Delinquency is up and repossessions are up. Of course, if these numbers are up, so is the volume of collection calls. According to data from the Federal Trade Commission (FTC), these are the cities and states getting the most calls.

In a recent article shared by NumberBarn, a phone number management company and marketplace, they analyzed the latest FTC complaint data to uncover which states, cities, and age groups are being hit hardest by collection calls, and how those trends have evolved over the past five years.

Key Findings

- Georgia leads the nation in debt collection calls per capita, with 80.8 reports per 100,000 residents in Q1 2025.

- Atlanta ranks first among U.S. cities for per capita debt collection call reports, followed by Dallas, Miami, Houston, and Memphis.

- Debt collection calls surged more than 150% year-over-year, rising from 44,999 in Q1 2024 to 112,583 in Q1 2025.

- Nearly 47% of 2025 reports were flagged as abusive, threatening, or harassing, which is a nearly 4x increase from the previous year.

- Americans aged 30 to 39 reported the most collection calls in 2025.

- The average personal debt in the U.S. is now $61,660, with California, Colorado, and Washington reporting the highest average balances.

States with the Most Debt Collection Calls in 2025

In the first quarter of 2025 alone, Americans reported over 112,000 debt collection calls to the Federal Trade Commission. That’s more than double the number of complaints filed during the same period in 2024.

Keep in mind, however, that not every call comes from a legitimate collector! Of the 112,583 reports filed, nearly 47% (53,243) were flagged as abusive, threatening, or harassing, which is a sharp increase from just 13,472 reports in Q1 of 2024! This might suggest an increase in scammers, or possibly, that debt collectors have just gotten nastier.

“Nationwide, the average debt per person is $61,660, which is a $970 year-over-year increase.”

Regardless, the overall trend points to an uptick in both contact volume and consumer concern.

Also worth noting that particular states are seeing especially high volumes lately. Georgia leads the nation in debt collection call reports per 100,000 residents so far this year, followed by Texas, Florida, and Delaware.

Unsurprisingly then, these states also rank high in abusive or threatening debt collection complaints calls that go beyond reminders and into harassment territory — thus, it’s worth noting that debt collection that involves aggressive tactics may violate the Fair Debt Collection Practices Act (FDCPA).

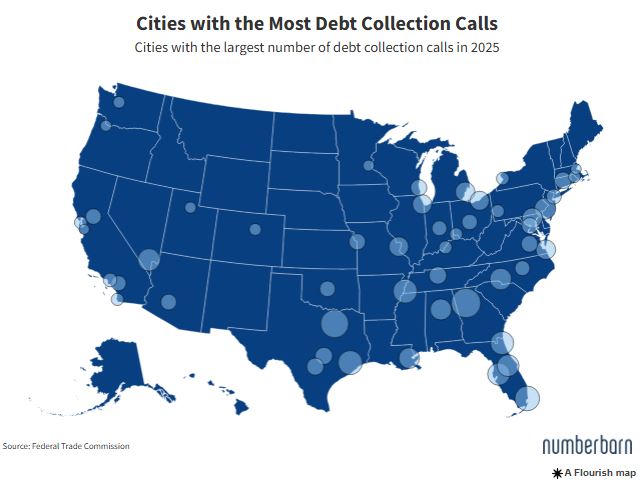

Cities with the Most Debt Collection Calls in 2025

An increase in debt collection call activity isn’t just a state issue, it’s impacting major cities across the country too. We analyzed complaint data across the country’s largest metro areas to find out where specifically residents are being contacted the most.

Debt collection calls have skyrocketed across the country within the last year. From 2024 to 2025, debt collection call complaints increased by 150%, according to new data from the Federal Trade Commission (FTC).

When adjusted for population, residents in Atlanta, Georgia reported the highest rate of debt collection calls in the nation, followed by cities like Dallas, Miami, Houston, and Memphis.

But in terms of total complaint volume, major population centers like Dallas, Atlanta, and New York saw the largest raw numbers of reports in Q1 2025.

–

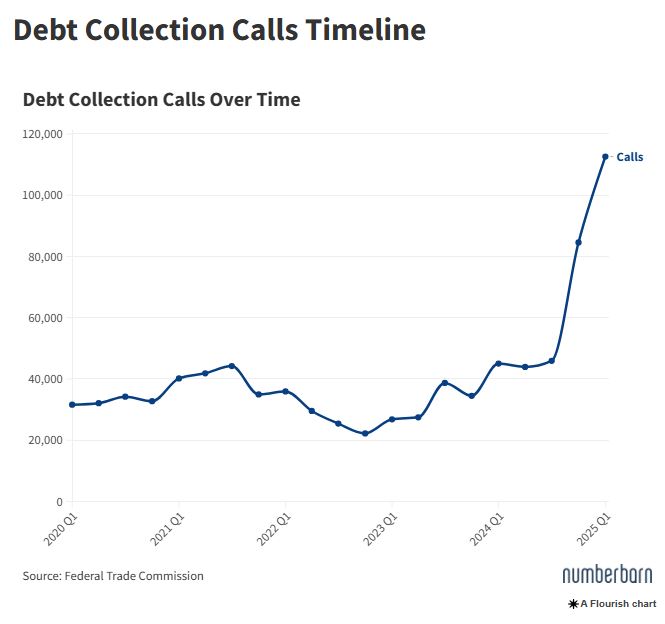

Debt Collection Calls Timeline

Debt collection calls have been a steady concern for consumers since the start of the decade, but something changed in 2025.

All the way from Q1 2020 through Q1 2024, the number of debt collection call reports to the Federal Trade Commission fluctuated modestly, averaging between 35,000 and 45,000 complaints per quarter.

“In the first quarter of 2025 alone, Americans reported over 112,000 debt collection calls to the Federal Trade Commission. That’s more than double the number of complaints filed during the same period in 2024. “

But in Q1 2025, reports more than doubled, jumping from 44,999 in Q1 2024 to 112,583 this year, which is a 150% increase. Even more alarming, the number of abusive or threatening debt collection reports grew nearly fourfold, rising from 13,472 to 53,243 in just 12 months.

The reason behind this sharp uptick isn’t entirely clear. However, it could reflect a rise in aggressive collection practices, increased financial stress among consumers, better awareness of reporting tools, or a surge in scam activity posing as debt collectors.

Whatever the cause, the data shows that 2025 has brought a dramatic shift in consumer experience with debt collection calls.

–

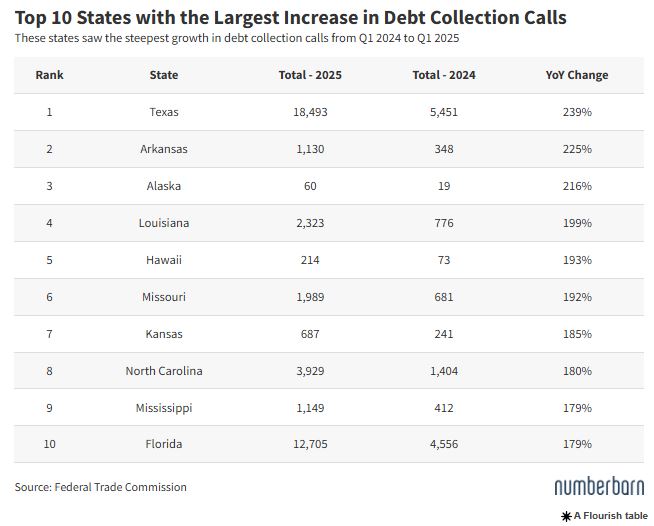

Where Have Debt Collection Calls Increased?

While debt collection call volume paints a broad picture, looking at year-over-year growth reveals which states are experiencing the most dramatic changes.

Between Q1 2024 and Q1 2025, Texas, Arkansas, and Alaska recorded the largest percentage increases in debt collection call reports. With the exception of Vermont and Maine, every state across the country experienced spikes in debt collection calls, according to FTC data.

–

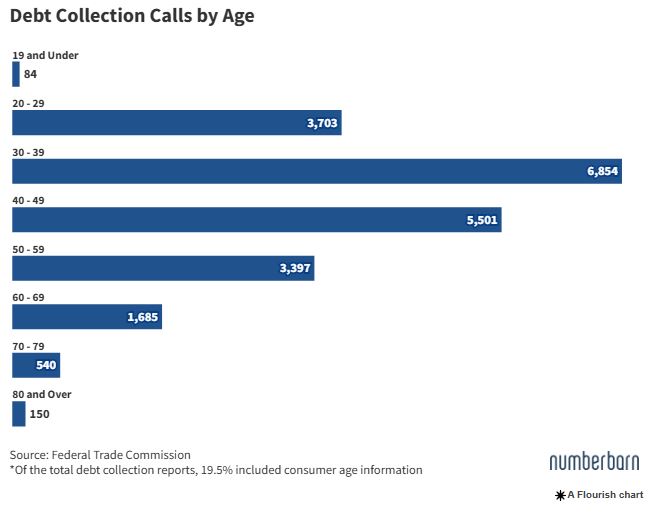

Which Age Groups Receive the Most Debt Collection Calls?

