“We’re concerned about servicers that charge fees above the actual applicable cost to the company, whether the company at issue is the lender or the repossession management company.”

EDITORIAL

Don’t say that I didn’t warn everyone back in July. I’ve been wondering how long it was going to take until the Consumer Financial Protection Bureau (CFPB) caught on to this. But their findings on repossession fees in Winter 2023 Supervisory Highlights Junk Fees Special Edition appear to have meant just what they say they meant according to their latest statement provided in my follow up question.

Over the past twenty years or so, repossession forwarding, the act of using a repossession management company to assign your repossessions, has grown dramatically. Over the past five years, we’ve even seen collateral protection carriers (CPI, advocate their usage and in many cases, requiring it before allowing credit unions to file for skip coverage claims.

While doing so, I assume that you have all been using exactly what the repossession forwarder told you the bill was when quoting amounts to reinstate or redeem repossessed collateral. While legal by law at this point, it appears from the CFPB’s latest clarification on their statements in their “Junk Fees” Supervisory Highlights report, it is an unfair deceptive and abusive practice (UDAAP) in their eyes.

In case you hadn’t read the earlier article, I have provided links to the related articles at the bottom of this page. In case you simply want to see their original March 8th Winter 2023 Supervisory Highlights Junk Fees Special Edition, please click below.

Click Here to Download the Entire Report

More Follow Up

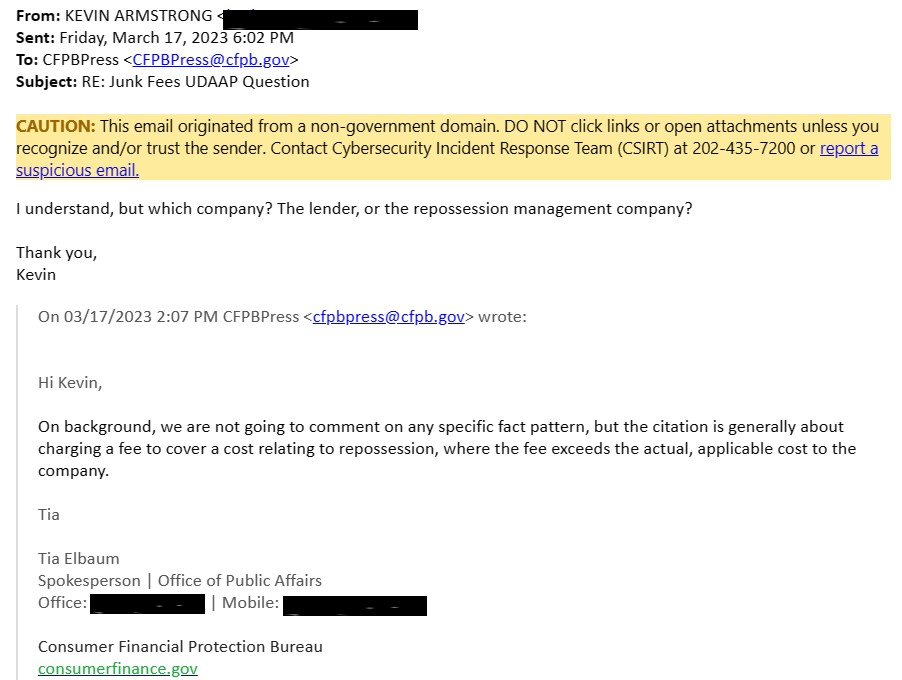

Last week I reported back that they had offered little in the form of clarity on their findings and had only stated;

“Hi Kevin,

Thank you for your query. On background, Supervisory Highlights summarizes actions the CFPB has taken in examinations. In the citations referred to in Supervisory Highlights, servicers were charging consumers for repossession costs that exceeded the actual repossession costs billed to the servicers.”

The CFPB’s Office of Public Affairs Spokesperson, Tia Elbaum, has been very responsive to the best of her ability, but obviously I wanted more. So, I asked her another question.

“Tia,

Thank you again for the quick response. So, this has to do only with the actual cost of the repossession itself and not any other estimated fees? In other words, if the repossession agent was paid $350, the borrower shouldn’t be charged any more for the actual repossession than what the agent was paid, correct?”

In response, she stated last Friday the 17th;

“Hi Kevin,

On background, we are not going to comment on any specific fact pattern, but the citation is generally about charging a fee to cover a cost relating to repossession, where the fee exceeds the actual, applicable cost to the company.”

Basically, she said the same thing in a different way, so, I followed up with hone more try;

“I understand, but which company? The lender, or the repossession management company?”

