What You Need to Know

In the world of auto lending, trends and statistics reveal important shifts in how different types of lenders are faring. Here is an overview of the latest updates and what they mean for borrowers and lenders alike. The information comes from our July 2024 Auto Insights Report. You’ll gain even deeper understanding there.

Lenders’ Performance – State of Play

- Banking: Year-over-year decline in outstanding loan balances.

- Credit unions: Holding steady with flat loan balances, showing no significant increase or decrease.

Captive Lenders–those associated with care manufacturers:

- Nearly 8% growth in their loan portfolios

- Now a leading choice for Baby Boomers, making up 43% of auto loan originations

- Rise in subprime lending

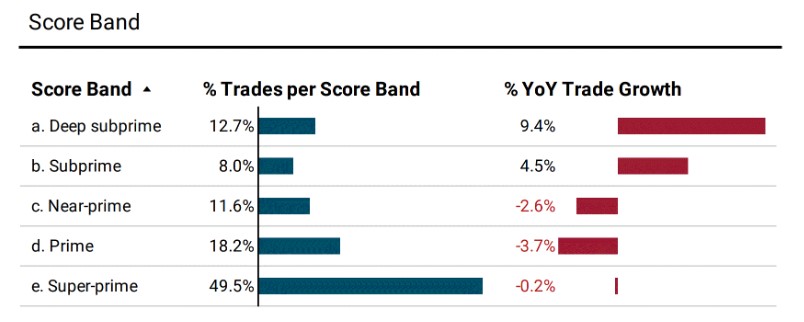

The Rise of Subprime and Deep Subprime Lending

The subprime market, which includes borrowers with lower credit scores, is seeing a rise. Both deep subprime and subprime loans are becoming more common. However, near-prime and prime loans are decreasing. This trend indicates a shift towards riskier loans. In fact, subprime lending hit its peak in Q1, following a seasonal trend.

Credit Union Trends

While credit union balances have remained stable over the past year, there’s been a 13.4% drop in new auto loan originations. In other words, while existing credit union loans have not changed much, credit unions are not issuing as many new loans compared to before.

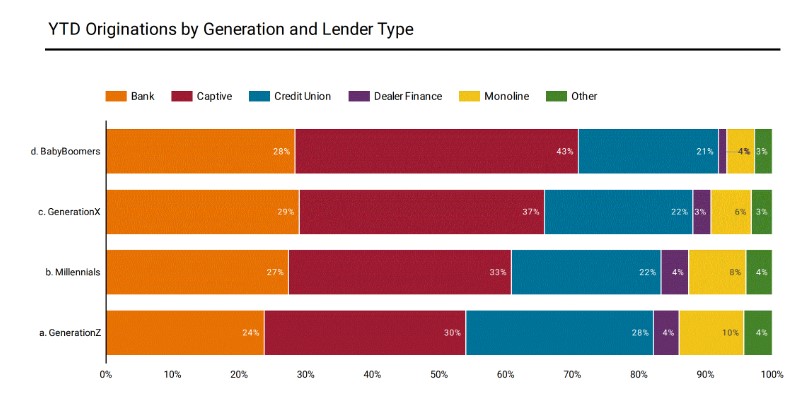

Auto Leases and Generational Preferences

Prime and super-prime markets dominate auto leases. They account for over 85% of all originations year-to-date. Interestingly, different generations have varied preferences for lenders. Gen Z, for instance, is less likely to borrow from captive lenders or banks, with only 30% and 24% choosing these options, respectively. Instead, they prefer credit unions (28%) and monolines (10%).

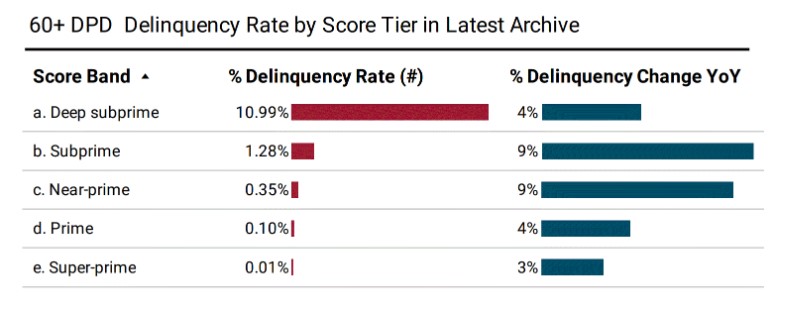

Delinquencies and Fraud Challenges

A concerning trend is the rise in delinquencies across all types of lenders, with a significant increase noted among credit unions and captive lenders.

Delinquency rates are particularly high in subprime and near-prime categories. This increase in missed payments is a critical issue, although Q2 usually sees a dip in delinquency rates, possibly due to tax refunds.

Fraud is another growing concern in auto lending. Recent Equifax data highlights that auto loan accounts with synthetic identity flags are at a much higher risk of default. Synthetic identities, meaning fake identities created to commit fraud, pose a significant threat. With auto loans flagged as synthetic being up to five times more likely to default for credit unions and four times more for banks. This remains a critical focus.

Looking Ahead

In summary, the auto lending landscape is evolving:

- There is a noticeable shift towards subprime lending and a rise in fraud-related risks.

- Captive lenders are growing and dominating the market for certain generations.

- Credit unions and banks face challenges with delinquencies and fraud.

For borrowers and lenders alike, staying informed about these trends is crucial for making smart financial decisions and navigating the complexities of auto financing.

Recommended in Auto

- Read the July Auto Insights Report to uncover the trends in first payment default, early delinquency, and delinquency

- Learn strategies to handle rising auto insurance costs from industry experts

- Find out how credit unions can address rising auto delinquencies

- Listen to panelists from Automotive Ventures, Connections Insights, and Cox Automotive as they deep dive on trends, fraud, and the future of auto

(c) Equifax Inc. All Rights reserved. The statistics and information contained in these materials are illustrative for informational purposes only, and shall not be used for any other purpose.

** Equifax Credit Trends is the primary source for the data in this report; for more information on this database please visit www.equifax.com/business/credit-trends. Data on new tradeline originations are subject to revision for up to 12 months due to lags in lenders and servicers reporting to Equifax. Data for the most recent 12 months are grossed up for expected but as yet unreported new loans. Data are sourced from Equifax’s U.S. Consumer Credit database of over 220 million consumers. These data are population level – not a sample.

Through our IXI Network, we directly measure about $28 trillion in anonymous, aggregated consumer assets collected from leading financial services firms. This “direct-measured” data represents about 45 percent of all U.S. consumer invested assets and serves as the foundation of our unique measures of consumer financial capacity, investment style, behaviors, and characteristics.

Equifax – Auto Loan Delinquencies and Fraud on the Rise – Equifax – Auto Loan Delinquencies and Fraud on the Rise – Equifax – Auto Loan Delinquencies and Fraud on the Rise

Equifax – Auto Loan Delinquencies and Fraud on the Rise – Equifax – Lending – Delinquency – Credit Union Collections – Credit Union Collectors – Fraud – Auto Loan – Repossession

More Stories

NC Man Charged with ID Theft and Auto Loan Fraud

From Dealership Desks to Racketeering: Another Miami Fraud Ring Busted

Talk Derby to Me at the NWCUCA 51st Annual Conference