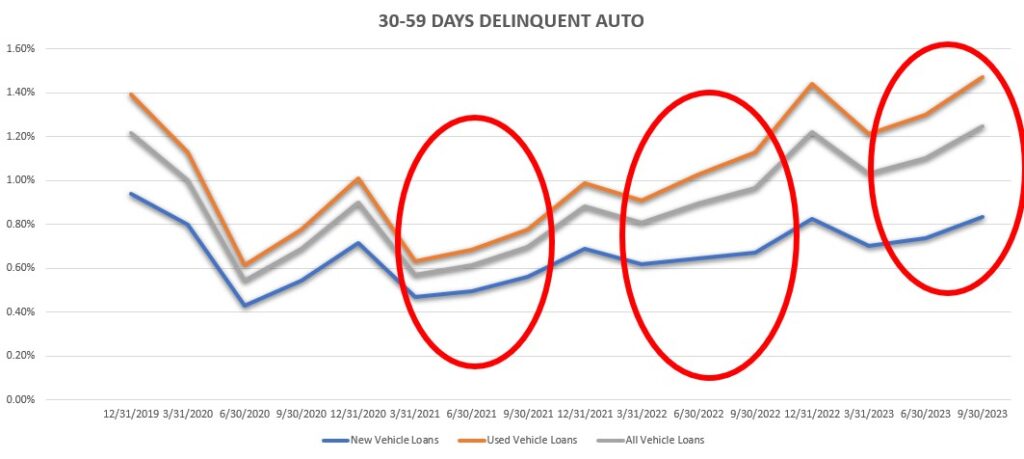

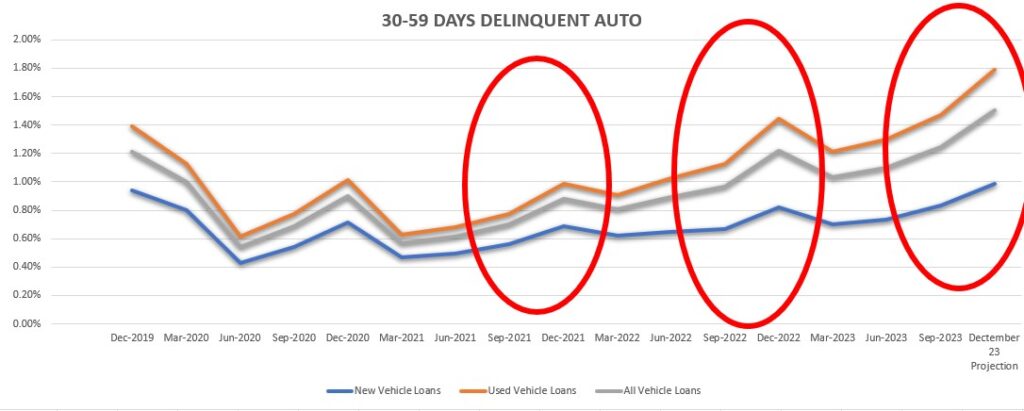

After the 1st quarter of the year’s NCUA’s combined credit union 5300 FPR financials, I had reported that the seasonal credit union auto loan delinquency pattern had returned to normal. After the second quarter, I predicted that with the return of this seasonal trend, we could expect that the 3rd quarter would show a continued increase. It did not disappoint, and we can expect that the 4th quarter will be brutal.

As usual, the National Credit Union Administration (NCUA) released their quarterly combined credit union 5300 FPR financials for the third quarter of 2023 late. Regardless, it was worth the wait for me. Most of my projections were very close to the actual results. If this pattern continues, the 4th quarter is going to be rough.

Download the Data Here!

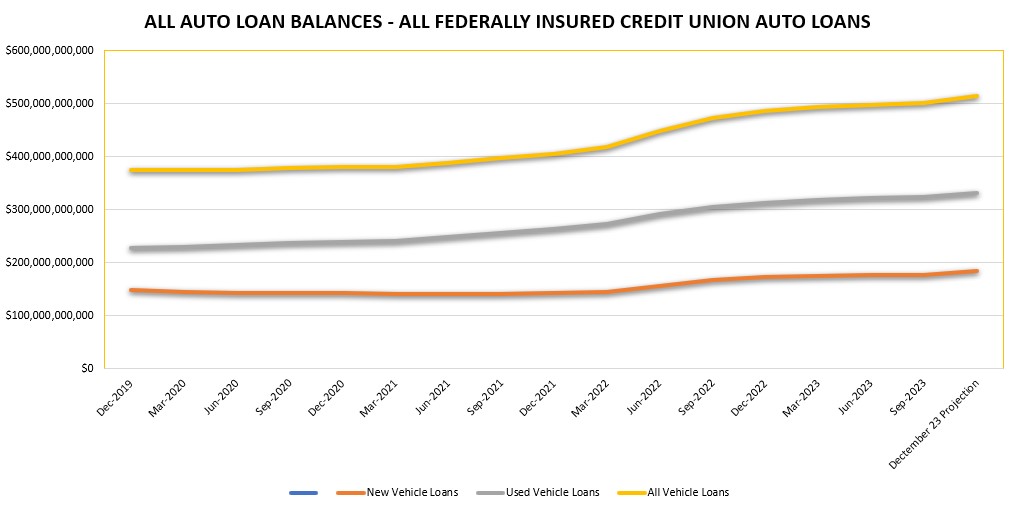

Worthy of mention, credit union auto lending has slowed down for most everyone I know. Ratios predicted could be higher if portfolio balances hold level or decrease.

30 Day Delinquencies

My 3rd quarter projections for the 3rd quarter for 30-day delinquency were way off. I had predicted it would rise to $6M with a 1.17% delinquency ratio. It was a little worse at $6.2B and 1.25%. Another 8-basis point increase over three months.

Historically, December is the worst month for delinquency in the year. I predict that the 4th quarter will continue to rise to $6.8B with a ratio of 1.50%.

