Each Face Up to 30 Years in Prison

–

Allegations of double-pledged overvalue collateral, wire fraud and bank fraud have finally been announced. It took longer than most may have expected, but the train wreck that was Tricolor has now resulted in felony charges. Arrested and charged were founder and former CEO of Tricolor Holdings LLC, Daniel Chu, former COO, David Goodgame, former CFO, Jerome Kollar and former Finance Executive Ameryn Seibold.

What began as a bankruptcy filing of Tricolor Auto Group (TAG) on September 10th, subprime lender and the seventh largest independent used car retailing chain in the U.S., has come to a full boil. Tricolor had allegedly double pledged for loans to lenders their $1.4B in auto loans as collateral as being worth $2.2B. All in, Tricolor’s debts owed to lenders and others exceed a reported $900M.

According to the indictment, Chu and his CFO Kollar had been manipulating data for additional loans for years. In the indictment they are accused of joking about it in texts all the while receiving seven figure salaries and bonuses while the house of cards was about to come crashing down.

Even three weeks before they laid off some 1,000 staff members, Chu allegedly received two payments from Tricolor totaling $6.25 million. He then reportedly used some of this money to purchase a multimillion-dollar property in Beverly Hills, California on or about August 27, 2025.

Read the Unsealed Indictment Here!

The U.S. Attorney General’s Office of New York, the FBI and the FDIC’s Office of the Inspector General have concluded their initial investigations and have found evidence enough of fraud perpetrated by Tricolor’s CEO and many members of its executive staff to file charges.

The primary charges laid against the four named are:

- Statutory Allegations

- Conspiracy to Commit Bank Fraud and Wire Fraud on a Financial Institution

- Bank Fraud

- Wire Fraud Affecting a Financial Institution

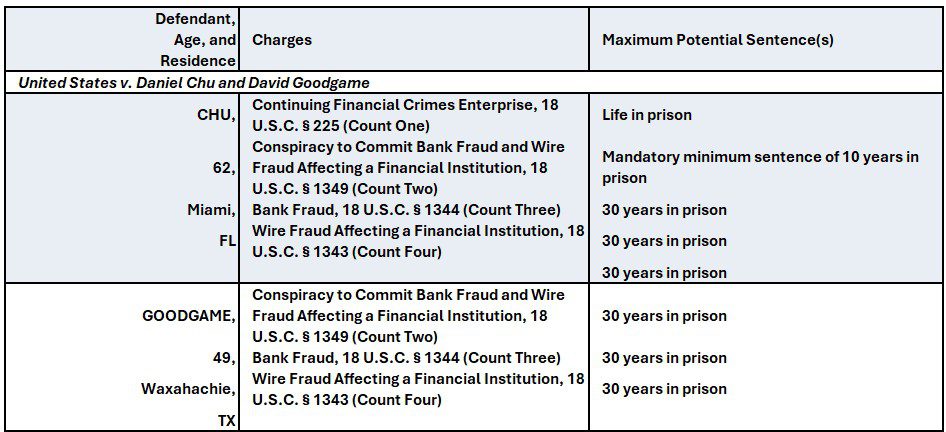

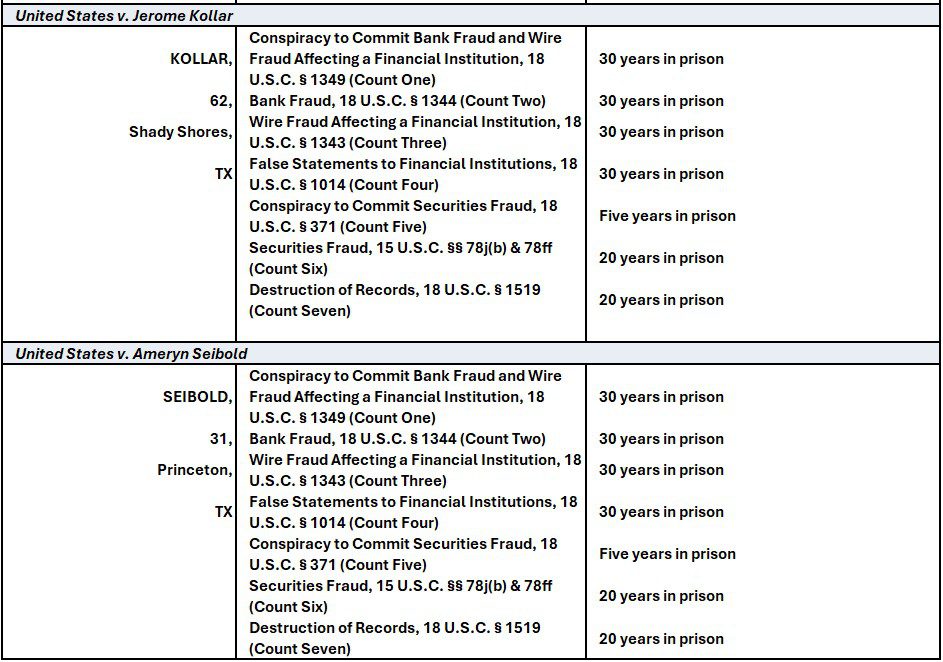

The individual charges against each are:

As of the date of this posting, on December 16th, in an unsealed indictment, Kollar and Seibold have plead guilty to fraud charges before U.S. District Judge Lewis J. Liman and both are cooperating with the Government.

Below is the US AG’s Press Release on the charges.

–

Daniel Chu—the Founder and CEO of Tricolor—and Three Others Charged With Systematically Defrauding Tricolor’s Lenders

United States Attorney for the Southern District of New York, Jay Clayton, Assistant Director in Charge of the New York Field Office of the Federal Bureau of Investigation (“FBI”), Christopher G. Raia, and Special Agent in Charge of the New York Regional Office of the Federal Deposit Insurance Corporation’s Office of Inspector General (“FDIC-OIG”), Patricia Tarasca, announced today the unsealing of an Indictment charging DANIEL CHU, the founder and former CEO of Tricolor Holdings LLC, with orchestrating a years-long financial crimes enterprise that defrauded multiple banks and other private credit providers. CHU and DAVID GOODGAME, Tricolor’s former COO, are also charged with bank fraud and wire fraud offenses in connection with schemes to fraudulently double-pledge collateral to multiple lenders and manipulate the characteristics of collateral to make ineligible, near-worthless assets appear to meet lender requirements. Both defendants were arrested today. CHU will be presented later today in the Southern District of Florida, and GOODGAME will be presented tomorrow in the Northern District of Texas.

Also unsealed today are the guilty pleas of JEROME KOLLAR, Tricolor’s former CFO, and AMERYN SEIBOLD, a former finance executive at Tricolor, in connection with their participation in the conspiracy. KOLLAR and SEIBOLD pled guilty to fraud charges before U.S. District Judge Lewis J. Liman on December 16, 2025. Both are cooperating with the Government.

“As alleged in the indictment, CEO Daniel Chu was the leader of an elaborate scheme to defraud creditors of Tricolor,” said U.S. Attorney Jay Clayton. “At his direction, Tricolor repeatedly lied to banks and other credit providers, including by falsifying auto-loan data and ‘double pledging’ collateral. Fraud became an integral component of Tricolor’s business strategy. The resulting billion-dollar collapse harmed banks, investors, employees and customers. It also undermines confidence in our financial system. New Yorkers and all Americans want continuing criminal enterprises shut down and their leaders brought to justice whether they are on our streets or in our markets.”

“These four executives allegedly conspired to defraud lenders based on bogus collateral,” said FBI Assistant Director in Charge Christopher G. Raia. “The defendants’ alleged manipulation not only ripped off multiple banks but also violated the integrity of our credit markets. The FBI will never tolerate any company that makes fraud part of its business.”

“As alleged, the defendants in this case participated in a years-long fraudulent scheme that deceived the lenders of Tricolor,” said FDIC-OIG Special Agent in Charge Patricia Tarasca. “The FDIC-OIG stands firm in its commitment to working with our law enforcement partners to investigate all allegations of fraud that target financial institutions, as we seek to preserve the integrity of our Nation’s financial system.”

