Why do you fight bankruptcy cases? What happens if you don’t?

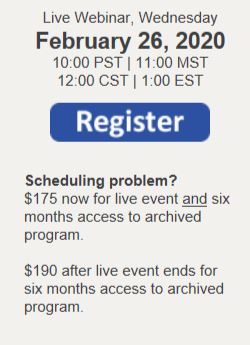

Live Webinar, Wednesday

February 26, 2020

10:00 PST | 11:00 MST

12:00 CST | 1:00 EST

What does a bankruptcy “discharge” do to a debt? Does the debt go away? May the debtor still voluntarily pay it? What risks are involved when that happens?

Are all debts discharged if you don’t fight back? (Hint: They aren’t.) What about loans secured by real property? When are they discharged and when aren’t they discharged? Are you wrongfully reporting some debts as having been discharged in bankruptcy when they weren’t? (That’s the subject of a number of lawsuits!)

May a debtor borrow money from you and use part of the money to repay all or part of a discharged debt? May you rewrite a discharged loan? What about a real property loan with a balloon payment—may you rewrite that after the bankruptcy is over?

During this online training program, attorney Eric North will provide answers to the questions above and will discuss:

- Which debts are and which debts are not discharged in Chapter 7 and Chapter 13 bankruptcy.

- What post-discharge actions are permitted by the Bankruptcy Code, and what actions can result in sanctions.

- Are you required to stop sending periodic statements once a bankruptcy has been filed? Are you required to continue sending them? Does a “for informational purposes only” disclaimer help?

- What actions may and what actions shouldn’t you take if a debtor who has elected to “retain and pay” without reaffirmation stops making payments?

- May you give the debtor an extension of the time to pay? May you modify the loan in a way that is in the debtor’s favor? May you rewrite the loan? Does it matter if the debtor asks for the extension, modification or rewrite? Does it matter if there is a non-bankrupt cosigner? Does it matter if you extend new credit as part of the rewrite?

Just because the bankruptcy is over doesn’t mean the relationship between your financial institution and the debtor is over. Often you will continue to do business for years after the discharge, but with a relationship that may have been changed significantly by the bankruptcy case.

For more information, call NorthLegal at 623.537.7150.

SPECIAL SALE! To help you get the most out of Bankruptcy 104: What Happens After the Bankruptcy is Over?, the following archived programs will be temporarily marked down to $100 (usually $190) each until February 28:

Bankruptcy 101: Introduction to Consumer Bankruptcy

Bankruptcy 102: The Automatic Stay

Bankruptcy 103: Dealing with Nonbankrupt Coborrowers

| NORTHLEGAL CONFERENCES COMING IN 2020 |

| NorthLegal Bankruptcy Fundamentals Seminar June 15, 2020 Nashville, Tennessee (Early registration discount ends February 28!) |

NorthLegal

Advanced Bankruptcy

Conference

June 16-19, 2020 Nashville, Tennessee (Early registration discount ends February 28!) |

NorthLegal

Consumer Collections

Conference

August 17-20, 2020 Las Vegas, Nevada |

| REGISTRATION NOW OPEN AT NORTHLEGAL.COM |

Facebook Comments