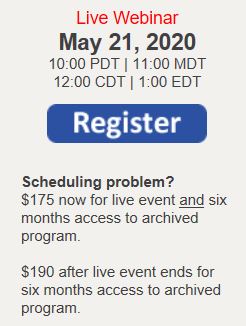

Live Webinar

May 21, 2020

10:00 PDT | 11:00 MDT

12:00 CDT | 1:00 EDT

It’s an unpleasant fact, but a fact nevertheless, that bankruptcy filings are likely to increase over the next 12 months as consumers feel the impact of the COVID-19 pandemic. And regardless of whether your financial institution is pursuing collection activities in general, when a bankruptcy is filed you stand to lose important rights if you do not take certain actions properly and quickly. One of those actions is the filing of a proof of claim in appropriate circumstances.

Just as important as filing a proof of claim is completing it accurately. Failing to do so may result in a loss of some or all of your financial institution’s rights—or even an accusation of deceptive conduct or perjury (because proofs of claim are filed under oath).

During this program, attorney Eric North will help participants understand:

- Circumstances under which a proof of claim should filed and when filing is unnecessary

- Deadlines for filing a proof of claim and when the court can permit a late claim

- Steps a debtor can take to try to defeat all or part of your claim, and how to respond

- How to complete the official Proof of Claim form

- How to itemize principal, interest, late fees, attorneys fees, and any other amounts included in the claim

- What information you are prohibited from including with a proof of claim and what your financial institution should do if you make a mistake

- When to include “Attachment A” and how to complete it

- What other attachments must be included with the proof of claim

- When an already-filed claim must be updated during the course of a bankruptcy using “Supplement 1” and/or “Supplement 2” and how to complete those forms

- What your duty is when a Chapter 13 provides your financial institution with a Notice of Final Cure Payment

- Common errors creditors make and how to avoid or fix them

Attend this webinar to learn the rules you must know in order to protect your financial institution’s rights, maximize chances for recovery, and avoid costly errors.

PREREQUISITE: This program is the latest in a series of webinars intended to provide basic bankruptcy training to financial institution staff. Although it may be helpful to have watched all four previous programs, it is not necessary to have done so. However, it is recommended that attendees for this upcoming program have watched ” Bankruptcy 101: Introduction to Consumer Bankruptcy” or have a fair amount of experience handling bankruptcy cases.

For more information, call NorthLegal at 623.537.7150.

SPECIAL SALE! To help you get the most out of this upcoming program, the following webinars have been temporarily marked down to $100 (usually $190) each until May 31:

Bankruptcy 101: Introduction to Consumer Bankruptcy

Bankruptcy 102: The Automatic Stay

Bankruptcy 103: Dealing with Nonbankrupt Coborrowers

Bankruptcy 104: What Happens When the Bankruptcy is Over? is also available from the archives, but is not discounted.

To see a list of seven other NorthLegal Webinars that have reduced prices during the month of May, visit http://northlegal.com/webinars.php

- Registration entitles the participant to a single connection during the live program. However, any number of employees of the participating financial institution may watch the archived version at times convenient for them for six months after the program ends.

Facebook Comments