Thank you,

Kevin

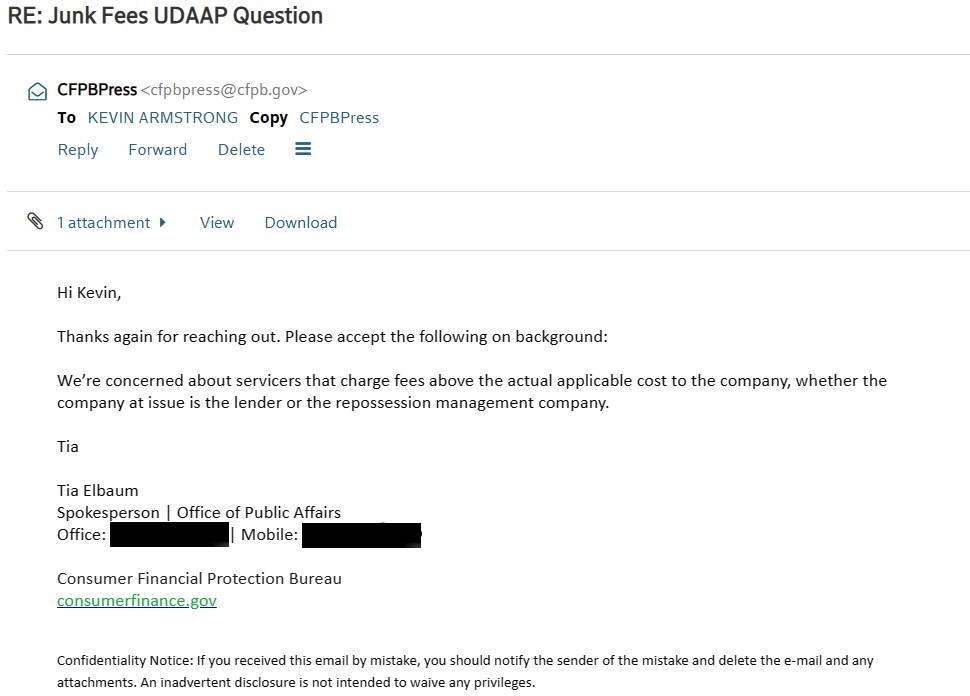

To which today, Monday the 20th, she replied;

“Hi Kevin,

Thanks again for reaching out. Please accept the following on background:

We’re concerned about servicers that charge fees above the actual applicable cost to the company, whether the company at issue is the lender or the repossession management company.

Tia

Tia Elbaum

Spokesperson | Office of Public Affairs

Consumer Financial Protection Bureau

consumerfinance.gov”

Conclusion

I would like to publicly thank Tia for her patience and assistance in providing as much clarity of information as she can.

First let’s look at the clarification of two different words;

“Concerned” – They were concerned enough about the practice of charging consumers for fees greater than the actual cost to perform them. Concerned enough to elicit the examined “service provider” to refund the difference between the actual cost to perform the service and what was actually billed;

e.g. ; “servicers charged a $1,000 estimated repossession fee as part of the amount owed. This estimated repossession fee was significantly higher than the average repossession cost, which is generally around $350. By policy, the servicers returned the excess amounts to the consumer after they received the invoice for the actual cost from the repossession agent.”

As I’d mentioned in last weeks article, I am unaware of who had this policy before these findings. Does this mean that no one was supposed to have been putting all of the repossession fees from the repossession forwarding company in their notices of intent (NOI) to dispose of collateral post recovery?

Does that mean that if you did or were charging it, are you required to refund it to the borrower now according to their findings? It looks that way. Do the math on this one, it could start to look like one of those multi-million dollar fines that they levy on some of the nation’s largest lenders.

I’m not even going to go down the rabbit hole of other possible FCRA and FDCPA violations this could trickle down into, but if you haven’t talked to your attorney on this yet, this might be a good time.

The next word in her statement that I suggest focus on is “servicers.” They have clarified that to include both lender and repossession forwarder.

I’ll say it once again, I AM NOT AN ATTORNEY! This is not legal advice. This is my humble opinion based upon the evidence and statement provided by the CFPB which I have provided to you for your own examination.

With that said, their follow up statement “servicers that charge fees above the actual applicable cost to the company, whether the company at issue is the lender or the repossession management company.”

In my view of this statement, if a repossession forwarding company is billing you $450 for a repossession and the repossession agent was only paid $350 or less, that this is a practice that they are concerned with.

A practice that they identified and clearly stated is an unfair deceptive and abusive practice (UDAAP) in their March 8th findings.

“During auto servicing examinations, examiners identified UDAAPs related to junk fees, such as unauthorized late fees and estimated repossession fees. Additionally, examiners found that servicers charged unfair and abusive payment fees.”

Keep in mind, your repossession forwarding company has likely charged for other services that they did not pay the repossession agent such as ; vehicle storage, assignment closing fees, dolly fees, flatbed fees and other surcharges like fuel surcharges that were not passed on to the repossession agency.

I’ll say it once again. The CFPB does not write laws. They voice their opinions and findings on practices that they deem unfair to the consumer. They also are well known for imposing huge fines.

Does this mean that you should simply use $350 for all of your stated repossession fees on communications to the borrower and not bill their account more than that? NO! That is just a working number used as an example. Some repossession management/forwarding companies only pay agents $275 and you could still be overstating it.

For most of you that work in banks or credit unions too small to be under direct CFPB supervision ,$10B in assets or less, this issue may never come around to become an issue for you. For those of you who are, it may, or may not. Your guess is as good as mine, but you should at very least pay attention to this finding and, dare I suggest, be proactive.

How all of this plays out in the future is anyone’s guess, but it is potentially a large liability sitting out there for everyone. When the CFPB states that you were not supposed to be charging them any more than the repossession agency got paid, it could very well come into play in future lawsuits revolving around repossessions, in defense and in offense by consumer advocate attorneys.

Perhaps its time for everyone to just got back to establishing relationships and working directly with the repossessors who actually do the work. That’s your call.

Once again, I am not an attorney and this is not intended to be legal advice. These are my opinions based on the information provided to me by the CFPB. Please feel free to reach out to them yourself. I encourage it.

If they provide you any different answers than what they provided me, I would really like to hear and see it. I’m not looking to be right for my own ego, I really want to know the truth.

I encourage you all to think this through. Share this with your Risk Management Officer, VP of Collections and, or your attorney. Discuss this and make the business decision on your own.

I’ll keep you all posted if I hear anything more. Again, if anyone would like to share their opinions or insight into this, lender, forwarder or attorney, you a most welcome to reach out to me at editor@cucollector.com.

Kevin Armstrong

Publisher

Related Articles;

CFPB’s Response to Questions on UDAAP Repo Fees

CFPB Labels Repossession Forwarding Fees as UDAAP?

CFPB; How is this not an UDAAP?

CFPB Provides Clarity on UDAAP Repossession Fees – Consumer Financial Protection Bureau – CFPB

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference