FOR IMMEDIATE RELEASE

Over the years, repossession and skip tracing services have come to be viewed somewhat as commodities by many in the lending community. As such, outside of compliance, the primary focus around the management of these services has been cost. After all, since these services are available through multiple providers, why pay more than what the low-cost provider is willing to accept?

This downward pressure on costs has resulted in the service providers having to reduce resource allocation, in several key areas, in order to maintain an acceptable margin on the business. In many cases, this strategy ends up costing the lender more in the form of higher charge offs, higher priced deep skip services, etc.

However, some lenders have realized that even small differences in recovery rates can translate into big gains in net dollars recovered even if the cost of the repossession was slightly higher.

When recovery fees are driven down to rock bottom levels, the service provider (whether a direct agent or a forwarder/skip company) is typically forced to undertake one or more of the followings:

- Reduce the labor allocation devoted to the portfolio

- Reduce payment to the agent/driver

- Reduce the amount and quality of the data purchased from third party providers

Let’s look at each of these issues in a little more detail:

Labor Allocation

In the case of forwarders or skip service providers, typically administrators or skip tracers are assigned to work a specific group of cases. The labor pool allocated to these functions is a significant part of the provider’s overall cost structure. When a lender pushes for rock bottom fees, inevitably queue sizes get increased in order to reduce labor cost. The more cases an investigator has to work, the less time that can be spent on each and recovery rates usually suffer.

Repossession Agent Fees

When margins are very tight due to low fees, the forwarder/skip provider is also limited as to how much can be offered to the recovery agency. In our case, those fees range from $275 on the low end to $375 on the high end. You can bet there is a big difference in the amount of effort the agent puts into the $375 cases than the $275 cases.

The repo agency faces the same dilemma since they also work primarily on a contingent model. On low fee cases, they will inevitably have to reduce the number of times an address is run, reduce the fee to the driver….or both.

This is a real issue in today’s world where the agent ranks have thinned over the past few years due to rising costs and compliance requirements. Fewer agents, combined with rising delinquency rates, means that agents are in a good position to pick and choose where they put their resources and you can be sure that they do just that. Wouldn’t you?

Reduced Data Purchases

When it comes to locating missing cars (outside of LPR technology) it is all about finding good addresses and contact numbers. Fortunately, there are many data sources out there that provide information. The cost can be anywhere from free to several dollars per report. As you might expect, the more expensive reports often (not always) contain the better/more current information. However, the service provider must be very careful on how and when the best data sources are used. For instance, a $6.00 report on a portfolio that generates a 20% recovery rate will add $30 in cost per recovery just for that report. Combine that with a low fee schedule and it makes it very difficult to utilize that data source.

All of these “adjustments” that are required to deal with low margin business absolutely make a difference in recovery rates, charge offs, auction values, etc..

Financial Impact

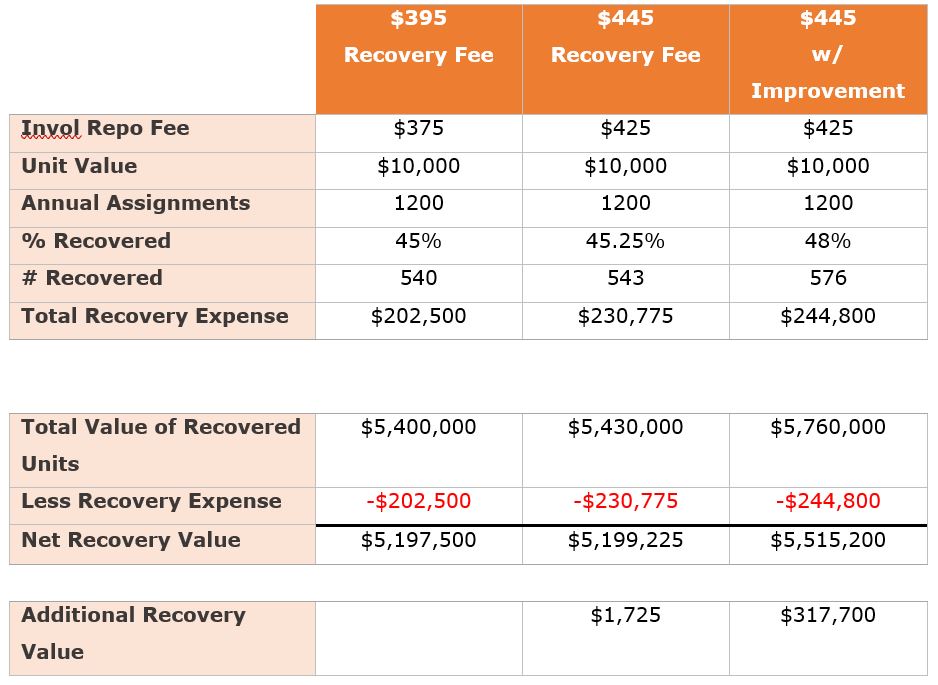

Let’s take a look at a couple of different analysis of the trade off between higher recovery costs and higher recovery rates.

The analysis below illustrates the additional “lift” in recovery rates that is required to offset a $50 difference in recovery costs.

As you can see, based on these assumptions, the service provider would only have to generate less than one additional recovery for every 100 assignments to offset the cost of paying $50 more on all recoveries. This does not even take into consideration the value of avoiding the charge off.

Note: The below analysis is designed to illustrate two issues:

- The extremely small (1/4 of 1%) additional recovery rate that would have to be achieved to offset an additional $50 recovery fee

- The additional value ALSR believes it will generate based on the higher recovery rate we believe we can achieve

Of course, the net benefit between higher costs and higher recovery rates is significantly impacted by auction values. Some portfolios deal in collateral that often has little more than scrap value when recovered and some have average values in excess of $25,000. The table below illustrates the financial gain, under different auction value scenarios, if recovery rate increases just 5%.

Assumptions

- 250 1st placement cases per month

- 35% vs. 45% recovery rate

- $50 increase in recovery fee

If you would like to see a more detailed analysis based on the specifics of your portfolio, just let us know and we will prepare.

Summary

Cost is an important variable in the repossession management process, but pushing costs too low can produce a diminishing return.

Mike Levison, CEO

ALS Resolvion

https://alsresolvion.com/