Live Webinar, Thursday, March 20, 2025

What are the rights of “secured” creditors in Chapter 7 bankruptcy cases? What are the rights of debtors who have pledged collateral?

With this online program, attorney Eric North begins a new bankruptcy series focusing on Chapter 7 cases. This first webinar will help new and experienced bankruptcy collectors (and their supervisors) learn about and handle cases in which the creditor holds a security interest in real or personal property. Participants will learn, among other things:

• What it means to be a “secured” creditor. (It isn’t as clear as it may seem to be.)

• How the value of collateral is measured, and how it varies depending on the type of collateral and the circumstances.

• When the value of collateral matters, and when it doesn’t matter, in Chapter 7 cases.

• What the debtor has the absolute “right” to do with respect to secured loans, and the debtor may only do with the creditor’s consent.

• What circumstances allow the debtor (with the court’s consent) to “strip away” liens on collateral, leaving the creditor unsecured.

• How a creditor can learn what the debtor intends to do regarding a secured loan.

• Under what circumstances a creditor may insist the debtor provide insurance on collateral.

• What options are available to a creditor if the debtor says he will “surrender” collateral but doesn’t actually do so.

As with all NorthLegal webinars, participants are encouraged to send questions you would like answered to Eric in advance of the program so he can try to address them.

For more information, call NorthLegal at 623.537.7150.

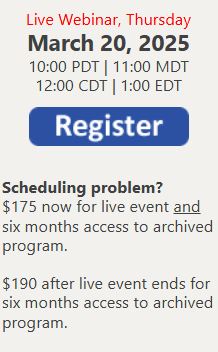

Live Webinar

Thursday, March 20, 2025

10:00 PST | 11:00 MST

12:00 CST | 1:00 EST

About NorthLegal Training and Publications

NorthLegal Training and Publications (“NorthLegal”) is dedicated to providing the most accurate and current legal information possible for credit unions and other consumer lending institutions, to helping those institutions develop careful and practical procedures for complying with the laws that govern them, and to doing so with a minimum of legal jargon and in a way that is understandable.

Types of Training

Recognizing that different people have different ways of learning and have different time and budgetary constraints, NorthLegal, working in cooperation with local, state and national trade associations, provides training for consumer lending personnel through:

- Seminars and breakout sessions provided in various cities. (For a list of upcoming seminars, click here.)

- NorthLegal Webinars provided regularly throughout the year. (For a list of webinars coming soon, or for on demand recorded webinars, click here.)

- Multi-day NorthLegal Conferences intended to provide participants with thorough, detailed, and practical training regarding the subjects covered.

Training Subjects

Seminar, webinar, and conference topics vary, but include:

- Legal Update seminars, conducted annually for certain state trade associations, provide an analysis of a wide variety of recent federal and state laws, federal and state regulations, and federal and state court decisions, and of current legal trends that are likely to affect financial institutions

- Bankruptcy seminars, webinars and conferences

- Collections seminars and webinars

- Complex Laws conferences

- Privacy seminars and webinars

- Third Party Relationships and Due Diligence seminars

- Miscellaneous other seminars and webinars

Publications

NorthLegal also periodically provides publications intended to help credit unions and other consumer lending institutions understand and comply with specific laws. NorthLegal currently publishes …

- California Repossessions: Law and Procedures Guide. This manual provides an in-depth explanation of the various laws affecting repossessions in California, including (but not only) the Uniform Commercial Code and the Rees-Levering Motor Vehicle Sales and Finance Act. The Repo Guide also provides sample forms. For more information click here.

For more information about upcoming programs, click here or Contact Us.

Related:

Drafting and Enforcing Cross-Collateral Clauses

NorthLegal Training and Publications | 5115 N. Dysart Rd, No. 202-500 | Litchfield Park, AZ 85340

Bankruptcy 701 – Handling Secured Claims in Chapter 7 Bankruptcy – Bankruptcy 701 – Handling Secured Claims in Chapter 7 Bankruptcy – Bankruptcy 701 – Handling Secured Claims in Chapter 7 Bankruptcy Bankruptcy 701 – Handling Secured Claims in Chapter 7 Bankruptcy – Bankruptcy – Credit Union Collections – Credit Union Collectors – Delinquency – Northlegal – Northlegal

Facebook Comments