WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) today published an issue brief showing that consumer applications for auto loans, new mortgages and revolving credit cards had mostly returned to pre-pandemic levels by May 2021.

Read the CFPB Recovery of Credit Applications to Pre-Pandemic Levels Brief Here.

Prime and near-prime consumers are driving this recovery as applications remain down from borrowers with subprime and deep subprime for all types of credit and, for borrowers with superprime credit scores, applications are down for all types of credit but mortgages. The report also provides a state-by-state analysis of the change in credit applications for auto loans, new mortgages, and revolving credit cards and shows wide geographic variability in the demand for auto loans. The report issued today follows previous data published in May and December of 2020. As with those previous reports, the CFPB notes an increase in credit applications, particularly from borrowers with below prime credit scores, in conjunction with federal stimulus payments.

“While consumer credit applications have generally recovered to pre-pandemic levels in the aggregate, we see important differences across consumers,” said Acting CFPB Director David Uejio. “Both borrowers with superprime and subprime credit scores are still not applying for credit as much as they were pre-pandemic. We will continue to keep a close watch on the marketplace as the economic recovery continues, to help ensure all consumers have access to financial products and services that are fair, transparent, and competitive.”

Key findings in the brief include:

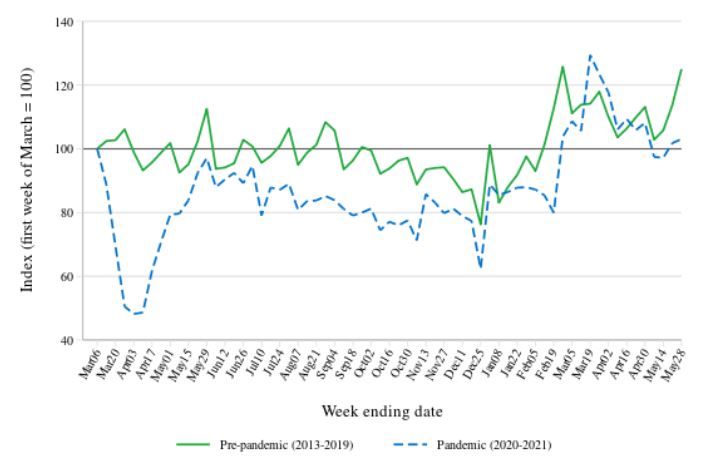

- Auto loan inquiries saw a drop of 52 percent by the end of March 2020 and returned to their usual pre-pandemic trend by January 2021.

- New mortgage credit inquiries saw a smaller drop in March 2020 compared to other types of inquiries and then surged. Subsequently, inquiries have exceeded their usual, seasonally adjusted volume by 10 to 30 percent, reflecting the unusually high activity in the mortgage market throughout the pandemic.

- Revolving credit card inquiries took the longest to recover from the initial March 2020 decline, until March 2021, when the level of these inquiries reached back to their usual levels.

- Consumers with deep subprime credit scores showed the largest decline in auto loan inquiries compared to prior years, followed by inquiries from consumers with subprime credit scores. These consumers also showed declines in new mortgage and revolving credit card inquiries.

- Changes in auto loan and new mortgage applications were quite varied across the states while changes in credit card applications were generally uniform.

In preparing the brief, the CFPB used its Consumer Credit Panel, a sample of credit records maintained by one of the three nationwide consumer reporting agencies (NCRAs). Before being provided to the Bureau, the records are stripped of any information that might reveal consumers’ identities, such as names, addresses, and Social Security numbers.