Sacramento, CA – 19 August 2020 – Apparently emboldened by the passage of AB 1436, the eviction and forbearance bill’s passage, California Assembly Woman Monique Limon re-placed on calendar for vote, AB 2501, the “Repossession and Foreclosure Moratorium Bill.” AB 2501, also monikered with the aesthetically pleasing title “The COVID-19: homeowner, tenant, and consumer relief Law of 2020”, This procedural move sets it for a second attempt at passage in the assembly next week.

Coincidentally timed with next week state senate vote on AB 1436, the “Eviction and Mandatory Mortgage Forbearance Bill”, it appears that Assembly Woman Limon is trying to slip this past while the attention is on AB 1436. Most puzzling, is the overlapping and contradictory terms for mortgage loan forbearance management in that AB 1436 calls for forbearances until at most April 2021 and AB 2501 calls for them until one-hundred and eighty days (6 months) after the end of the Federal Crisis.

In addition to long term mortgage forbearances, AB 2501 places a moratorium on auto repossessions. This would be a final coffin nail on an already struggling sector of the auto lending industry and would likely tighten loan underwriting for years to come.

Despite it’s good intentions, the bill does nothing to prevent negative credit reporting and will destroy the access to consumer credit for many years to come as those most affected will be unable to acquire credit to improve their scores. This limited access to credit would trickle down into a tightening of the credit market to all those except the highest credit tranches (720+). This tightening will cripple the auto dealership industry and undoubtedly cause yet more business closures and reductions in staff for lending, collections, repossessions and auto sales further increasing the roles of the unemployed in the state of California.

The bill, drafted by California House Banking and Finance Committee Assemblywoman and Committee Chair, Monique Limon (D) of Santa Barbara and introduced on May 11th, is receiving heavy opposition from the California Chamber of Commerce, American Bankers Association (ABA), American Financial Services Association (AFSA), Bank Policy Institute (BPI), Credit Union National Association (CUNA), Housing Policy Council (HPC), Mortgage Bankers Association (MBA) and the Securities Industry and Financial Markets Association (SIFMA) as well as the state’s credit union league, the California Credit Unon League, a lobby with very strong Democratic ties.

On the May 17th, joint letter from the California Chamber of Commerce, American Bankers Association (ABA), American Financial Services Association (AFSA), Bank Policy Institute (BPI), Credit Union National Association (CUNA), Housing Policy Council (HPC), Mortgage Bankers Association (MBA) and the Securities Industry and Financial Markets Association (SIFMA), it was stated that;

“AB 2501 would undermine these ongoing efforts to help customers by creating duplicative and sometimes contradictory requirements for the mortgage and auto finance industries when viewed alongside federal rules, regulations and program requirements established by Congress, regulatory bodies, federal executive agencies, and government sponsored enterprises.”

In a more direct letter, the California Chamber of Commerce referred to the bill as “JOB KILLER” and that “Requiring these institutions to potentially go years without receiving payment is a significant burden that will negatively impact financial opportunities for Californians. Given the financial risk this proposal creates for such institutions, there is no question that the institutions will limit the mortgage and auto loans it offers. There will likely be stricter criteria to qualify, or, higher rates to offset the potential loss these institutions could suffer under AB 2501. This limitation will have a negative impact on the housing market, further exacerbating the housing crisis and creating job loss in the housing industry. It will also unquestionably limit car loans, especially for those with problematic credit history, and will harm both consumers and workers in the auto industry.”

AB 2501, the disastrous “Job Killer Bill”, providing no questions asked forbearances until the year 2023 and forcing judicial only repossessions and foreclosures, would kill many credit unions and costs thousands of credit union jobs while destroying the repossession industry.

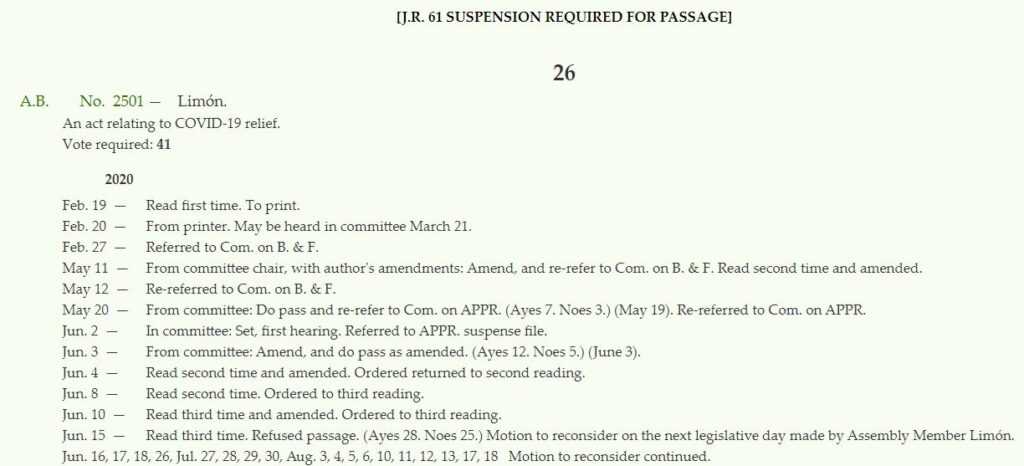

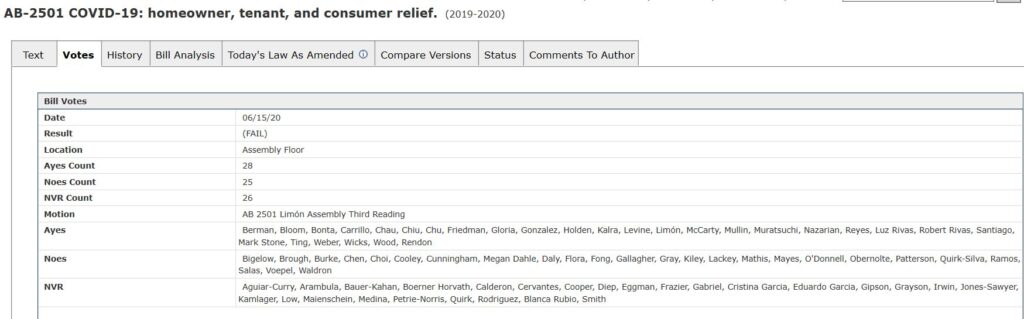

Last time this bill went to vote, it came as close as two votes from passage before votes were reversed for the record when realized that it did not have adequate support. Even then, the state assembly members did not want their names showing as having voted for it.

We need everyone’s help again to contact each and every assembly member. We have provided a link below with all contact information. The bill will be heard this coming Monday August 24, 2020. Assembly Member Limon is not letting this go. We need to act together and fight against this bill.

Please contact your state assembly person and voice your concerns against this bill ASAP!

Find Your Assembly Representative Here!

Your help and support is essential.

Thank you!