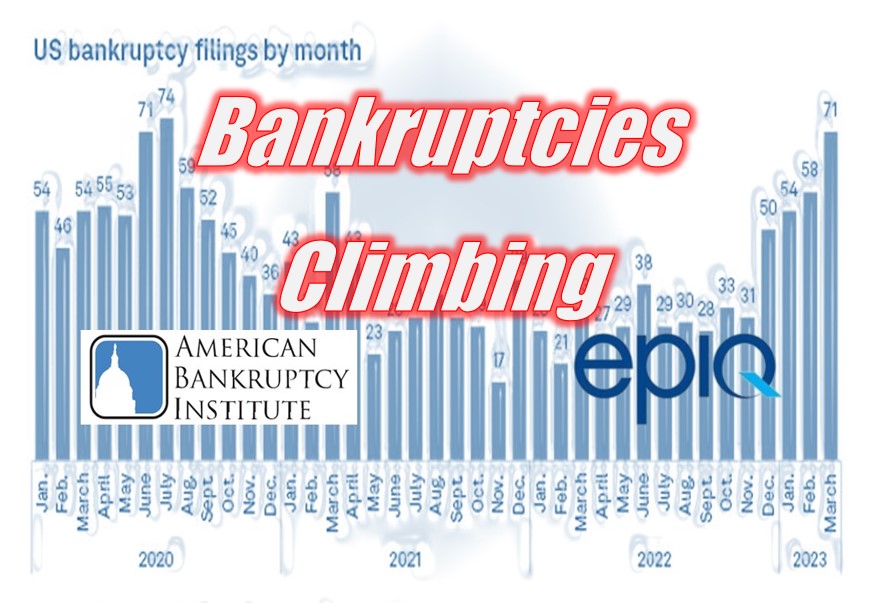

Commercial Filings Up 79 Percent Year-over-year – Total filings exceed 40,000 for first time since April 2021

NEW YORK – April 3, 2023 – New bankruptcy filings in March 2023 registered year-over-year increases across all U.S. major filing categories for the third month in a row, according to data provided by Epiq Bankruptcy, the leading provider of U.S. bankruptcy filing data.

A total of 42,368 new bankruptcies were filed in March, up 17 percent from the 36,068 filings registered in March 2022, and marking the highest number of monthly filings since 40,931 bankruptcies were recorded in April 2021.

Year-over-year commercial filings were up 24 percent to 2,305 compared to 1,854 in March 2022. Commercial chapter 11 filings (including subchapter V) increased 79 percent to 548 versus the 306 filings registered the previous year. Of the total commercial chapter 11 filings, the 140 subchapter V filings in March represented a 12 percent increase from the 125 filings in March 2022.

Total individual filings increased 17 percent to 40,063 versus 34,214 in March 2022. Year-over-year individual chapter 7 filings increased 13 percent to 24,467 versus 21,594, and individual chapter 13 filings were up 24 percent to 15,537 versus 12,532 in March of 2022.

“While total filings are up for the third month in a row and exceeded the 40,000 level for the first time in two years, the jump also reflects the historical trend of March consistently being the highest month for filings every year,” said Gregg Morin, Vice President of Business Development and Revenue for Epiq Bankruptcy.

For the first calendar quarter of 2023 (Jan. 1 through March 31), the 105,433 total bankruptcy filings represented an 18 percent increase from the 89,289 total filings during the same period last year. Consumer filings also increased 18 percent, to 99,700 filings in the first quarter of 2023 from the 84,481 consumer filings during the same period in 2022.

Total overall commercial bankruptcies increased 19 percent in the first quarter of 2023, as the 5,733 filings surpassed the 4,808 commercial filings during the first quarter of 2022. Total commercial chapter 11 filings registered a 77 percent increase to 1,301 during the first quarter of 2023 from the 735 total commercial chapter 11s during the same period in 2022. Subchapter V elections for small businesses increased, as the 371 filings in Q1 2023 were up 33 percent from the 280 filed during Q1 2022. Individual chapter 7 filings during the first quarter 2023 were 57,172, a 12 percent increase over the 51,083 individual chapter 7 filings during the same period of 2022. Individual chapter 13 filings during the first quarter 2023 were 42,364, a 28 percent increase over the 33,189 individual chapter 13 filings in the same period of 2022.

Comparing month-over-month, the 42,368 total filings in March were 33 percent higher than the 31,898 filings recorded in February. Total commercial filings increased 35 percent to 2,305 from the 1,710 filings the month prior. Total commercial chapter 11 filings (including subchapter V) increased 46 percent to 548 from the 375 filed in February. Of the total commercial chapter 11 filings, subchapter V filings increased 18 percent to 140 in March, up from 119 in February.

Total month-over-month individual filings increased 33 percent to 40,063 from 30,188. Individual chapter 7 filings increased 44 percent to 24,467 from 16,988 in February, while individual chapter 13 filings increased 18 percent to 15,537 from the 13,148 filed in February.

“The increase in bankruptcy filings in the first quarter of the year demonstrates the growing debt burdens of both consumers and businesses,” said ABI Executive Director Amy Quackenboss. “As inflationary prices have increased in tandem with the cost of borrowing, struggling companies and households have access to a financial reprieve through the bankruptcy process.”

The American Bankruptcy Institute (ABI) has partnered with Epiq Bankruptcy to provide the most current bankruptcy filing data for analysts, researchers, and members of the news media. The new bankruptcy filing data will be the focus of an abiLIVE webinar, “Bankruptcy Filing Growth: Will Increases Continue Beyond 1Q 2023?,” at 1 p.m. EDT on Tuesday, April 11. Morin will be joined by Ed Flynn of ABI and Hon. Judith K. Fitzgerald (ret.) to discuss first-quarter filings and what trends might lie ahead for the remainder of 2023. For more information and to register, visit https://www.abi.org/events/bankruptcy-filing-growth-will-increases-continue-beyond-1q-2023.

Epiq Bankruptcy is a division of Epiq and is the leading provider of data, technology, and services for companies operating in the business of bankruptcy. Its Bankruptcy Analytics subscription service provides on-demand access to the industry’s most dynamic bankruptcy data, updated daily. Learn more at https://bankruptcy.epiqglobal.com.

About Epiq

Epiq, a global technology-enabled services leader to the legal industry and corporations, takes on large-scale, increasingly complex tasks for corporate counsel, law firms, and business professionals with efficiency, clarity, and confidence. Clients rely on Epiq to streamline the administration of business operations, class action and mass tort, court reporting, eDiscovery, regulatory, compliance, restructuring, and bankruptcy matters. Epiq subject-matter experts and technologies create efficiency through expertise and deliver confidence to high-performing clients around the world. Learn more at https://www.epiqglobal.com.

About ABI

ABI is the largest multi-disciplinary, nonpartisan organization dedicated to research and education on matters related to insolvency. ABI was founded in 1982 to provide Congress and the public with unbiased analysis of bankruptcy issues. The ABI membership includes nearly 10,000 attorneys, accountants, bankers, judges, professors, lenders, turnaround specialists and other bankruptcy professionals, providing a forum for the exchange of ideas and information. For additional information on ABI, visit www.abi.org. For additional conference information, visit http://www.abi.org/calendar-of-events.

Bankruptcy Filings Are Up Across All Chapters in March – Credit Union Collections – Credit Union Collectors

Bankruptcy Filings Are Up Across All Chapters in March – Credit Union Collections – Credit Union Collectors

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference