“As of late June, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the Covid pandemic”

The New York Federal Reserve Bank’s Center for Microeconomic Data has just released their Q2 2021 report on credit and debt. While the Equifax credit report data driven report paints a picture of stability and continued growth for lending and balances, the trends do not look promising for those in the ARM or repossession industries.

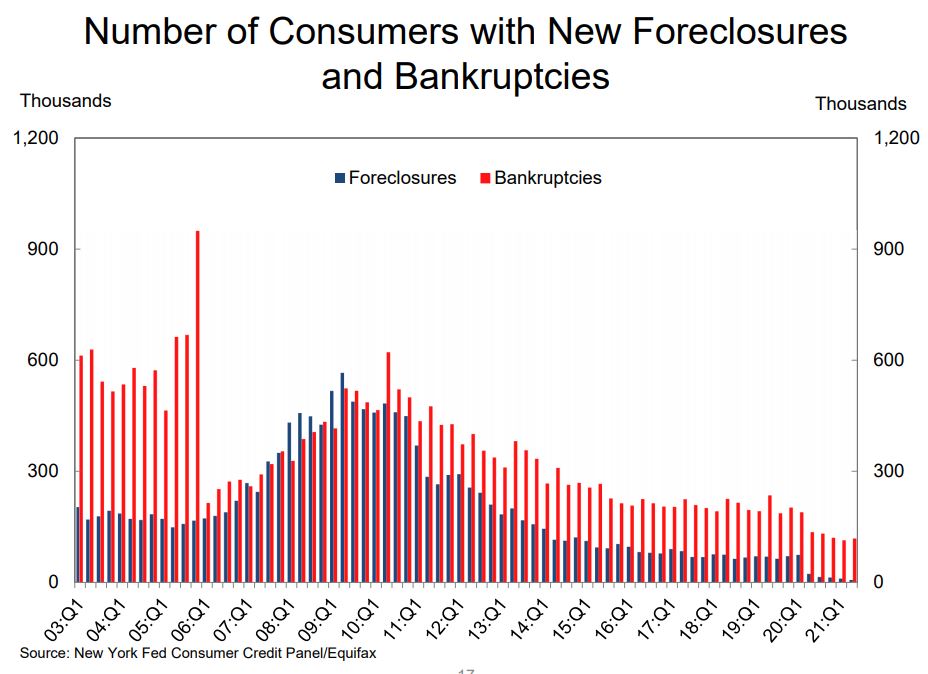

The Fed’s report drills down on delinquency by state and age groups and product but shows little deviation from previous trends. Notable, are the charts and data on foreclosures and bankruptcies, which illustrate the impact of foreclosure moratoriums and record high loan modifications over the past year.

In summary of some of the Fed’s report;

Delinquency & Public Records Aggregate delinquency rates have remained low and declining since the beginning of the pandemic recession, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments.

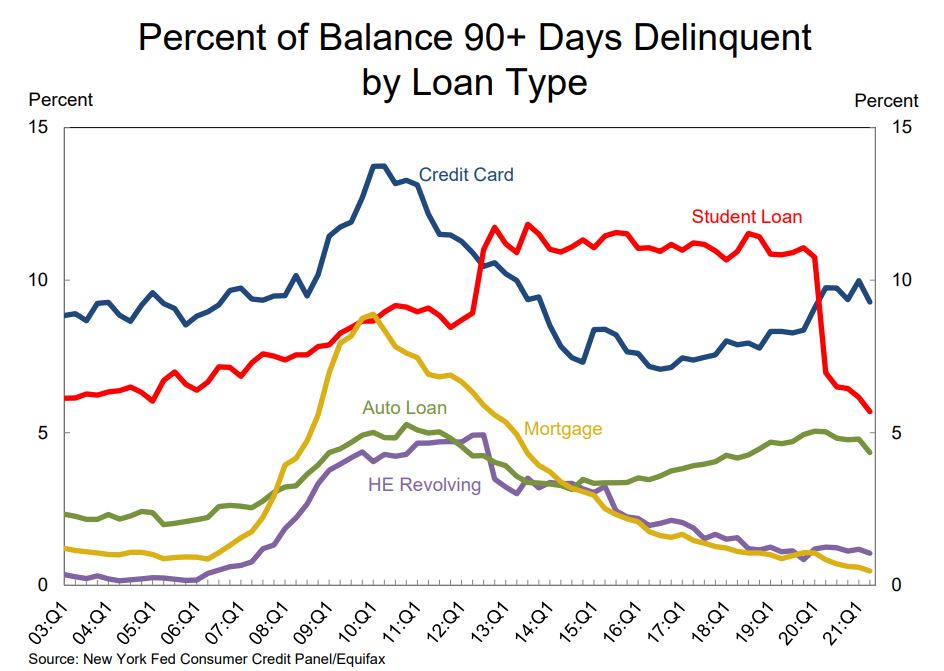

As of late June, 2.7% of outstanding debt was in some stage of delinquency, a 2.0 percentage point decrease from the fourth quarter of 2019, just before the Covid pandemic hit the United States. Of the $405 billion of debt that is delinquent, $316 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders’ books but upon which they continue to attempt collection).

The forbearances and other supportive policy measures continues to be visible in the delinquency transition rates. The share of mortgages that transitioned to delinquency hit a record low 0.4%, as the option to enter forbearance is available. Meanwhile, 53% of loans in early delinquency transitioned to current, a higher rate than before the pandemic as delinquent loans enter forbearance. Foreclosures remain on pause for most loans due to the CARES-provisioned moratorium.

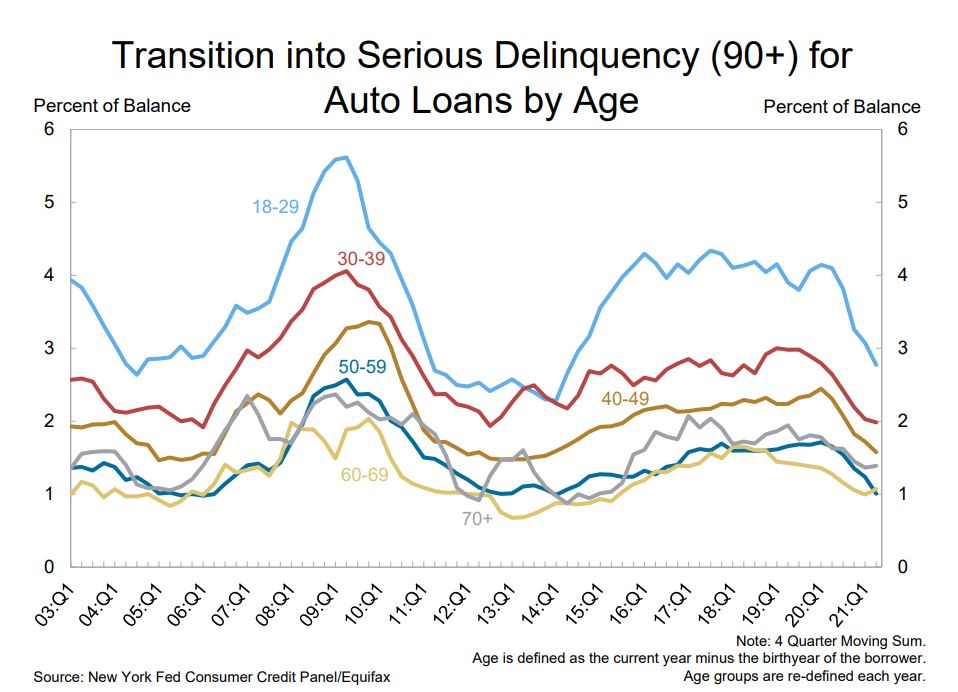

Delinquency rates by product continued to decline, and new transitions into delinquency mostly declined across the board, continuing to reflect the various borrower assistance programs available. The share of student loans that are reported as delinquent remains very low, as the majority of outstanding federal student loans are covered by CARES Act administrative forbearances. Auto loans and credit cards also showed continued declines in their delinquency transition rates, reflecting the impact of government stimulus programs and bank-offered forbearance options for troubled borrowers.

About 119,000 consumers had a bankruptcy notation added to their credit reports in 2021Q2, a small uptick from the previous quarter but near a historic low. The share of consumers with a 3rd party collection account is also near a historic low.

The Fed reported that aggregate household debt balances increased by $313 billion in the second quarter of 2021, a 2.1% rise from 2021Q1, and now stand at $14.96 trillion. These balances are $812 billion higher than at the end of 2019 and $691 billion higher than 2020Q2. This 2.1% increase in aggregate balances was the largest seen since 2013Q4 and marked the largest nominal increase in debt balances since 2007Q2.