This Coming Thursday

Are “cross-collateral clauses” enforceable?

Regardless of those who answer with an emphatic “Yes! I use them all the time!” or those who answer with an equally emphatic “No! Our courts won’t allow them!” the real answer is “Maybe.” The enforceability of cross-collateral clauses depends on a number of factors, any one of which, if poorly handled, can turn a great clause into something that could get your financial institution sued.

Properly drafting and carefully enforcing your cross-collateral clauses are the keys to success, but you cannot do those things if you do not know what the issues are that can make or break your clause.

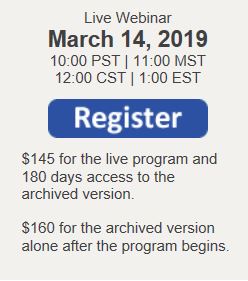

Next Thursday, March 14, consumer finance attorney Eric North will help webinar participants learn what cross-collateral clauses are, how they are used in real-life situations, when they can help you recover debts and when they have no value, and what steps you can take it improve the chances your financial institution’s cross-collateral clauses will be enforced. Participants will learn:

- What courts have to say about cross-collateral clauses, why many courts don’t like them, and what you can do to address their concerns.

- The laws that govern the use of cross-collateral clauses.

- How improper or careless use of a cross-collateral clause can get your financial institution in trouble.

- How to tell a good cross-collateral clause from a bad cross-collateral clause (and how to make yours a good one).

- Mistakes your financial institution can make that may cause you to lose the benefit of a perfectly good cross-collateral clause.

- Why the full support of management is absolutely essential for a successful cross-collateral clause program.

- How to properly and effectively use your financial institution’s cross-collateral clauses!

For more information, call NorthLegal at 623.537.7150.

Facebook Comments