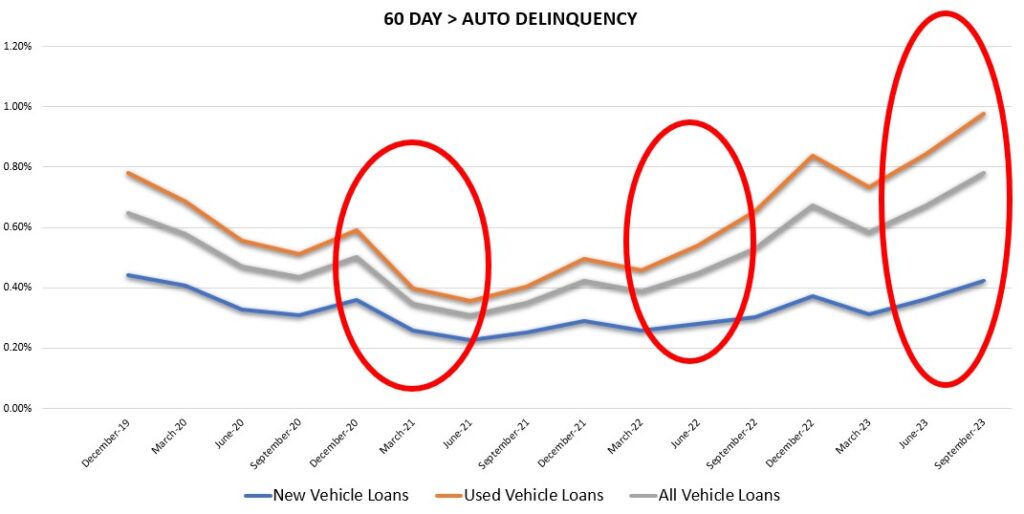

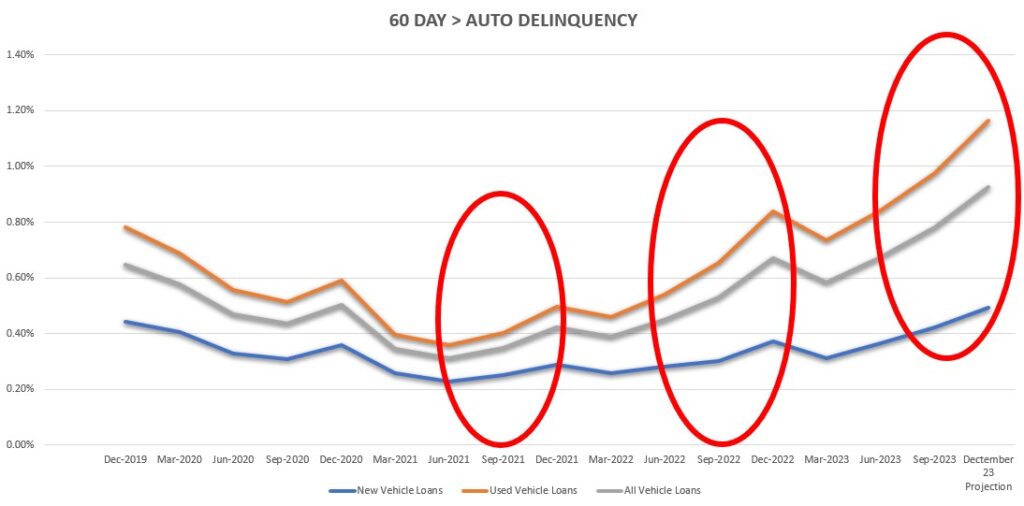

60 Day Delinquencies

60-day delinquency tranche is pretty much the end of the line for collectability and the cradle of repossession assignments. I had predicted that Third quarter delinquency would finish at $3.8M and have a ratio of .75%. Well, I was wrong, it was worse. It finished at $3.9B and had a ratio of 0.78%.

Using the same seasonal average methodology, I suspect that the 4th quarter will continue its climb and finish at $4.1B and a ratio of 0.80%. With that said, I expect that there will likely be a boom of repossession activity in January.

