BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim

A Live NorthLegal Webinar

When should a creditor file a “proof of claim” in a bankruptcy case, and when is it unnecessary? What happens if you don’t file one when you should, or do file one when you shouldn’t?

What are common mistakes creditors make, what harm can those mistakes cause, and how can those mistakes be avoided? Must a creditor use the official form, or may the creditor use its own form? What value should be used for collateral? Should the creditor attach evidence of that value? What documents must be attached?

Filing a proof of claim in a bankruptcy case isn’t just clerical work — it is serious business. It can affect when payments to a creditor begin, how much the creditor is paid, and whether the creditor is paid at all. An improperly prepared proof of claim can even lead to sanctions against the creditor! The proof of claim must be completed accurately and on time.

It is imperative that whoever files proofs of claim for your financial institution really understand and comply with the rules that govern them.

During this online training program, attorney Eric North will help participants understand:

• Deadlines for filing a proof of claim and what happens if you are late

• Steps a debtor can take to try to defeat all or part of your claim, and how you should respond

• How to complete the official Proof of Claim form

• How to itemize principal, interest, late fees, attorneys fees, and any other amounts included in the claim

• What information you are prohibited from including with a proof of claim and what your financial institution should do if you make a mistake

• When to include “Attachment A” and how to complete it

• What other attachments must be included with the proof of claim

• When an already-filed claim must be updated during the course of a bankruptcy using “Supplement 1” and/or “Supplement 2” and how to complete those forms

• What your duty is when a Chapter 13 trustee provides you with a Notice of Final Cure Payment

• Common errors creditors make and how to avoid or fix them

Attend this webinar to learn the rules you must know in order to protect your financial institution’s rights, maximize chances for recovery, and avoid costly errors.

This program is the fifth in a series of webinars intended to help collections and bankruptcy professionals understand and respond appropriately to bankruptcy filings.

EARLIER IN THE SERIES

(And Still Available)

Dealing with Nonbankrupt Coborrowers

What Happens When the Bankruptcy is Over?

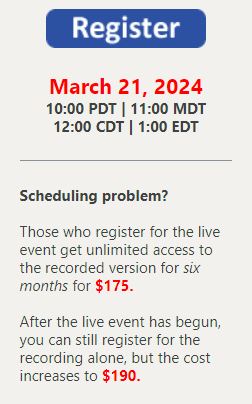

Register now or call NorthLegal at 623.537.7150 if you have any questions.

NorthLegal Training and Publications | 5115 N. Dysart Rd, No. 202-500, Litchfield Park, AZ 85340

BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim – BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim – BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim

BK 105 – Preparing, Filing and Updating Bankruptcy Proofs of Claim – Repossess – Credit Union Collections – Credit Union Collectors – Delinquency – Northlegal – Northlegal – Bankruptcy

Facebook Comments