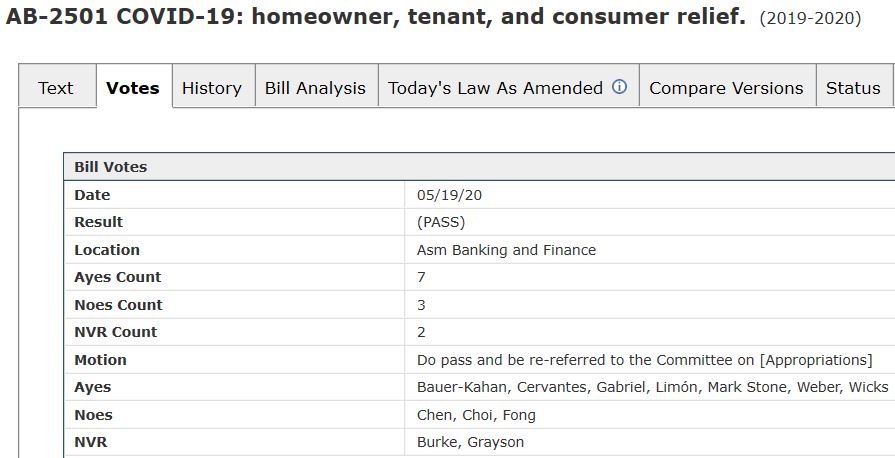

Sacramento, CA – 19 May, 2020 – In a 7 to 3 vote, with two abstaining, the California State Legislature passed AB 2501 to move on to its next step of the legal process. If passed, amongst other conditions, all repossession, foreclosure and collections activities would be on hold in the state of California until one-hundred and eighty days after the end of the Federal Crisis. If fully enacted, this bill would utterly decimate the entire repossession industry in the state of California.

On May 11, 2020, California House Banking and Finance Committee Assemblywoman and Committee Chair, Monique Limon (D) of Santa Barbara, introduced AB2501 “COVID-19: homeowner, tenant, and consumer relief Law of 2020”. Within it’s pages are proposals to create a moratorium on repossession, foreclosures during the COVID-19 period and an additional 180 days (6 months) after the “the emergency related to the COVID-19 disease has ended.” The bill also requires extended loan forbearances of 90 days to be granted with additional extensions upon request and forfeits lender deficiency rights if these forbearances are not fulfilled as per the bill’s loose standards.

The long-term ramifications of this bill have been brought to the attention of Assemblywoman and Committee Chair, Monique Limon, as well as the other five sitting members of the committee but clearly to no avail as seven of the ten voted in favor of it. The long-term damaging effects of it have been clearly spelled out in a series of three letters to the committee by eight large national and state level banking associations.

On the May 17th, joint letter from the California Chamber of Commerce, American Bankers Association (ABA), American Financial Services Association (AFSA), Bank Policy Institute (BPI), Credit Union National Association (CUNA), Housing Policy Council (HPC), Mortgage Bankers Association (MBA) and the Securities Industry and Financial Markets Association (SIFMA), it was stated that;

“AB 2501 would undermine these ongoing efforts to help customers by creating duplicative and sometimes contradictory requirements for the mortgage and auto finance industries when viewed alongside federal rules, regulations and program requirements established by Congress, regulatory bodies, federal executive agencies, and government sponsored enterprises.”

In a more direct letter, the California Chamber of Commerce referred to the bill as “JOB KILLER” and that;

“Requiring these institutions to potentially go years without receiving payment is a significant burden that will negatively impact financial opportunities for Californians. Given the financial risk this proposal creates for such institutions, there is no question that the institutions will limit the mortgage and auto loans it offers. There will likely be stricter criteria to qualify, or, higher rates to offset the potential loss these institutions could suffer under AB 2501. This limitation will have a negative impact on the housing market, further exacerbating the housing crisis and creating job loss in the housing industry. It will also unquestionably limit car loans, especially for those with problematic credit history, and will harm both consumers and workers in the auto industry.”

The bill’s next hurdle is a low one, in the Appropriations Committee, where, as the result of no state expenses in the implementation and maintenance of this “law” is passed on to the lending, collections and repossessions industries, it should face little opposition. These committees, while small tend, to mirror political allegiance and this bill’s similarity in content to that of the destined to fail, “Heroes Act” illustrate this lockstep measure. There is currently no posted date for this hearing on the states legislative information pages.

This bill’s first step may have seemed destined to fail, as we all might assume, but given the political environment of California, that can not be assumed. While the larger national and state financial associations have considerable clout, they do not represent the expressed interests of the repossession industry and your support of the California Association of Licensed Repossessors (CALR) lobby is still very much needed.