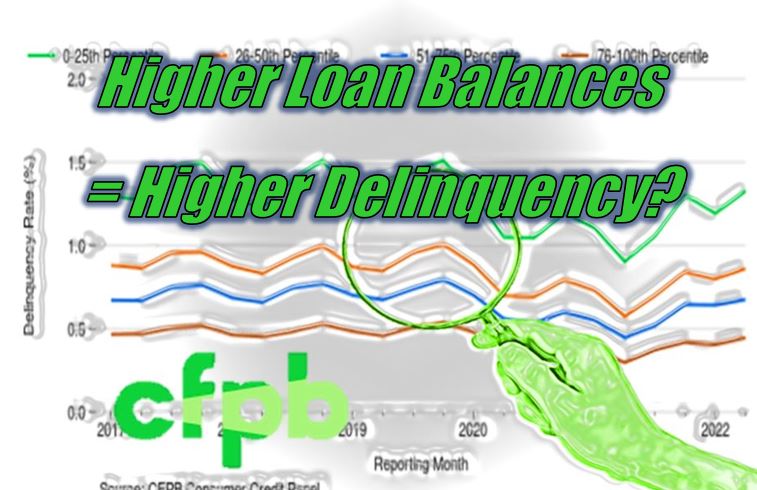

“loans originated in 2021 and 2022 are starting to show higher delinquency rates relative to loans originated in previous years”

CFPB – In our continued monitoring of the auto lending market, we examined available data to explore the potential relationship between rising car prices and changes in auto loan characteristics and performance. This post explores how rising car prices may be leading to larger loan amounts and monthly payments, and how this may be impacting consumers.

CFPB examining impact of higher loan amounts to rises in delinquency – Consumer Financial Protection Bureau – CFPB

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference