Guest Editorial

June 10, 2019 – There are few actions that a lender takes that has more potential for legal claims than a vehicle or collateral repossession. Ensuring that your service providers have the right types and amounts of insurance coverage is critical to managing the risk. While your contracts may be clear that the service provider indemnifies your institution in these matters, without the coverages in place, the contractual obligation may not mean much.

Unfortunately, there is no single policy that covers the full range of potential risks. Multiple policies are required. Understanding what types policies, key provisions and coverage amounts can be a confusing issue. This article attempts to shed light on the matter and provide a recommended framework.

Ask any repossession agency and they will tell you that after fuel costs, insurance is their top expense . In recent years, the number of insurance companies that are even willing to write policies for repossession agencies has shrunk dramatically. At the same time, due to the fewer number of agencies to spread the risk across, rates have grown dramatically. Even a single claim can result in large premium increases for the agency and can jeopardize its existence. For this reason, it is important that lenders have a clear view of what policies/coverage amounts are really necessary to mitigate the risks. Taking a “the more, the better” attitude that some have adopted in recent years is actually quite detrimental to the industry.

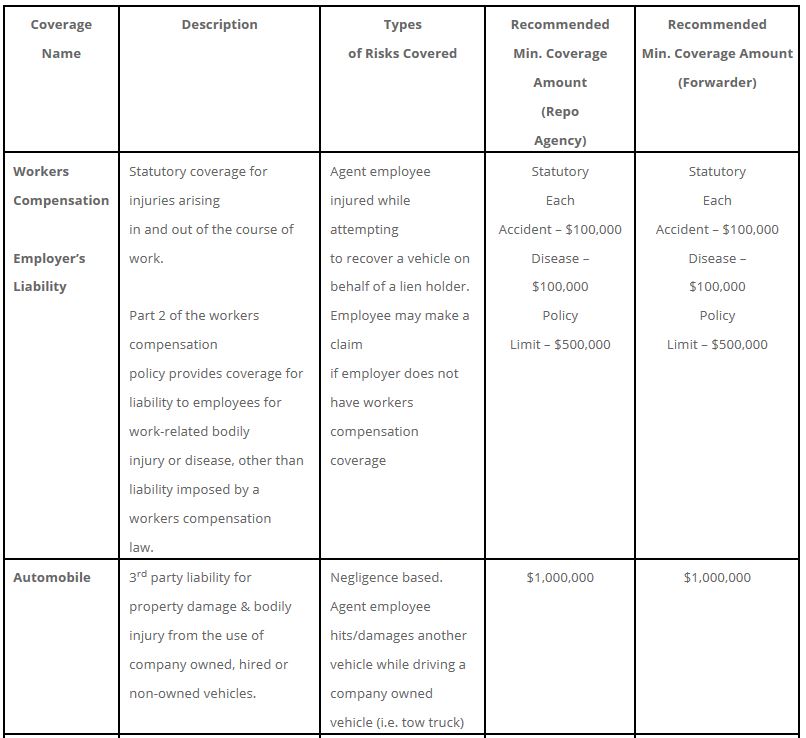

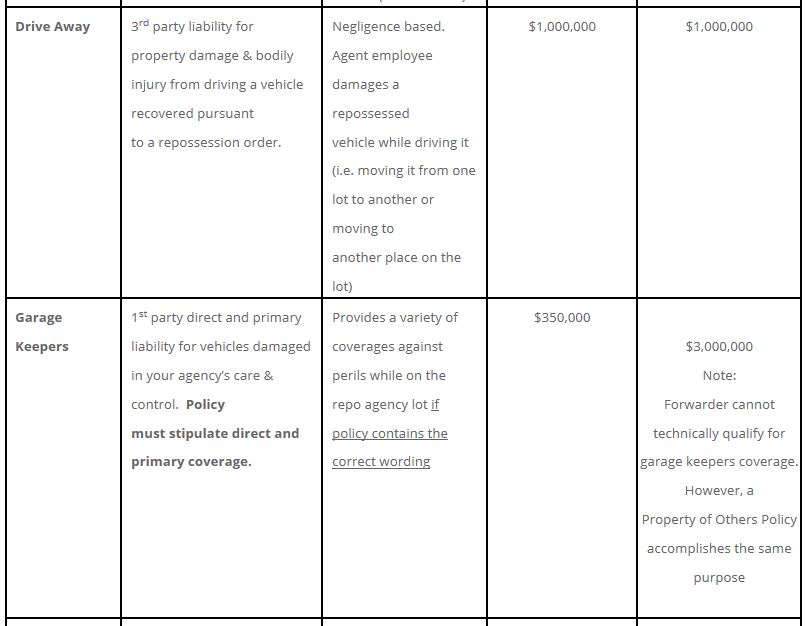

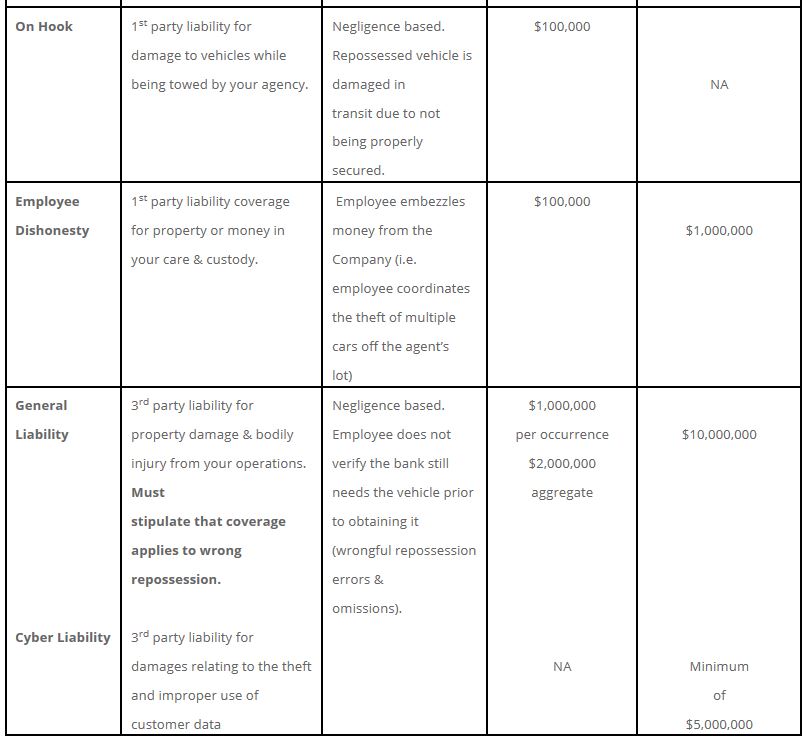

The following table summarizes the types and levels of coverage that, based on our experience as a nationwide repossession management firm, we feel are appropriate. Note that the recommendations vary based on whether your institution works directly with repossession agencies or a repossession management firm (forwarder).

Following these guidelines can go a long way towards mitigating risk, but it is important to note that things can still go wrong. Some insurance companies, in an effort to reduce claims, have inserted problematic policy language/exclusions in their policies. It takes expert review to identify these situations. One benefit of using a national repossession management company to manage your repo activity is that it provides your institution with an additional layer of coverage. You only have to rely on proper wording from one company as opposed to multiple insurers.

10815 David Taylor Drive, Suite 250

Charlotte, NC 28262