The former long time CEO of the now defunct CBS Employees Federal Credit Union in Studio City, who is accused of embezzling $40 million from the institution, will stand trial in June, a federal judge ruled April 18.

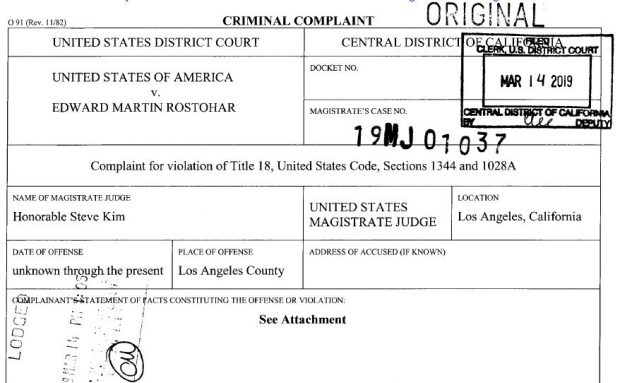

The complaint against former CEO Edward Martin Rostohar filed in the U.S. District Court for the Central District of California reveals that he was arrested following a 911 phone call from his fearing for his life, and that at the time of his arrest he was carrying a significant amount of cash, which turned out to be $200,000.

Edward Martin Rostohar of Studio City was arrested March 12 and charged with two felony counts of bank fraud and one felony count of aggravated identity theft in connection with an alleged 20-year embezzlement scheme. He is being held in a downtown detention center after being designated both a flight risk and an “economic danger to the community.”

The 62-year-old Rostohar was arraigned last week and has a jury trial set for June 11 in downtown federal court before U.S. District Court Judge Otis Wright II.

Several local entertainment credit union executives expressed anger over the failure of the National Credit Union Administration to uncover Rostohar’s alleged malfeasance sooner.

Daniel Taay, chief executive of the $70 million-in-asset Technicolor Federal Credit Union in Burbank, said his institution and others around the country could be on the hook for additional payments to a joint insurance fund.

“It absolutely angers me,” Taay said. “Our members own this place.”

The NCUA is the regulator that oversees the financial health of the nation’s 5,700 federal credit unions. It typically conducts a financial examination of the institutions every 12 to18 months.

“I’ve seen plenty of embezzlements, but this is the largest that I’ve ever seen,” said Gary Hertzberg, a former NCUA examiner who retired in 2007. Hertzberg examined CBS Employees in 1998, a few years before the alleged fraud began.

“Prior to his employment at CBSEFCU, Rostohar was an auditor at NCUA for several years. Because of that, Rostohar knew what NCUA auditors looked for in their exams and audits of the credit unions,” the documents state. “Rostohar explained that the auditors themselves never operated a financial institution, and thus didn’t really know what to look for. Rostohar knew how to respond to the auditors so that his theft would not be discovered.”

According to the documents, Rostohar told investigators one of the items the auditors looked for were quarter end records, which was historical.

“In order to hide his theft, Rostohar adjusted the balance in General Ledger Account 9999999, which was a clearing account. Expenses and income went through this account,” the documents state. “Rostohar deposited fake income into this account, drawing the funds from the credit unions’ clients’ certificate of deposits. The funds were not taken from individual CDs belonging to the clients but from the overall CD balance held by the credit union. Then the real expenses would be processed through the account.”

Rostohar allegedly also told the FBI and LAPD that another item NCUA auditors looked for were negative earnings, and that he would alter the credit union’s records so that the credit union would appear to operate with positive earnings, even if it was as little as $1,000.

As CUToday.info reported earlier, C B S Employees CU’s year-end 2018 5300 indicates the credit union had approximately $120,000 in income.

NCUA spokesman John Fairbanks declined to comment on questions about how examiners overlooked the alleged embezzlement for two decades.

Where Did the Money Go?

Investigators said they pressed Rostohar for where the more than $40 million suspected of being embezzled has gone, and he responded by claiming to have lost most of it gambling. “He also described spending money freely, such as traveling by private jet, giving his wife an allowance of $5,000 a week, and buying expensive watches. He also bought his Porsche and Tesla with funds stolen from the credit union,” according to the court documents.

Rostohar also told investigators he started a cafe in Reno, Nev., with his business partner, Ellen Burcham, and purchased a real estate lot in Reno with stolen funds from the credit union.

When asked what his recent large checks that were in the tens of thousands of dollars from CBSEFCU were used for, the documents state Rostohar responded by saying his Reno business had just launched and he needed more money as it was only opened in December. He added that his mortgage payment for his house was $5,000 a month.

Rostohar also indicated he owns a quarter share of a residence in Cabo Mexico, and one half share of a house in Reno.

Rostohar told investigators he deposited CBSEFCU checks into his personal bank accounts at Citibank and Chase, according to the court filings.

Dialing 911

Prior to his arrest, court documents indicate Alice Tsujihara of the FBI’s White Collar Crimes Squad spoke with Rostohar’s wife, Linda Tlemsani, on March 14, after Tlemsani called 911 “because she was afraid that he would harm himself and that it was the right thing to do after he said he stole from the credit union.”

“When I asked her what she meant by ‘doing the right thing by calling 911,’ she responded that if someone steals and did something bad, she believed in the justice system,” Tsujihara stated in court documents. “She also believed at that time Rostohar was in a state of panic and she didn’t know what he would do. She was afraid for his safety, that he might kill himself, or do something stupid. She also didn’t know where he was call so she called the police.”

According to the report Rostohar did not ask Tlemsani to go with him.

In a federal criminal complaint filed last month, prosecutors say Rostohar stole $40 million from the Studio City credit union, siphoning off the funds to pay for expensive cars, private jet travel and gambling.

If convicted on the felony counts, Rostohar faces a maximum 30 years in federal prison and a $1 million fine on the bank fraud counts and a mandatory consecutive term of two years in prison on the aggravated identify theft count.

The NCUA liquidated CBS Employees and discontinued its operations after determining the financial institution was insolvent in the wake of Rostohar’s indictment. The $721 million-in-asset University Credit Union, located in Westwood, took over the $21 million-in-asset CBS Employees’ assets, loans and all member shares on March 29.

The affidavit states that, beginning before 2000 and continuing until earlier this year, Rostohar used his position as chief executive to make online payments from the credit union to himself or by forging the signature of another credit union employee on checks made payable to himself.

The alleged scheme was uncovered on March 6 when a credit union employee found a $35,000 check made payable to Rostohar, and the check did not include the reason for the high dollar amount, according to court documents. The unnamed CBS Employees’ worker conducted an audit of the credit union checks issued since January 2018 and discovered $3.8 million in checks made payable to Rostohar that contained the forged signature of another employee.

CBS Employees is not connected on a corporate level to CBS Corp. The financial institution had $20 million in assets and 2,798 members when it was taken over by University Credit Union.