Since 2020, a long-established pattern of seasonality in delinquency had been disrupted. Like tradition, for credit unions, auto loan delinquency rates have dropped in the first quarter from the prior year. During 2020, the peak of the pandemic, loss reporting became heavily skewed by loan modifications and ultra-sensitive collection efforts and as the result, all delinquency models had lost relevant data to pre-pandemic modeling. But for at least the credit union world, that pattern has returned.

Download the Data Here!

It wasn’t until the end of 2019 that the National Credit Union Administration (NCUA) reported the combined credit union 5300 FPR financials quarterly. Since then, the NCUA reports it about six weeks following the end of a business quarter. Unfortunately, their aggregate reporting which combines all credit unions, tend to run much later and almost runs int the next quarter like it has done again in reporting the 1st quarter results.

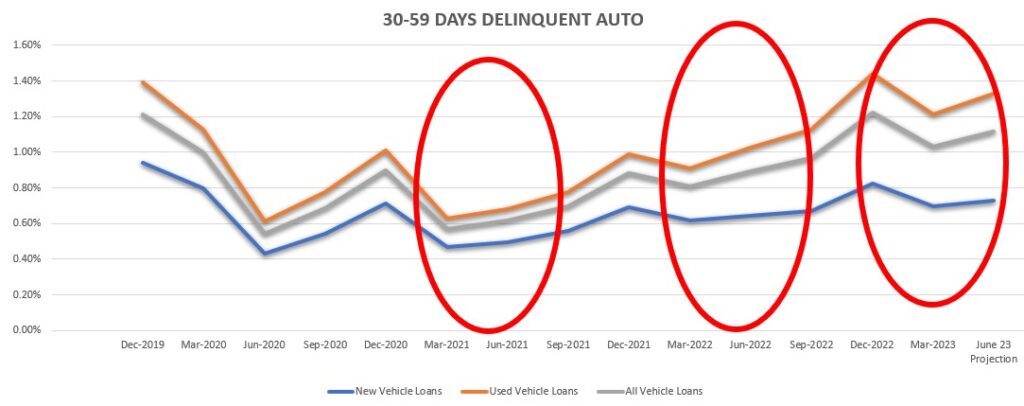

Better late than never, the data does provide some mixed signals. On the bright side, auto loan delinquency for credit unions, finished the 1st Quarter of 2023 lower than in the 4th Quarter of 2022. This was normal before 2020, but with a data disrupter like a Pandemic, data models are far less reliable as before. On the dark side, if we have indeed returned to traditional seasonal trends, we can expect auto loan delinquency to continue to climb over the 2nd and 3rd quarters.

Trends in Delinquency

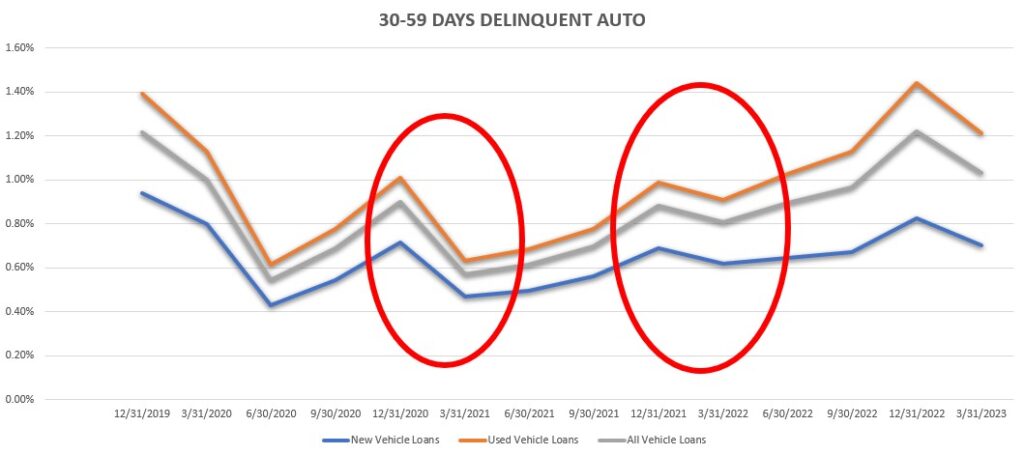

Auto loans, 30 days delinquent, have a typical trend of spiking at the end of the year and then showing reductions by the end of the 1st quarter. Even during the pandemic, this trend remained constant in this delinquency tranche.

During the pandemic, auto loan delinquency plummeted. Extensions and loan modifications coupled with economic stimulus checks brought delinquency to historic lows. Keep in mind, they weren’t very high before the pandemic and you can get a sense of just how dramatic this event was to the normal flow of delinquency. If you didn’t already know, the days of low auto loan delinquency are over.