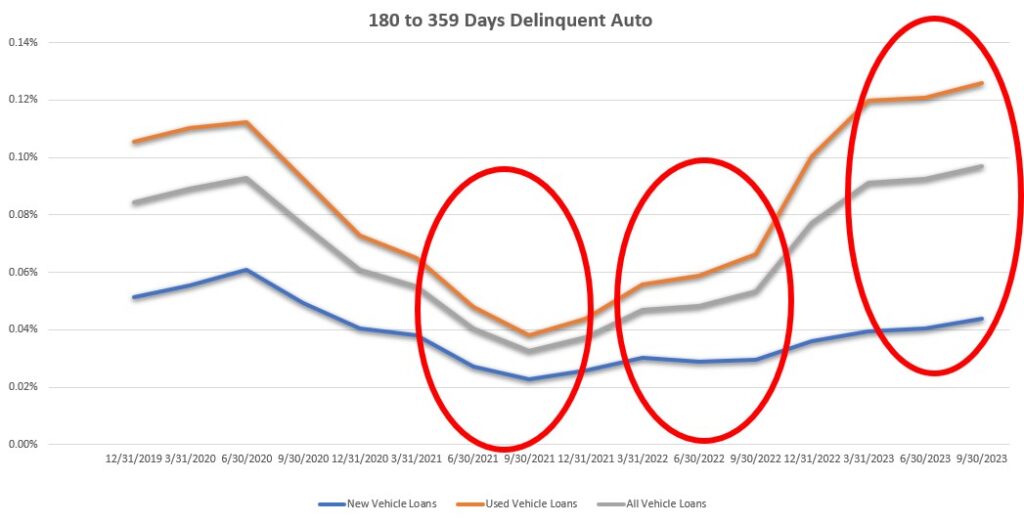

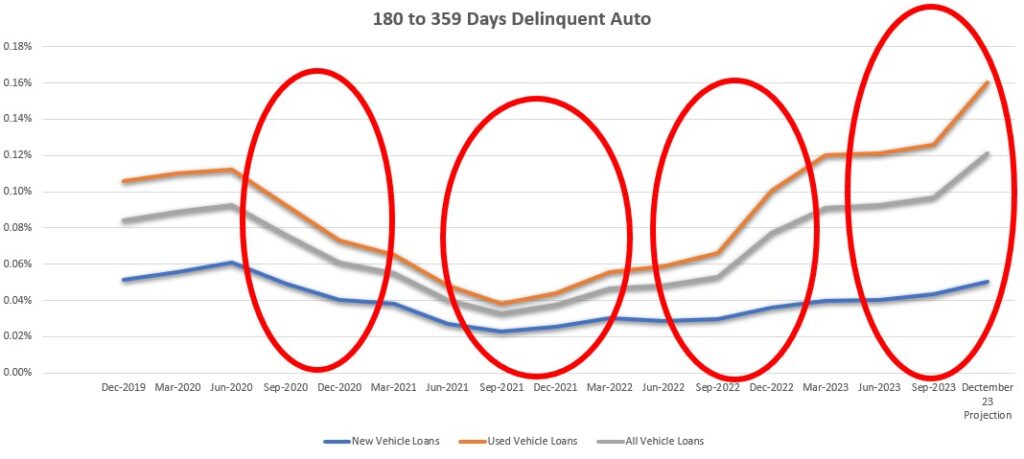

180+ Days Delinquent

The 180-day tranche of auto loan delinquency is a morgue of movement a mere formality to charge off with minimal financial impact to lenders and would have already been taken in reserves. Q3 actually came in substantially higher than I predicted but with the same delinquency ratio. I had predicted that the 3rd quarter would finish at $495M and a ratio of 0.10%. It was actually lower and finished at $486M with a ratio, as predicted, 0.10%.

I’m sticking with my projection model and predict that we will see this category climb up to $585M and a ratios of 0.12%. This bucket is tricky to predict at year end due to many lenders expediting charge off to start the next year lower.

Summary

Interest rates are at killing auto lending. If the portfolio balances go stagnant or reduce while the delinquency rises, the delinquency ratios become magnified. For decades before the pandemic, the seasonal trend was that delinquency rises in the 4th quarter. There’s little question that we’re in the middle of it.

While inflation has slowed down, it didn’t go away. Credit card balances and delinquencies are huge, and I suspect something of a canary in a coal mine of the overall economic strain that is causing these increases in delinquency.

Wholesale auto values have been dropping hard all year and if auto repossession activity climbs over the next two months, as I suspect it will, the glut in inventory coupled with high interest rates, will be a remarketing nightmare.

Repossession activity is high. I know one agency who had to stop repossessing for a day because they had no more room on their lot. I know another who is so overloaded with personal property from the increased repo activity, that their scheduled appointments for borrowers to pick it up can take weeks.

Personal bankruptcies (chapters 7 and 13) have been on the climb, and I suspect that we’ll see a mini-boom of them in Q1 next year coming from all of the credit card charge off and auto loan repossessions. Let’s not forget how high the auto process were in 2021 and 2022. These underwater loans are likely to be the source of many a cram-down.

It’s been over a decade since the credit union industry has experienced this, so it will be a challenge for many. With the decade long low delinquency levels we’d been experiencing, no one has been developing many collectors. Where are all of the new collectors needed to manage this going to come from?

It’s December and as the Christmas song lyric goes; “Tis the Season.” Well, it is, it’s collections season and I suspect that it will be for months to come. At least.

Kevin Armstrong

Publisher

Related Articles;

Credit Union Auto Loan Delinquency Surges

Credit Union Auto Loan Delinquency Pattern Back to Normal

Credit Union Auto Loan Delinquency Climb Continues – Credit Union Auto Loan Delinquency – – Credit Union Auto Loan Delinquency Climb Continues – Credit Union Auto Loan Delinquency Climb Continues – Credit Union Auto Loan Delinquency Climb Continues

– Credit Union Auto Loan Delinquency Climb Continues – Credit Union Collections – Delinquency – NCUA – Repossession – Wholesale

More Stories

Q4 2025 Credit Union Auto Loan Delinquency – An End of Year Meltdown

Former CU Loan Officer Sentenced for Million-Dollar HELOC Scheme

Credit Unions at a Crossroads: Shifts, Risks, and Opportunities — Part 2