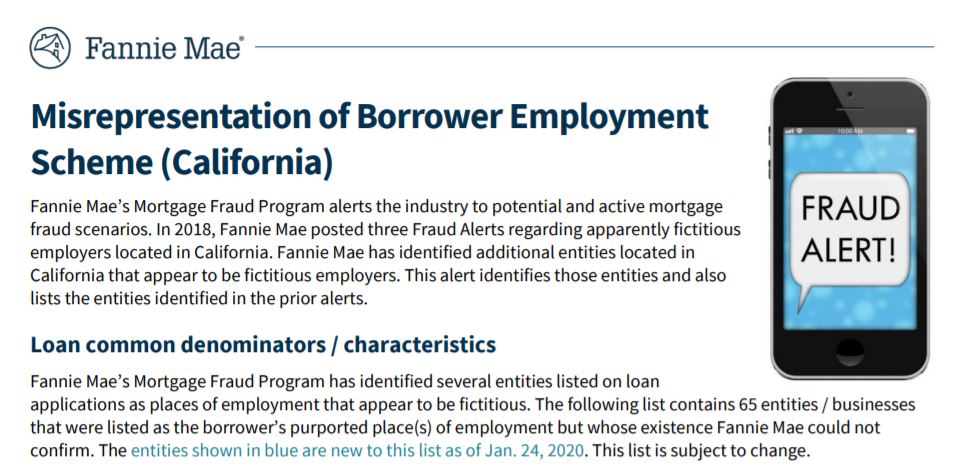

All Allegedly Located in California

In 2018, Fannie Mae issued a warning to lenders identifying more than 30 fraudulent companies that were appearing on borrowers’ mortgage documentation as their place of employment. While there were initially 30 companies on the list of potentially fake employers. They later identified 15 additional companies that appeared to be fictitious.

For some time, things were quiet, but now, the GSE is warning lenders that there are more potentially fake companies out there and Fannie Mae sent a bulletin to lenders identifying an additional 15, apparently fake companies that it has detected on borrowers’ mortgage documents.

All of the previously identified fake companies are allegedly located in California as well as the 15 new ones.

There are now a potential 65 fraudulent companies that Fannie Mae has identified on loan documents. According to the GSE, the 65 companies were listed as borrower’s reported places of employment on an unknown number of mortgages that Fannie Mae could not verify as actually existing or not.

Click Here to View or Download the Fannie Mae Fraud Alert

The 15 newest Fake Employers, according to Fannie Mae, are listed below:

• BK Precision, located on E. Lowell Street in Ontario

• CY Petfood, located on Boyle Avenue in Los Angeles

• Galaxy’s Auto Parts and Accessories, located on Stellar Drive in Culver City

• GBF Freight System, located on Easton Drive in Bakersfield

• Gold Coast Transport, located on Imhoff Drive in Concord

• Golden State Electronics, located on Evans Avenue in San Francisco

• Gonz Fidel Books and Engineering, located on North Milpitas Boulevard in Milpitas

• Ideal Pro Systems, Barnard Avenue, located on Barnard Avenue in San Jose

• Public Mark Productions, located on Sherman Way in Reseda

• Ricardo’s Beauty Wholesale Supplies, located on Pirrone Road in Salida

• Rodell Network Communications, located on Lakeside Drive in Santa Clara

• Sac Bar and Kitchen Supplies, located on Raley Boulevard in Sacramento

• San Fernando Service, located on Sherman Way in North Hollywood

• Senior Home Health Care, located on Industrial Boulevard in Victorville

• West LA Dental Studio, located on Overland Avenue in Los Angeles

In the Fannie Mae Fraud Memo, they provide a series of red flags that all lenders should lookout for on loans that could include a fake employer or other potential mortgage fraud issues, including:

• Third-party originated/broker loans

• Originated 2015–2019 (present)

• Employment (occupation) does not “sensibly” coincide with borrower’s profile (age or experience)

• California (geographic common denominator)

• Borrower on current job for short period of time

• Prior borrower employment shows “Student”

• Starting salary appears high

• Purported employer does not exist

• Employer’s purported location cannot be ascertained

• Paystub templates are similar for various employers across other (involved) loan files

• Paystubs sometimes lack typical withholdings (health, medical, 401(k), etc.)

• Gift letters are substantial and are not (or cannot be) supported through re-verification

Fannie Mae lays out a series of steps that lenders can do to identify and address these issues.

“Prudent origination, processing, and underwriting practices should include looking for red flags in the loan documents that raise questions about the transaction,” Fannie Mae said.

“Verify that the borrower’s place of employment actually exists and obtain supporting documentation. If one of these entities is disclosed as the borrower’s place of employment, exercise due diligence in reviewing the entire loan file,” Fannie Mae continued. “Lenders must exercise caution in these situations and take appropriate steps to prevent the institution from being the victim of fraud.”

Examples of fraudulent activity that lenders should be on the lookout for are provided in Fannie Mae’s memo as well as all 65 potentially fake companies, which should be circulated with all risk management, loan origination and collections personnel to stave off future potential losses and catch those already in progress.

Facebook Comments