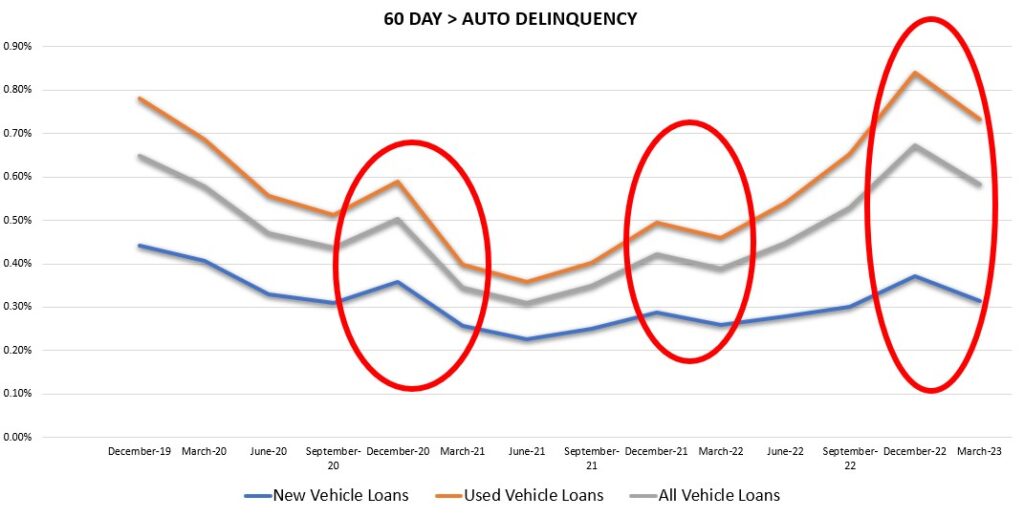

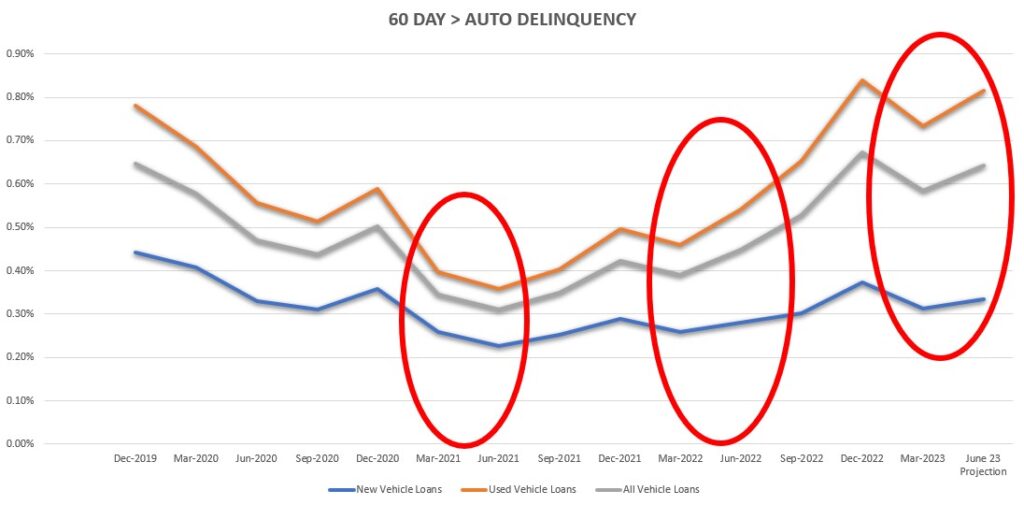

Above, you can see 60 day delinquency was already starting to climb in 2022 and by the end of the year had recovered to pre-pandemic numbers. But as has been the long tradition, delinquency shows some decreases by the end of the 1st quarter and Q1 2023 was no different. Much of these reductions can be attributed to tax refunds, which coincidentally also account for many increases in retail auto sales.

