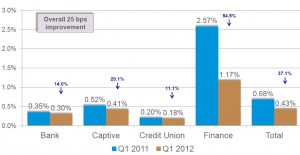

June 21, 2012 – In Experian’s 1st Quarter “State of the Automotive Finance Market” report, it was reported that in the first quarter of 2012, auto repossessions were down 37.1% or, 25bp lower than they were in the first quarter of 2011. This coupled with a 19bp improvement in 30-day delinquencies paints a picture of yet another thin year for both the repossession and the auto collections industries.

June 21, 2012 – In Experian’s 1st Quarter “State of the Automotive Finance Market” report, it was reported that in the first quarter of 2012, auto repossessions were down 37.1% or, 25bp lower than they were in the first quarter of 2011. This coupled with a 19bp improvement in 30-day delinquencies paints a picture of yet another thin year for both the repossession and the auto collections industries.

Recently, Melinda Zabritski, Experian’s Director of Automotive Credit, presented Experian’s quarterly market overview of auto loan delinquency and originations showed that 60 day delinquency was as well declining with a decrease of 8bp or 12.17% from 2011.

Overall, banks gained the largest amount of market share of new loan originations, accounting for 40.21% with a 7.5% increase. While only holding 16.89% of the auto loan market, Credit Unions gained 10% over their originations 2011. The big losers in this comparison were the Buy Here Pay Here Dealers, Captives and Finance companies who all showed market share decreases.

The average amounts financed on new vehicles rose by $589 to $25,995 while used car average prices rose by $411 to $17,050.

On the bright side, risk distribution on new loans originated has dropped 6 points average on new cars loans from 766 to 760 and 4 points on used vehicles from 663 to 659. These averages are the lowest since 2009 and could possibly with aging, provide additional delinquencies and repossessions for the future should the economy and unemployment rates remain sluggish.

With these historic lows in delinquency coupled with increases in sub-prime lending of 11% on new vehicles and 4% on used, these delinquency rates are not likely to remain this low for very long.