Live NorthLegal Webinar Next Week

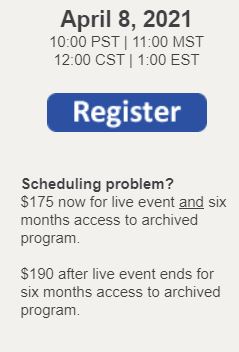

April 8, 2021

10:00 PST | 11:00 MST

12:00 CST | 1:00 EST

CONSUMER COLLECTION LAWS 102

The federal Fair Debt Collection Practices Act (FDCPA) is one of the granddaddies of all collection laws and is still the most important. Its requirements are both broad and very specific. It contains rules that are obvious and rules that are surprising. Although it does not directly apply to all collectors, everyone who collects consumer debts and everyone who supervises those who collect consumer debts should have a thorough understanding of it.

In late 2020, the Consumer Financial Protection Bureau issued more than a hundred pages of new regulations explaining and adding to the requirements of the FDCPA.

Separately, two other federal “UDAAP” laws broadly prohibit unfair, deceptive and abusive acts and practices. Although not as specific or well known as the FDPCA, these laws have an equal (or greater) impact on consumer debt collectors.

Last month’s webinar ( Consumer Collection Laws 101 ) provided a general overview of these and other collection-related laws. This month’s program will focus on the details of the the FDCPA and UDAAP laws and regulations, including —

- Who the Fair Debt Collection Practices Act (“FDPCA”) says it applies to and who it says it does not apply to

- Why it is absolutely necessary even for collectors who are not governed by the FDCPA to study it

- What the FDCPA and UDAAP laws prohibit collectors from doing

- What the FDCPA and UDAAP laws require collectors to do

- What the FDCPA has to say about things like—

- Frequency of calling

- Calling at the debtor’s place of business

- When you must stop calling

- Talking with third parties (including when trying to locate the debtor)

- Post-dated checks

- Splitting payments among debts

- What the recent CFPB regulations have clarified and what they have left unresolved

For more information, call NorthLegal at 623.537.7150.

* Registration entitles the participant to a single connection during the live program. However, any number of employees of the participating financial institution may watch the archived version at times convenient for them for six months after the program ends.

| IN-PERSON NORTHLEGAL CONFERENCES ARE BACK THIS SUMMER! |

| NorthLegal Consumer Collections Conference August 16-18, 2021 Las Vegas, NV | NorthLegal Bankruptcy Fundamentals Seminar September 20, 2021 Nashville, TN | NorthLegal Advanced Bankruptcy Conference September 21-24, 2021 Nashville, TN |

Facebook Comments