According to the allegations contained in the Indictment unsealed today in Manhattan federal court:[1]

From in or about 2018 through in or about 2025, CHU, GOODGAME, KOLLAR, and SEIBOLD conspired to defraud the lenders and asset-backed securities investors of Tricolor Holdings, LLC and its affiliates (“Tricolor”), a subprime auto retailer and financing company. CHU, Tricolor’s founder and chief executive officer; GOODGAME, Tricolor’s chief operating officer; and others operated Tricolor through systematic fraud. At CHU’s direction, multiple Tricolor executives repeatedly double-pledged collateral to multiple lenders and manipulated the characteristics of collateral to make ineligible, near-worthless assets appear to meet lender requirements. By in or about August 2025, Tricolor had pledged approximately $2.2 billion of collateral to lenders and investors, but Tricolor had only approximately $1.4 billion of real collateral. The difference—consisting of approximately $800 million in bogus collateral—resulted from the series of schemes and the conspiracy in which CHU, GOODGAME, KOLLAR, SEIBOLD, and others participated. Over time, this series of fraudulent schemes had a profound effect on Tricolor, which obtained hundreds of millions of dollars in cash advances; on CHU, who used a portion of the funds to enrich himself; and on Tricolor’s lenders, who extended billions in loans based on fabricated data and false statements.

In or about the summer of 2025, lenders confronted CHU and others at Tricolor about problems with Tricolor’s collateral. In a series of secretly recorded phone calls, CHU and his conspirators concocted plans to conceal or explain away the fraud. For example, on or about August 17, 2025, CHU proposed blaming certain loan data discrepancies on fictitious deferment policies. CHU acknowledged, however, that “where we would have an issue is if, if they sent an auditor and they said, pull this up on your screen, right, that would be a problem.” KOLLAR agreed, stating, “Yes. That would be bad.” These efforts to conceal failed.

Unable to explain or excuse Tricolor’s fraud, CHU turned his sights on blaming others. On another recorded phone call, CHU compared Tricolor’s circumstances to the circumstances of Enron, the energy trading firm that collapsed into bankruptcy following the discovery of accounting fraud and other misconduct. Specifically, CHU and others discussed the possibility that they could blame the banks for ignoring red flags and use that threat as leverage to extract a favorable settlement. CHU proposed using artificial intelligence tools to search for key words that GOODGAME could use in a discussion with a lender. After another participant described an Enron-related litigation, CHU stated: “Enron obviously has a nice ring to it, right? <laugh>, I mean, Enron, Enron raises the blood pressure of the lender when they see that <laugh>. It, it has to, right? I’m not— […] Cause who wants to be thrown in the category?” CHU later said, “That Enron case is fucking perfect, I think.”

CHU, recognizing that Tricolor was, in his words, “basically history,” turned his attention to extracting millions of dollars from the company. As Tricolor approached collapse, and after CHU observed that the company was “definitely insolvent,” he directed KOLLAR to pay him the final installments of a $15 million bonus. On or about August 19 and 20, 2025—roughly three weeks before Tricolor placed more than 1,000 employees on unpaid leaves of absence and before the company filed for bankruptcy—CHU received two payments from Tricolor totaling $6.25 million. CHU used some of this money to purchase a multimillion-dollar property in Beverly Hills, California on or about August 27, 2025.

Unable to maintain its access to loans, and unable to sustain its business without substantial cash, Tricolor filed for Chapter 7 bankruptcy on September 10, 2025. By that time, the company’s largest lenders had advanced and were owed more than $900 million as a result of the fraudulent double-pledging and collateral manipulation schemes that CHU had orchestrated, and in which GOODGAME had knowingly participated as the company’s chief operating officer, for years.

* * *

A chart containing the names, ages, residences, charges, and maximum penalties for the defendants is attached.

The maximum potential sentences in this case are prescribed by Congress and provided here for informational purposes only, as any sentencing of the defendants will be determined by a judge.

Mr. Clayton praised the outstanding work of the FBI and the FDIC-OIG. Mr. Clayton also thanked the U.S. Securities and Exchange Commission for its assistance and cooperation in the investigation.

This case is being handled by the Office’s Securities and Commodities Fraud Task Force. Assistant U.S. Attorneys Micah F. Fergenson and Justin V. Rodriguez are in charge of the prosecution.

The charges contained in the Indictment are merely accusations, and the defendants are presumed innocent unless and until proven guilty.

Arrests and Federal Fraud Charges Filed Against Tricolor Executives – Arrests and Federal Fraud Charges Filed Against Tricolor Executives – Arrests and Federal Fraud Charges Filed Against Tricolor Executives – Arrests and Federal Fraud Charges Filed Against Tricolor Executives

Arrests and Federal Fraud Charges Filed Against Tricolor Executives – Arrests and Federal Fraud Charges Filed Against Tricolor Executives – Repossession – Repossession Agency – Repossessor – Credit Union Collections – Credit Union Collectors – Lending – Bankruptcy

More Stories

NC Man Charged with ID Theft and Auto Loan Fraud

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions