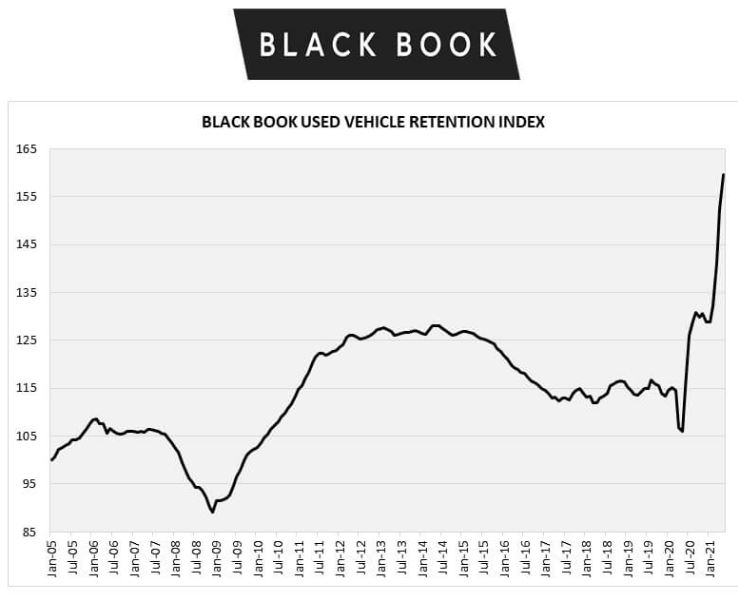

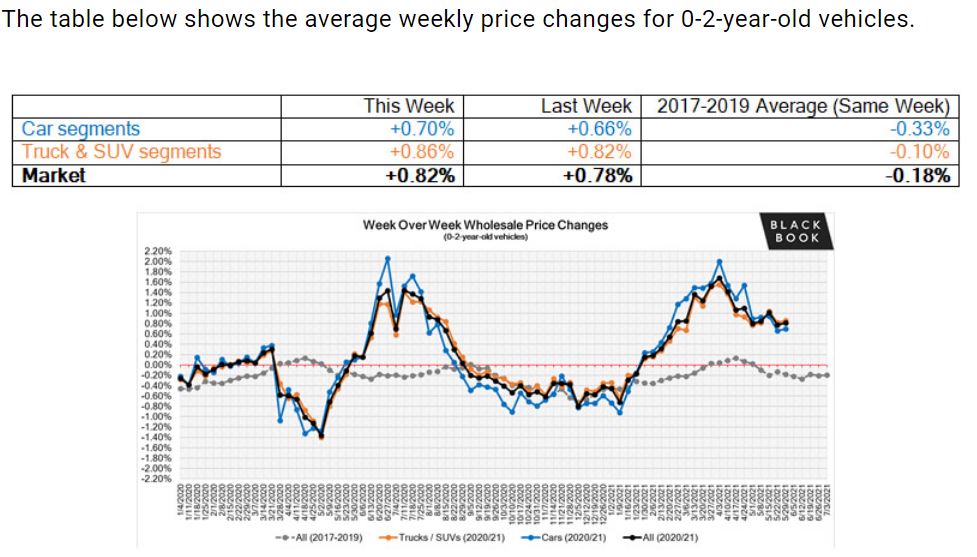

Lawrenceville, GA – Black Book’s Used Vehicle Retention Index for set another record in May. Climbing 4.7% above April’s (152.4), which was an (or 8.0%) increase over March, the index, now at (159.6), is showing signs of slowing. Regardless, May’s auction results showed, in some cases newer used units reaching auction sales levels that, in some cases, exceeded new car pricing. Driven by an extreme shortage of rental returns and limited inventory of new vehicles, the price trends of newer used vehicles have been experiencing larger weekly gains.

As an example of the impact of reduced production, dealers are paying above MSRP for “New Used” vehicles (0-2 years old) on the following vehicles; F150 Raptor, 2020-21 Chevrolet Corvette, and 2021 Jeep Gladiator and Wrangler, 2021 Kia Telluride and Hyundai Palisade, as well as other mainstream models. Wholesale prices are exceeding MSRP in some cases although the rate of increase has slowed down in the last several weeks.

“Wholesale prices continued their ascent each week in April, although the rate of increase declined through the month,” said Alex Yurchenko, SVP, Data Science and Analytics. “Demand for used and new vehicles remained strong even with dwindling new inventory. Available used inventory stabilized in April and started to build up at the end of the month, although we are still about 10% below where we started the year. This strong demand and still low inventory together with low (and declining) incentive levels on new vehicles helped the retention index to increase for the fifth month in the row, to a new record. This month, all segments besides Full-Size Vans showed increases, with Minivans having the largest gains again (almost 13%)”

According to the Alliance for Automotive Innovation, the semiconductor chip shortage could cause a shortfall in US vehicle production by as many as 1.27 million vehicles in 2021. Earlier this year, IHS Markit predicted the chip shortage would cut annual production by 1 million to 1.3 million vehicles; Alix Partners anticipated the shortage would result in between 1.5 to 5 million fewer vehicles produced.

The purpose of Black Book Wholesale Used Vehicle Retention Index is to provide an accurate and unbiased view of the strength of used vehicle wholesale market values. The index is calculated using Black Book’s published Wholesale Average value on 2- to 6- year old used vehicles, as percent of original typically equipped MSRP. Black Book’s Wholesale Average is a benchmark value for used vehicles selling in the wholesale auctions with the vehicle quality in Average condition. The index is weighted based on registration volume and adjusted for seasonality, vehicle age, mileage, condition, and inflation (MSRP). In short, this index measures the trend in percent retention from original MSRP of a typical 4-year old vehicle in the market.

Click here for a copy of the Black Book’s Latest Market Insights