Live NorthLegal Webinar

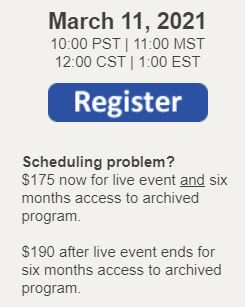

March 11, 2021

10:00 PST/11:00 MST

12:00 CST/1:00 EST

The laws that govern the business of collecting consumer debts are as complex as any laws financial institutions face—and more complex than most. Failure to understand those laws can do more than just lead to lost recovery opportunities—it can cause significant litigation-related losses.

It is crucial that collectors learn each of these laws in detail in order to comply with them and to protect their financial institution. However, as looking at a map is a good way to start to learn about a new city before exploring its details, getting an overview of important and mid-level collection laws at the start of (or as a periodic refresher to) collection training will help the collector understand which laws apply in which circumstances and how those laws relate to each other.

Likewise, it is important that those who oversee or have management responsibility for collections departments have at least a general understanding of consumer collections laws. It may not be important for the Vice President of Lending and Collections to know the details of every collection law, but it is important that person at least broadly understand what laws apply. Without that, a collection department is essentially unsupervised.

During this program, participants will gain a basic understanding of—

- How to determine which state’s laws apply to a matter.

- How the legal system works with respect to collections and related compliance issues.

- An overview of important laws and regulations (including CFPB regulations) collectors and management need to understand, such as:

- debt collection laws

- unfair and deceptive acts and practices laws

- credit reporting laws

- repossession laws

- military protection laws

- laws relating to communication with borrowers

- privacy laws

For more information, call NorthLegal at 623.537.7150.

* Registration entitles the participant to a single connection during the live program. However, any number of employees of the participating financial institution may watch the archived version at times convenient for them for six months after the program ends.

Facebook Comments