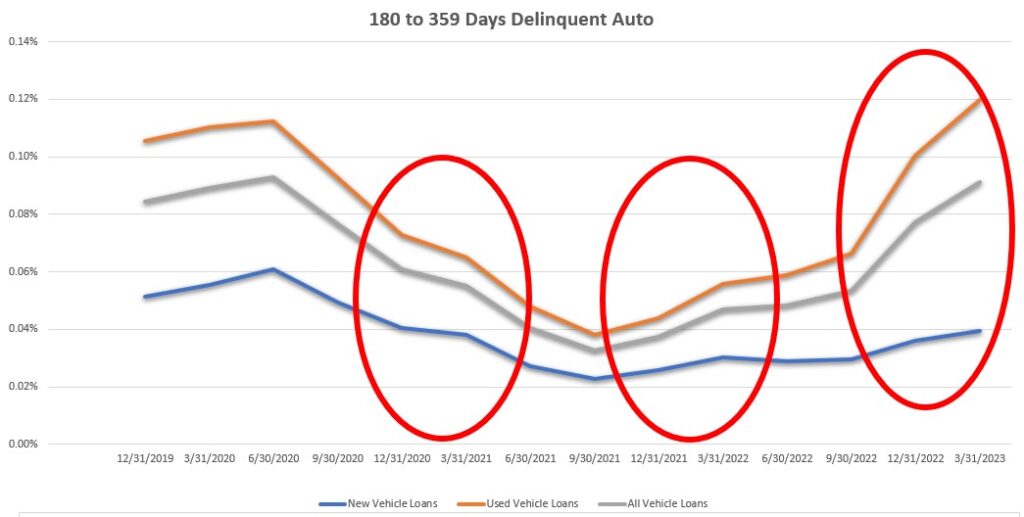

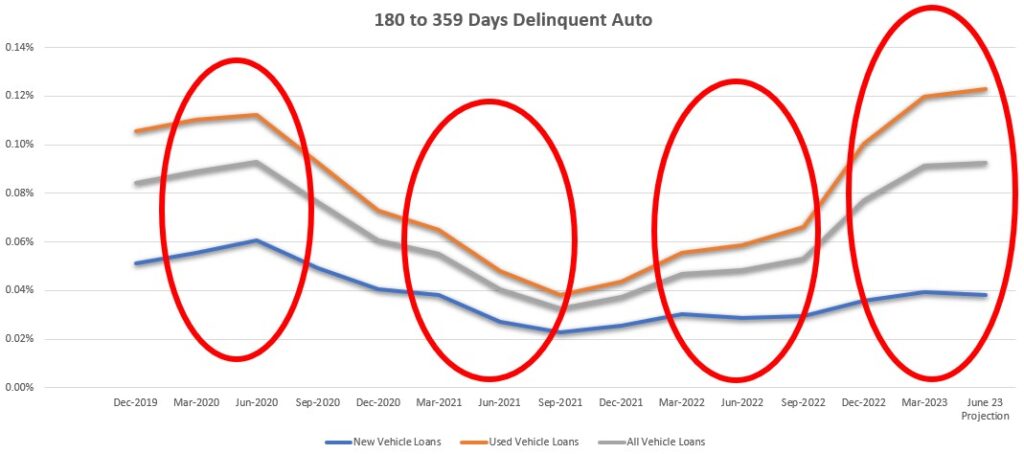

While this trend has held steady in most delinquency categories, it is in the 180 day + delinquency tranche that we are seeing a continued growth. This tranche is usually populated with bankruptcies and repossession inventory. With bankruptcy filings on the rise and soft wholesale auction values, it appears very likely that this delinquency category will continue to climb and result in increased charge off losses.

Projections

Based on an average quarterly increase in delinquency in each of the provided delinquency tranches over the past two years, we can expect that auto loan delinquency will begin to show significant increases reported for the end of the 2nd quarter of this year in all delinquency tranches. Of little surprise, used auto are showing the most dramatic increases.

60 day+ delinquency is pretty much the point of no return for auto loans. Being down three payments is a difficult thing for a borrower to overcome. Assuming a similar increase in ratio from the Q1 to Q2 2022 data and applying it to the Q1 data for 2023, we can see what will be likely a return to Q4 2022 ratios. If Q2 to Q3 ratios climb in 2023 the same as in 2022, we will be looking at significant increases in auto loan delinquency not previously seen since the Great Recession.

Summary

More than a decade of Low delinquency has left us in the process of a long slow climb in delinquency that many collectors have not experienced in the careers unless they been in collections for twenty years or more. Expect additional stress on collections departments and charge off losses throughout the year.

My projections are pretty modest. The impact of the resumptions of student loan payment requirements hangs heavy on the fourth quarter of this year and could be a Gen Y and Gen Z crisis. Inflation remains high, the Fed will probably make two more rate increases by the end of the year and wholesale auto sales are in a slide which creates will makes many borrowers underwater in their loans. There is no telling what other variables will come into play but it could be a perfect storm for massive delinquency, repossessions and charge off losses.

Credit Union Auto Loan Delinquency Set to Climb – Credit Union Collections – Delinquency – NCUA

More Stories

CarMax Settles with DOJ Over Illegal Repossessions

Talk Derby to Me at the NWCUCA 51st Annual Conference

The Auto Lending Surge is Here: How Lenders Can Navigate Rising Demand and Growing Risk