Debt collection calls don’t discriminate by age, but some groups are clearly being contacted more than others.

In the first quarter of 2025, Americans between the ages of 30 and 39 filed the most debt collection call complaints, followed by those aged 40 to 49, and 50 to 59. These middle-aged groups may be facing a combination of financial responsibilities like mortgages, student loans, and credit card balances, making them more vulnerable to both legitimate collection efforts and potential scams.

Interestingly, the under-30 and over-70 age groups reported significantly fewer calls. This could be due to lower overall debt levels or fewer active credit accounts, but it may also reflect lower reporting rates or different patterns in how these groups interact with collection agencies.

–

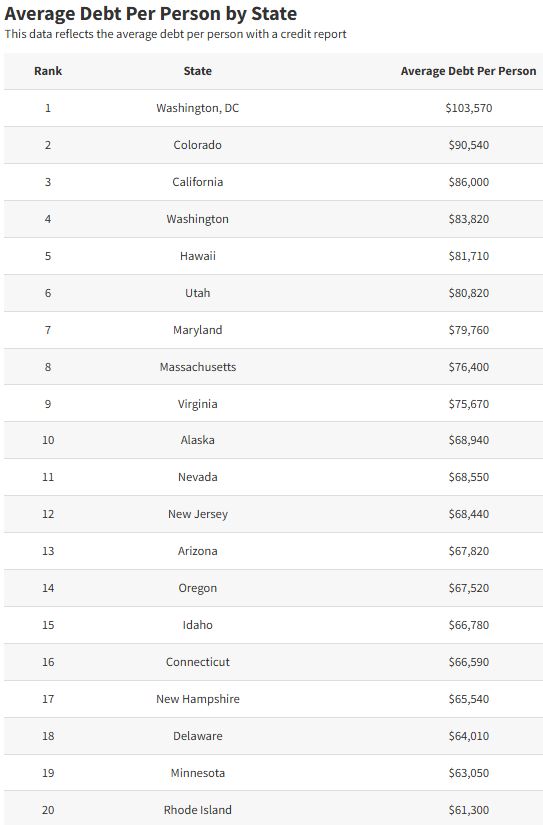

Average Debt by State

While debt collection calls don’t always mean someone owes money, the broader financial landscape still plays a role in shaping how and where these calls occur.

According to the most recent data from the Federal Reserve Bank of New York, average personal debt levels vary widely by state. In Q4 2024, states like California ($86,000), Colorado ($82,820), and Washington ($85,490) reported some of the highest average debt levels per person with a credit report. Elsewhere, states like West Virginia ($41,490) and Mississippi ($42,870) carried some of the lowest.

Nationwide, the average debt per person is $61,660, which is a $970 year-over-year increase.

It’s important to note that these numbers don’t reflect debt per household, but rather the average balance per person with a credit report and include consumer expenses such as mortgages, auto loans, student loans, and credit card debt.

These figures don’t indicate financial distress on their own, but they do help provide context around the financial obligations Americans are managing behind the scenes of rising collection calls.

–

Methodology

This study analyzes the number of debt collection call reports per capita across all 50 states and the 50 most populous cities in the United States, using data from the Federal Trade Commission (FTC). It also incorporates average personal debt levels by state based on the latest data from the Federal Reserve Bank of New York.

The data includes the most recent information available as of May 2025.

All findings are based on publicly available FTC reports and were adjusted to account for variations in population size, ensuring accurate per capita comparisons. This study aims to provide a comprehensive overview of debt collection trends.

Sources: Federal Trade Commission, Federal Reserve Bank of New York, U.S. Census Bureau American Community Survey

Fair Use: Feel free to use this data and research with proper attribution linking to this study.

Media Inquiries: For media inquiries, contact media@numberbarn.com Illustrations by Chanelle Nibbelink

Written by

Alan Lopez

Alan is a lifestyle blogger, marketing manager, and art director who has been covering electronics and media culture for so long, he remembers being disconnected from the internet whenever somebody would pick up the phone.

Source: NumberBarn.Blog

Collection Calls Surging in 2025: These States and Cities Report the Most – Collection Calls Surging in 2025: These States and Cities Report the Most – Collection Calls Surging in 2025: These States and Cities Report the Most

Collection Calls Surging in 2025: These States and Cities Report the Most – Credit Union Collections – Credit Union Collectors – Lending – Delinquency – Auto Loan

More Stories

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference