With millions of consumers plunge and swipe their plastic into card readers on a daily basis, we barely take a moment to consider the path that we’ve taken from barter, to coin, to currency and to plastic. While it may seem to have occurred over a relatively short period of time, it has actually been in the making for centuries.

Long before the advent of paper currency in the 17th century, the “Bill of Exchange” was the first use of credit and can be traced back as far as the 14th century. While credit methods had been in use as far back as Babylon, the advent of the credit card, is relatively new in the lending world. Ironically, even the word credit is ancient, the word credit comes from the Latin word for trust.

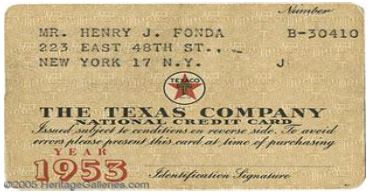

The earliest record of the credit cards can be found in Europe in the 1890’s and some oil companies and hotel chains had their own cards as early as the 1920’s. The first Bank Credit Card was issued by the Brooklyn, NY, Bank of Flatbush in 1946. Their “Charge It” card allowed bank customers to use their card with participating merchants who would submit the slips to the bank for payment. The bank would then bill the customer much as is done today. During this era, credit cards were usually made of paper and occasionally metal tokens. Plastic didn’t come into play for some time.

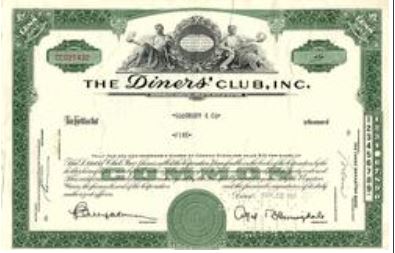

But the honor of the first mainstream credit card goes to the Diners Club card, which in 1950 issued the card to an exclusive 200 customers who could only use it in 27 New York restaurants. Technically, this was a charge card rather than a credit card because the entire bill was due in full rather than payments being allowed over a period of time with an interest calculation. In fact, interest loans were by most of the world considered usury and consider decadent and sinful. In many cultures, this belief still exists.

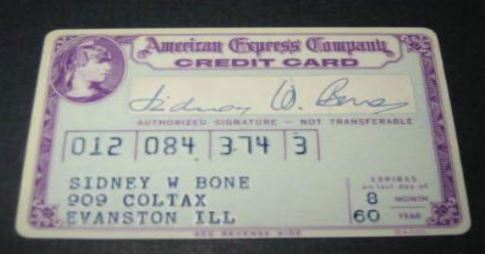

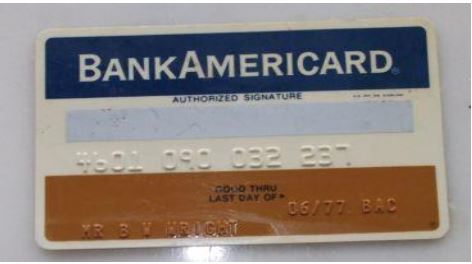

In 1958 American Express and Bank of America, then, BankAmericard (now VISA) issued their first cards. These cards were initially targeted to provide services to traveling salesmen as a time saving device rather than as a form of credit. As some of us old timers will recall, early credit cards had no magnetic strip. Verification was done manually through a large book of active card numbers at the point of transaction. The advent of the magnetic strip in teh early 1960’s didn’t get introduced until the establishment of standards for such data in 1970. Still, it took time for this to catch on.

As we look back to the simple methods of billing and the low-tech verification methods, you can’t help but marvel at how much simpler and honest the world was in decades gone by. With the security levels where they were, has technology not have developed, there is no way credit cards would have survived to these times. These cards were just too simple and too easy to replicate. Con men and thieves would have torn this industry down in no time. It’s a small miracle they made it past their humble beginnings.

Today, the use of such cards is quite the norm. CreditCards.com reports there were 576 Million credit cards and 507 Million Debit cards held by consumers in the United States alone at the end of 2009. They also state that there is an average of $15,788 in credit card debt per household. With these figures, it is almost impossible to imagine our country living without credit cards. For better or for worse, credit cards are here to stay.

Kevin Armstrong

Editor

*This is a republish from 2010