and removing some of the friction around them.”

- Enrique Mayor-Mora (CFO, Carmax) “… we began testing an enhancement to our policy that further empowers delinquent customers to take advantage of a payment extension …”

Sources: Equifax, Federal Reserve Bank of St. Louis, most recent earnings call transcripts.

Commercial and Consumer Auto Finance Industry Knowledge

Principal Owner

WCP Consulting LLC

Are Lenders Masking the True State of Auto Loan Delinquency? – Are Lenders Masking the True State of Auto Loan Delinquency? – Are Lenders Masking the True State of Auto Loan Delinquency?

Are Lenders Masking the True State of Auto Loan Delinquency? – Delinquency – Equifax – Lending – Auto Loan – Credit Union Collections – Credit Union Collectors

More Stories

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk